Gov. Murphy pushes new tax credit proposals, amid investigations of current program

“Economic growth can’t just be about helping a select few and the politically connected,” Murphy said.

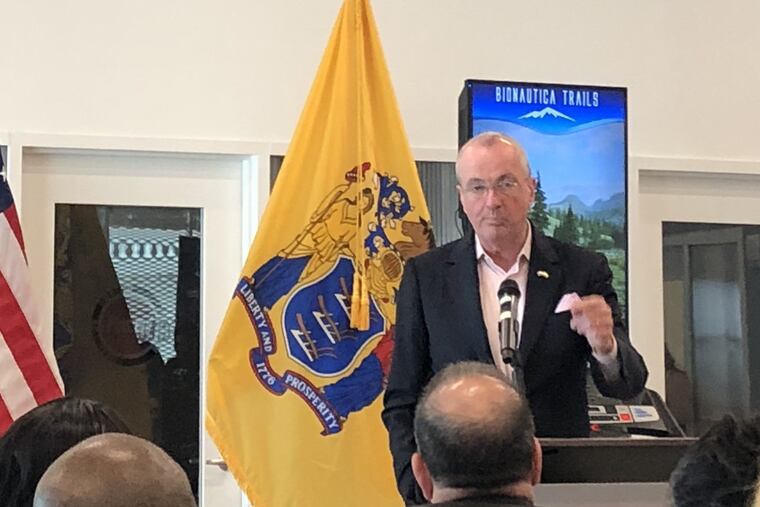

New Jersey Gov. Phil Murphy continued his quest to craft new tax credit programs for businesses, with a stop Wednesday at a tech incubator space in the Cherry Hill Mall.

Murphy’s speech underscored proposals that his administration has pushed for months: placing a $400-million annual cap on incentives that the state doles out, and emphasizing venture capital investments in startups, along with mixed-use projects geared toward revitalizing downtown areas.

But the political climate has recently shifted. Murphy’s re-stated policy aims now come amid two investigations, a high-profile lawsuit, and the ensuing political pressures that have engulfed the current tax break programs. The incentive programs were expanded by Murphy’s predecessor, Chris Christie, and championed by South Jersey Democratic political boss George Norcross – who is now suing Gov. Murphy in order to disband an investigation by a special task force.

And just this week, a state grand jury probe into the tax credit program came to light.

Meanwhile, the multi-billion dollar programs – namely Grow New Jersey and Economic Redevelopment and Growth – are set to expire June 30.

“I will not simply renew a set of incentive programs when serious questions exist, whether they’ve been successful in spurring broad-based economic activity in our communities, or even if their most basic premises have been met,” Murphy, a Democrat, said at a half-hour long press conference.

“Economic growth can’t just be about helping a select few and the politically connected,” he added.

Incentive programs should be transparent, and ensure that communities are “true partners” of businesses that receive state tax breaks, he said.

The comments echoed criticism by progressive political groups up and down the state, who have said the current programs rewarded cronyism and big businesses, at the expense of neighborhoods and workers in struggling communities.

Across Murphy’s five proposed incentive programs, businesses would be eligible for bonuses based on criteria such as hiring local employees, using union labor, and creating health care centers and alleviating food deserts.

But the fate of the Christie-era Economic Development Authority (EDA) incentive programs, and an investigation into how they were shaped, have blown up into a battle royale in Trenton, carrying over to prime season for budget talks.

It’s unlikely a compromise will be reached this month on a new incentive program, said Micah Rasmussen, director of the Rebovich Institute for New Jersey Politics at Rider University.

“I think we’re going to have a budget on July 1," Rasmussen said. "I don’t think we’re going to have a renewed EDA incentive program on July 1.”

This political fight is different from most that have roiled Trenton, he said. The special task force that Murphy appointed to investigate the tax break programs – following a scathing state comptroller’s audit in January – made a criminal referral to law enforcement in April. Investigators didn’t name the subject of the referral, saying only that it had to do with evidence of “unregistered lobbying.”

“Battles of Trenton are nothing new,” Rasmussen said. "But the criminal referral by the governor’s task force is what seems to have violated the usual rules of political engagement.”