Four factors really driving U.S. health care change in 2020

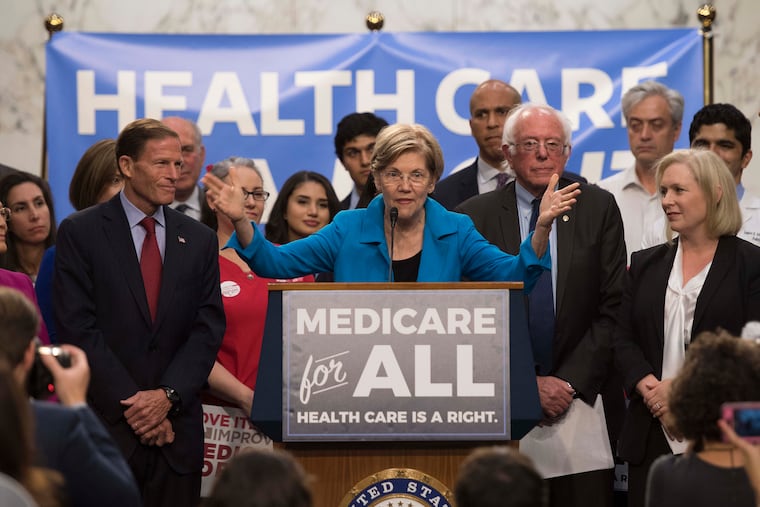

Medicare for All? Virtually impossible. But that doesn't mean the status quo will prevail.

If you listen only to the national political debate on healthcare you would believe that we are headed inevitably toward some form of universal, nationally controlled system of care.

However, the federal government has not and will not lead the essential changes required in the industry. The political environment and politicians’ dependencies on historical campaign funding from healthcare industry donors will cause congressional behavior to continue, as it has, making small incremental change. This behavior every year simply reinforces the existing system.

Dramatic, fundamental change by government action will not be forthcoming for three reasons. First, there is no feasible funding plan for “Medicare for All.” Second, 150 million U.S. citizens are not going to accept having their current healthcare insurances and providers changed. Third, the fundamental solutions for healthcare are reducing cost and inappropriate utilization. Adding money to the healthcare system to cover uninsured persons is irrational when we have plenty of money already in the system to cover everyone today.

So, if you step back and examine healthcare industry trends the following four factors will be principal drivers of change in 2020:

1. Employers are frustrated with the government, commercial insurers and healthcare providers for not solving the financial issues of an overbuilt system. Angered employers will be the principal actors driving healthcare change in the commercial sector. Action by leading national employers (notably Walmart’s health benefits strategy) will be replicated by other employers and, over time, their collective efforts will generate a national effect:

Employers will seek solutions that can be provided over broad geographic areas.

Employers will seek full risk arrangements through direct contracts with providers.

Employer behavior will reflect employee preferences. The expression of these preferences will lead to the breakdown of the traditional provider model into its parts, as well as the expansion and diversification of the means of access to essential care and information.

2. Insurers will continue their efforts to reposition as providers. For example, Optumcare owned by UnitedHealthcare and entities like them will expand their capabilities as direct care of providers (e.g., physical therapy, home care, urgent are, ambulatory surgery, etc.). As a result, hospitals will become providers of reasonably priced inpatient care.

3. Costs and utilization will radically be reduced:

The assumption of financial risk by provider organizations creates great opportunities to address excessive utilization (rates of utilization in the U.S. when compared to other advanced countries are twice as high; two times as many CT scans, tonsillectomies, C-sections, etc.). Managing utilization while assuming risk will be the best means to produce profits.

New economies of scale are being produced by providers working across corporate boundaries with other providers to create innovative solutions.

Technology will reduce healthcare employment for repetitive activities. It will, as well, be a vehicle to materially improve safety and standards of care.

4. The pace of change will accelerate. Unfortunately, most provider entities are inhibited by their existing organizational process and practice, unable to match the pace essential to compete.

Take another look at these predictions in January 2021 and see whether they are reflected in what actually happens.

Howard Peterson, MHA is the founder and managing partner of TRG Healthcare and a member of the Inquirer’s Health Advisory Panel.