U.S. economy shakes free of recession fears in striking turnaround since August

WASHINGTON - The U.S. economy is heading into 2020 at a pace of steady, sustained growth after a series of interest rate cuts and the apparent resolution of two trade-related threats mostly eliminated the risk of a recession.

WASHINGTON - The U.S. economy is heading into 2020 at a pace of steady, sustained growth after a series of interest rate cuts and the apparent resolution of two trade-related threats mostly eliminated the risk of a recession.

This marks a dramatic turnaround in momentum since August, when some forecasters predicted a 50% chance of a downturn starting by the end of next year.

Many economists credit the Federal Reserve's recent interest rate reductions and the slightly improved trade picture for propelling the stock market to fresh record highs and causing forecasters to bump up their predictions for how long the economy can keep growing and adding jobs without stumbling.

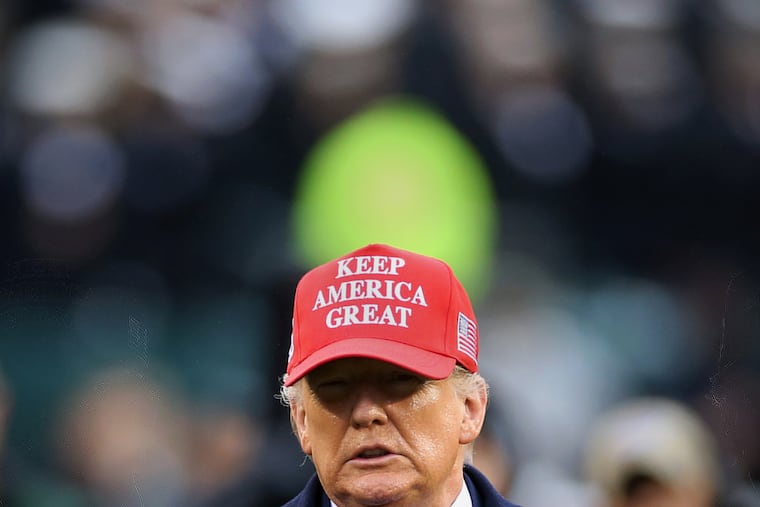

President Donald Trump secured Democrats' approval last week of a trade deal with Mexico and Canada that would keep most goods traded between the three nations tariff-free. He also reached a limited trade agreement with China that scrapped hefty tariffs in exchange for China agreeing to buy about $200 billion more in U.S. goods over the next two years.

The trade deals, while not nearly as ambitious as Trump promised, have lessened one of the biggest drags on the U.S. economy: uncertainty. While some industries still face significant tariffs and final details remain in flux, business leaders say at least they know what the situation is likely to be in 2020, offering more clarity than they have had since Trump's trade war commenced nearly two years ago.

"Tariffs will be much more stable for quite a while," Larry Kudlow, Trump's top economic adviser, told The Washington Post. "Some of the obstacles to growth, including the Fed and trade uncertainties, are being removed, and that will have a powerful positive impact on the economy."

U.S. Trade Representative Robert Lighthizer said Sunday that some of the larger-scale structural changes the White House wants China to make could take "years" to accomplish, reinforcing the belief that the White House could scale back some of its adversarial tactics next year as Trump nears his reelection bid.

"The risk of a trade-war-induced recession - which we never thought was high - has been materially reduced," said Ian Shepherdson, chief economist at Pantheon Macroeconomics Sunday, in a note to clients.

Kudlow predicts 3% economic growth next year, a pace that Trump promised voters but that has not been reached since 2005 and almost no forecasters outside the White House think is feasible.

While Trump is almost certain to fall short of his vow, the majority of economists now think the economy will grow about 2% next year, a rate solid enough to ensure that unemployment stays near a half-century low of 3.5%. This could benefit Trump on the campaign trail, as no president since World War II has lost reelection when unemployment was below 7.4%.

The major fears in August were that businesses would continue pulling back their spending, Trump would continue imposing tariffs, and companies would soon turn around and ax jobs. But that worst-case scenario didn't materialize. Job gains exceeded expectations in October and November.

