President Donald Trump says he will seek payroll tax cut, relief for hourly workers as part of coronavirus response

It was unclear, based on Trump's comments, whether he would ask Congress to help these industries or whether he thought he could do it on his own.

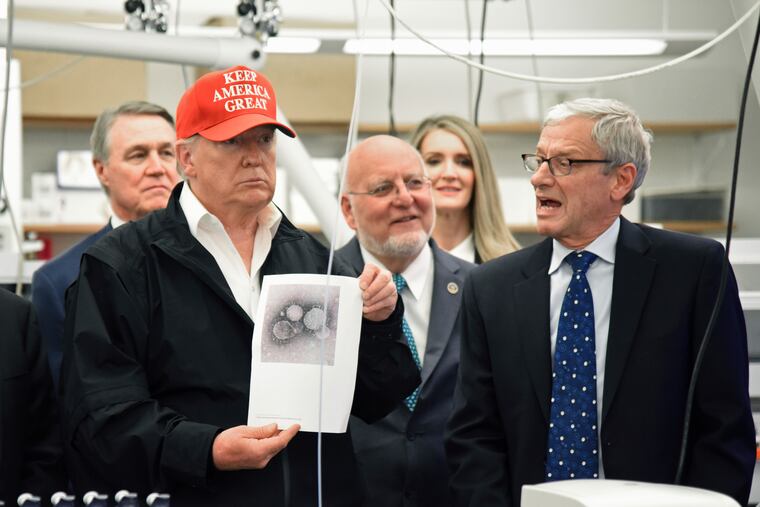

WASHINGTON — President Donald Trump said Monday that he is seeking major policy changes that White House officials hope will arrest the widening economic turmoil caused by the coronavirus outbreak by providing immediate federal aid to workers and a number of business groups.

But his proposals were quickly brushed aside by key congressional Democrats who are working on their own plan that could be released as soon as this week. The sparring comes as financial markets and the public increasingly look to Washington for answers as fear continues to spread.

Trump said he will ask Congress to cut payroll taxes and provide relief to hourly workers suffering from the economic fallout of the coronavirus. He also said he was seeking to provide assistance to the airline, hotel and cruise industries, which are all suffering as Americans rapidly cancel travel plans.

It was unclear, based on Trump's comments, whether he would ask Congress to help these industries or whether he thought he could do it on his own.

"We are going to take care of and have been taking care of the American public and the American economy," Trump said. He added that he would have a news conference Tuesday to talk about the big economic package.

Trump's comments made clear that the White House is considering a huge and expensive government response. Reducing the payroll tax by a single percentage point would cut between $55 billion and $75 billion in revenue, according to a recent projection from the Committee for a Responsible Federal Budget.

Payroll tax cuts in the past have been popular with Democrats and opposed by many Republicans. Trump's top economic adviser, Larry Kudlow, said Friday that big stimulus packages have "never really worked in the past." But House Majority Leader Steny Hoyer, D-Md., expressed skepticism about the idea.

"I don't think we think that the payroll tax cut is what we need right now," Hoyer said. "What the economy needs right now is some stability and confidence that we are addressing the issue that is undermining the economy. And I mean, the president's answer for almost everything is a tax cut. We think we need to make sure that people in health facilities and insurance companies and others have confidence that they're not going to be bankrupted by this and they'll have some support of the government."

Later in the day, House Speaker Nancy Pelosi, D-Calif., and Senate Minority Leader Chuck Schumer, D-N.Y., went into more detail about the Democrats' planned proposal. They said they would pursue legislation that would provide free coronavirus testing for all Americans, paid leave for those affected by the epidemic, expanded food subsidies and an expansion of the federal unemployment insurance program.

Still, other senior Democrats said it was inevitable that Washington will have to step in with measures to stimulate the economy. "We're going to reach that point," said Sen. Dick Durbin, D-Ill. "If we're serious about this, we have to put all the cards on the table."

There did appear to be growing common ground between the White House and Democrats over paid leave for workers. Vice President Mike Pence, who is leading the administration's coronavirus task force, said the administration would work with Congress to make sure people who contract the coronavirus do not lose pay as a result, though details of such a plan were unclear.

The efforts came on a day when the Dow Jones industrial average fell more than 2,000 points and as pressure was rapidly building on federal policymakers to address the growing economic impact of the outbreak.

After resisting a large economic package for weeks, the White House seems to be quickly assembling one. Congressional leaders said they are considering their own legislative remedies to address the economic turmoil. Democrats are discussing how to propose paid sick leave as part of new legislation, while Republicans have expressed reservations about a one-time change. Senate Finance Committee Chairman Chuck Grassley, R-Iowa, has said he would consider tax code changes to address the economic turmoil.

The White House has faced intense pressure to arrest falling markets and stabilize an economy that investors increasingly fear may tip into recession.

Last week, The Washington Post reported that White House officials were looking at deferring taxes for the airline, travel, and cruise industries. It was not clear whether Trump's own hotels would benefit from the changes he is contemplating.

In a sign of how quickly the White House is ramping up its economic response, White House officials have invited senior bank executives to meet this week to discuss the economic turmoil. Goldman Sachs chief executive David Solomon is expected to attend the meeting.

Despite growing fears, Treasury Secretary Steven Mnuchin at the news conference downplayed the chances of a recession, saying the fluctuations in the stock market reflected the oil shock rather than weakness in the U.S. economy. Mnuchin said the administration would also consider extending money to companies through the U.S. Small Business Administration to certain firms hurt by the downturn. He added that the government could provide temporary tax relief to businesses and individuals.

"This is not like the financial crisis where we don't know the end in sight. This is about providing proper tools and liquidity to get through the next few months," Mnuchin said. "The economy will be in very good shape a year from now."

Congress last week passed an $8.3 billion emergency spending bill that focused on medical and public health needs caused by the coronavirus outbreak, but Democrats are already working on a new bill that would seek to address the economic problems that are rapidly expanding.

Rep. Rosa DeLauro, D-Conn., a senior member of the House Appropriations Committee, told reporters on a conference call Monday that Congress should move forward quickly.

"I believe that this is precisely the direction we need to go in. There are the economic consequences from the crisis that are of equal concern as responding on the health-care side," DeLauro said.

"Everybody is trying to move at warp speed," DeLauro added, although the timing, price tag and exact contours of any legislative response is uncertain.

DeLauro has introduced legislation that would mandate 14 days of paid sick leave in the case of an emergency health crisis such as coronavirus, noting that most workers - especially low-wage workers - have no paid sick leave and thus would face difficulty complying with medical quarantine advice.

Grassley, meanwhile, is looking at "targeted tax relief measures" with the aim of providing a "timely and effective response to the coronavirus," a spokesman said Monday.

Senate Finance Committee spokesman Michael Zona said several options under the committee's jurisdiction were being reviewed as members learn more about the impact on specific industries and the economy as a whole.

He did not specify what the measures might be.