Here’s a better way to tax the super-rich

Senator Elizabeth Warren's plan would put a 2 percent tax on those with a net worth above $50 million, and 6 percent on billionaires. While it makes sense to tax the wealthy more, there are better ways to do this.

Tax the rich! Tax the super-rich even more!

This has become a staple proposal from many Democratic presidential candidates. Sen. Elizabeth Warren, among the most progressive, has proposed tax increases that could result in a more than 100 percent marginal tax rate on billionaires. Bill Gates and Jeff Bezos, the richest men in the world, could still pass on multiple billions when they die, but not as many billions.

Perhaps the most controversial proposal for taxing the rich is a wealth tax – not on income, but on the value of the things rich people own. To help pay for all of her policies, Sen. Warren’s wealth tax would be 2 percent on those with a net worth above $50 million, and 6 percent on billionaires.

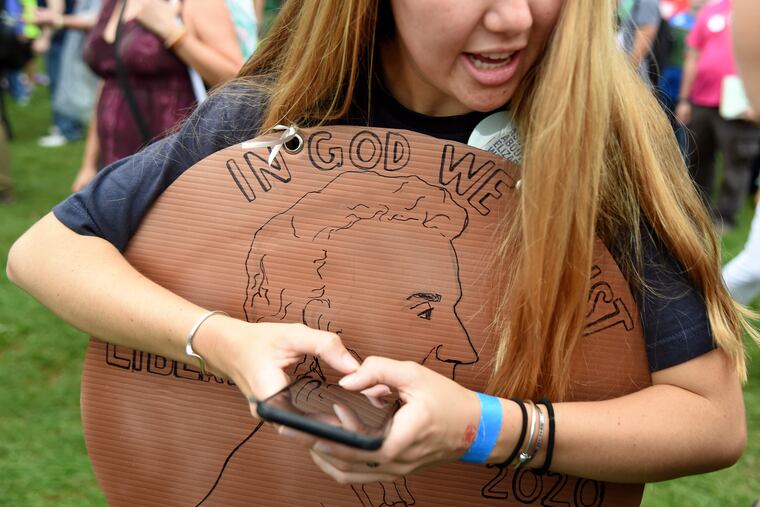

“Tax the rich” is an age-old refrain of politicians, but their calls for big tax increases on the wealthy seem especially loud this presidential election cycle. And voices that in times past cautioned against such so-called class warfare have been hardly heard.

It’s not difficult to understand what is driving this: The federal government is being starved. Federal revenues have flat-lined and, as a share of GDP, are declining and have rarely been as low, except during recessions. It is unprecedented for revenues to be so low when most everyone is working and businesses are making lots of money.

The Trump tax cuts that took effect last year are a big reason why government revenues are flaccid. When arguing for the tax cuts, the president claimed they would pay for themselves. Not even close. The federal budget deficit ballooned to $1 trillion this past year as the government was forced to borrow to pay for tax breaks that have largely gone to big corporations and, yes, rich taxpayers.

This is especially problematic given our rapidly aging population. Over the next two decades the large baby-boom generation will move fully into retirement, increasing demands on the Social Security system while ramping up the cost of Medicare. For the government to simply provide the same financial support to boomers as to previous generations, it will need more revenue, not less.

The Democratic candidates’ focus on taxing the rich is also motivated by the fact that the rich are getting a lot wealthier. The statistics are eye-popping. The super-wealthy, the top 0.1 percent of the population, own about 20 percent of the nation’s wealth. That is double the share of wealth this exclusive group owned just two generations ago. And the trends aren’t encouraging, as wealth seems set to become even more concentrated.

This widening gulf between the haves and have-nots is not consistent with our capitalist economy and democracy. Everyone must have the same opportunity to succeed, regardless of how much one has. It is reasonable to worry that if wealth becomes too skewed, the rich will capture the political process and bend regulations and laws in their favor. This would limit the ability of our best and brightest to shine, stunting our economy and living standards.

Thus, it makes a lot of sense to tax the wealthy more. The question is how best to do this. A wealth tax is intuitive, but it has significant practical problems. Determining someone’s wealth can be difficult, particularly for the very rich who own things that are hard to put a price on. For example, many of the wealthy own stakes in privately held businesses whose stock isn’t regularly bought and sold. Of course, the IRS could write rules that address these nuts-and-bolt issues, but it would be messy.

The wealthy will also work overtime to avoid the wealth tax, particularly if it is set too high. Sen. Warren recognizes this concern, so she would empower the IRS to improve enforcement of tax law. IRS funding has steadily declined over the years, and not surprisingly the difference has grown between the taxes owed and the taxes paid.

A better approach would be to increase taxes on the wealthy already in place. They include the estate tax, which has been scaled way back by President Trump. Reducing how much the wealthy can pass on to heirs will reduce the concentration of wealth. Eliminating the preferential tax treatment of capital gains would be effective, and taxing carried interest, which is the income earned by wealthy owners of private equity firms, is a slam dunk. And phasing out the income cap on payroll taxes used to fund Social Security and Medicare would be good policy.

These tax increases won’t raise as much revenue as what Sen. Warren has in mind, but they will be an effective way to ensure that the government has the revenue it needs to meet its future obligations to all Americans without putting an undue burden on the wealthy.