Many economists say Trump should be thanking the Fed for coming to the rescue after he escalated the trade war this summer. The Fed reduced the benchmark U.S. interest rate three times this year - in July, September and October - taking it from nearly 2.5% down to just under 1.75%. Trump has repeatedly bashed the Fed, calling the central bank's leadership "boneheads," but it was the central bank that stimulate the economy in recent months.

"The reason things are looking more positive now is due to the Fed," said Constance Hunter, chief economist at KPMG. "We are seeing a turnaround in housing because mortgage rates are low."

White House officials say the trade deals alone could push growth up half a percentage point next year, up from about 2.3% this year. U.S. consumers have been the powerhouse of the U.S. - and global - economies this year, and that is likely to continue next year. On top of that, Kudlow argues, business investment is likely to make a comeback next year now that the Fed has made it cheaper to borrow money and Trump has hit the pause button on most additional tariffs.

Business investment contracted from April through September despite assurances from White House officials that the 2017 tax cuts would lead to a surge in new investments. That pullback helped create a drag on economic growth.

The economy next year is also expected to benefit from high levels of government spending, as well as an uptick in Chinese purchases of U.S. products. The government is projected to spend $1 trillion more than it brings in through revenue next year, an unusually large gap during a period of economic growth.

This adds to the debt and drives up borrowing costs, something Republicans have long opposed, but they have been largely supportive since Trump entered office.

Despite the low interest rates and progress in trade talks, a number of independent economists still believe the economy won't pick up much momentum. Many see the economy treading water next year, with a modest uptick in business investment offset by weaker consumer spending. They base this on recent clues, such as sluggish retail sales for November, typically a powerhouse month.

"We are not headed toward a recession, but the data do not indicate any form of sudden re-acceleration going into 2020," said Gregory Daco, chief U.S. economist at Oxford Economics.

Import tariffs remain on nearly $370 billion worth of goods from China, with the bulk of those aimed at parts used in manufacturing cars and other items. This has created an ongoing drag that caused a contraction in U.S. manufacturing this year. While the latest data on manufacturing indicate that the sector might have stabilized, it's unclear whether things are improving.

Trump did agree to cut tariffs on about $120 billion worth of Chinese imports - mostly shoes and clothes - from 15% to 7.5%, but Daco ran the numbers and found that the impact was "negligible" on the economy.

Weak growth abroad has also dampened business optimism in the United States this year, as roughly 90% of the world economy experienced a slowdown. Next year should be slightly better, according to the International Monetary Fund and other forecasters, but Paul Christopher of Wells Fargo Investment Institute says this will be a "slow and shallow" global recovery that is much weaker than what occurred coming out of 2012 and 2015.

"China is re-orienting its growth to domestic sources, especially technology production," Christopher says. "It is not yet clear what will drive a global manufacturing recovery."

The one part of the economy that has shown noticeable pickup in recent months is housing, a sector influenced far more by the Fed's action than by Trump's trade negotiators. Purchases and refinancings have picked up since the summer, even though the share of homes for sale has remained low and affordability has been a major issue in many cities.

But even in housing, the outlook for next year is uncertain. Mortgage rates are likely to stay in the same place for months to come after Fed Chairman Jerome Powell indicated last week that there is a high bar for the central bank to cut - or raise - interest rates in 2020 because it thinks the economy is in a good place and does not need extra stimulus. None of the Fed leaders penciled in a rate cut next year in their December forecasts.

Home Depot, a major home-improvement chain that is also seen as a bellwether for the housing sector, scaled back its sales forecast for next year after Chief Financial Officer Richard McPhail said the U.S. housing market in 2020 would "not [be] at a level that we've seen in prior years."

But Ken Simonson, chief economist at Associated General Contractors of America, predicts a "burst of home construction" next year and said the latest surveys show contractors are "very busy and upbeat" about the future.

Much of this will depend on the spending habits of consumers next year, which economists, business executives and political leaders are watching very closely.