The IRS wants a cut of internet sales topping $600 per year

The new law was tucked in to the voluminous American Rescue Plan that Congress passed last year.

Online sellers who hope to cash in on anything from baseball and football card collections to a valuable old toy may now have to pay a portion of the proceeds to Uncle Sam if they use a third-party payment platform to collect the proceeds.

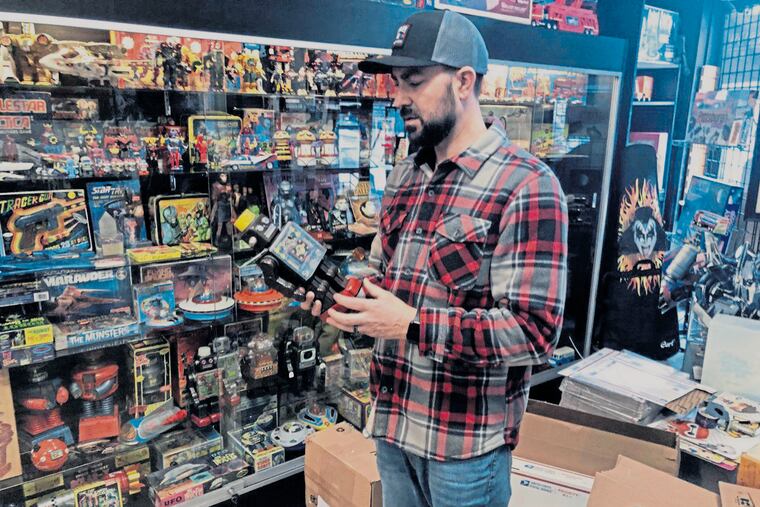

“It will be a change for all those hobbyists who are selling things,” through a platform such as PayPal, said Jeremy Fairgrieve, who owns Pop Culture Connection in downtown Greensburg.

Those who might complain about the new Internal Revenue Service reporting requirements can blame it on the government’s desire to collect unreported income. The IRS rule requiring third-party payers — such as PayPal and Venmo — to report the money it sends to people for purchases of good and services if the individual’s sales top $600 total in a year.

The new law was tucked in to the voluminous American Rescue Plan that Congress passed last year while supplying the nation with financial relief during the COVID pandemic.

“It means anyone out there, whether you are selling something for $600 or $600,000, you are going to pay taxes,” said Fairgrieve, who has operated the business selling classic toys and games for 15 years.

Bob Eisel, who is a co-owner of D and E Collectibles on Main Street in Sharpsburg with Matt Dugan, agrees that the new tax rule won’t have an impact on how they report income compared to previous years.

“The person who is selling (collectibles) out of their basement” will feel the impact of the revised tax law, said Eisel, who has had his business for nine years.

A PayPal spokesperson did not respond to a request for comment.

The U.S. Department of Treasury last fall estimated the “tax gap” — which is the difference between taxes owed and collected — to be around $600 billion annually. That would accumulate to about $7 trillion of lost tax revenue over the next decade, according to Natasha Sarin, deputy assistant secretary for economic policy.

The reporting rules were rather relaxed before this year. The IRS did not ask money transmitters to report income sent into someone’s bank account unless they accumulated more than 200 business transactions totaling more than $20,000 in one year.

“We can do that (200 transactions) in four days,” Eisel said of the prior IRS reporting criteria.

D and E Collectibles does a healthy business over the internet, as well as customers coming to their brick-and-mortar store in Sharpsburg, Eisel said.

“The (pop culture) market is very good,” he said, noting their clientele largely is between the ages of 30 and 50.

Next, the government may tax income from garage sales, Fairgrieve joked.

Applying more stringent rules on income derived from internet sales “is the right thing to do. They’re making money,” said Eric Bononi, a Greensburg attorney and certified public accountant.

“It has been generating a lot of work. There is a lot of confusion,” Bononi said.

Considering the current IRS backlog and months-long response times, Anthony Rossi, a New Kensington CPA, predicts “some headaches due to this broadening of the reporting scope.”

For those who buy something such as clothes at a yard sale and then sell them over the internet to make a profit, that’s reportable income — whether they are paid by cash, check or merchant services, Rossi said. They should document the costs and expenses associated with this revenue now, he said.

Selling personal items at a loss is not taxable, and neither is getting gifts and reimbursements from friends and family. “That might be a problem if the IRS is matching the 1099-Ks payment reporting forms with the tax returns,” Rossi said. “I can see some back and forth with the IRS over these types of transactions.”

Rossi said he hopes the 2022 tax forms include a line to report nontaxable amounts “to avoid this potential matching nightmare.”

If the federal government wants taxes from such sales, the state likely isn’t far behind. The state will want to make sure these businesses are registered to collect and report sales tax if they’re selling taxable products, Rossi said. And then municipalities that have business privilege and mercantile taxes could apply to tax that revenue, he added.