How to pay down debt, stick to a budget, and accomplish your other finance resolutions in 2024

More than a third of U.S. adults are setting financial resolutions in 2024. Improving financing was the second most popular goal after improving fitness.

As holiday spending sprees come to a close and the calendar flips to January, you may be thinking about how you can be better with money in the new year.

More than a third of U.S. adults are setting financial resolutions in 2024, according to a recent Forbes survey. Improving finances was the second most popular goal after improving fitness, according to the late October poll of 1,000 people nationwide. It was cited more often than improving mental health, losing weight, and improving diet.

If you’re among those setting finance-related goals — whether it’s to pay down debt or finally create a budget — here are some helpful tips from experts, gathered during a year of consumer reporting.

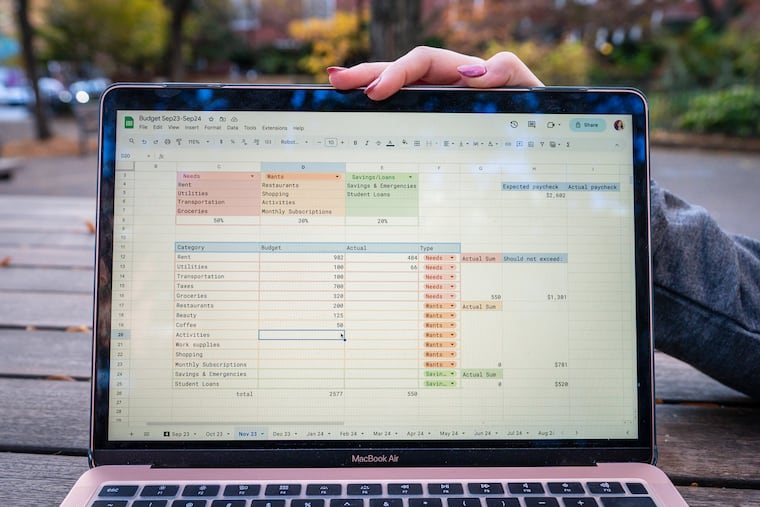

Resolution: Make and stick to a budget

Opt out of apps: Financial experts advocate for an old-fashioned strategy: Pen and paper. A spreadsheet on your computer works, too. They have found people are more likely to stick to a budget long-term this way. Some Philly-area Gen Zers can attest, and told The Inquirer that manual budgeting has made them more aware of their spending habits.

Audit yourself: Regardless of how you make your budget, make sure you are checking your bank accounts regularly enough that you know how much money you have and how much you’re spending each month.

Identify problem areas: Be honest as you check your accounts about areas where you are more likely to overspend, be it on meals out or online shopping, and set your budget accordingly.

Monitor subscriptions: Make a list of all the subscriptions that you have on auto-pay. Cancel ones you rarely use.

Give yourself grace: If you go over your budget, don’t throw in the towel. Take it as a learning experience and create a plan for how you can meet your goal next month.

» READ MORE: Why some Gen Z Philadelphians and financial experts say to put down the apps and budget by hand

Resolution: Spend less on your energy bills

Bundle up: Keeping your thermostat even one degree colder in the winter — or one degree warmer in the summer — can save you more than 4% on your monthly bill.

Make investments up front: If you’re in a home you plan to live in for awhile, it may be worthwhile to spend money now on upgrades, be it something relatively small like as a smart thermostat ($60 to $300) or something larger like a heat pump water heater ($1,500 or more). They’ll save you money in the long run.

Unplug appliances and electronics: If something is plugged in and doesn’t have an on-off switch, it is using energy when you’re not using it.

Close up windows and doors: Make sure your doors and windows are properly closed and locked. Install storm windows and doors. Buy a tube of caulk for $4 and insulate around all windows.

Look into energy audits: You could be eligible for a free or low-cost energy assessment, during which a professional can walk through your home and point out more specific ways you can save.

» READ MORE: Make your home energy efficient with this expert advice

Resolution: Pay off credit card debt

Stop using your credit card: Switch to a debit card for day-to-day purchases as you work to dig out of debt.

Negotiate a lower interest rate: First, find out what your current interest rate is. Then call your credit card company and ask for a lower rate. In 2022, 70% of people who asked for a lower rate got one, according to a LendingTree survey.

Consider a 0% interest balance transfer card: Transferring your debt to a 0% interest credit card can be especially helpful if you incurred an unexpected, one-time expense. “It gives you time to almost put yourself on a payment plan,” Sara Rathner, a credit card expert at NerdWallet, told The Inquirer.

Look into a personal loan: Consolidating your debt into a personal loan is a good option for those with lower credit. These loans typically come with a fixed interest rate, meaning they won’t change over time, and will break up your debt into equal monthly payments.

Keep some cash in savings: Try to strike a balance between keeping some money in savings and paying down debt. That way you won’t be forced to put unexpected expenses on your credit card and continue the cycle of debt.

» READ MORE: The average Pennsylvanian has nearly $7K in credit card debt. Here’s how to manage it.

Resolution: Spend less next holiday season

Start saving early: Figure out how much you’d like to spend on holiday gifts and other expenses in advance, and then set a savings goal each month or each pay check. That way you have money set aside when the holidays come around.

Stack rewards and points: Hold onto those store rewards or credit-card points throughout the year, then put them toward your holiday purchases.

Keep a running list of gift ideas: Listen all year for things your loved ones say that they could use, but that they probably won’t buy for themselves.

Look for sales on those items all year: You don’t have to wait until Black Friday to find deals. Sales occur around summer holidays, too, and if you have gift ideas in mind, you can keep an eye out for discounts on those items.

» READ MORE: Want to avoid holiday shopping stress? Finish it in August like this South Jersey couple.