High-end payday loans

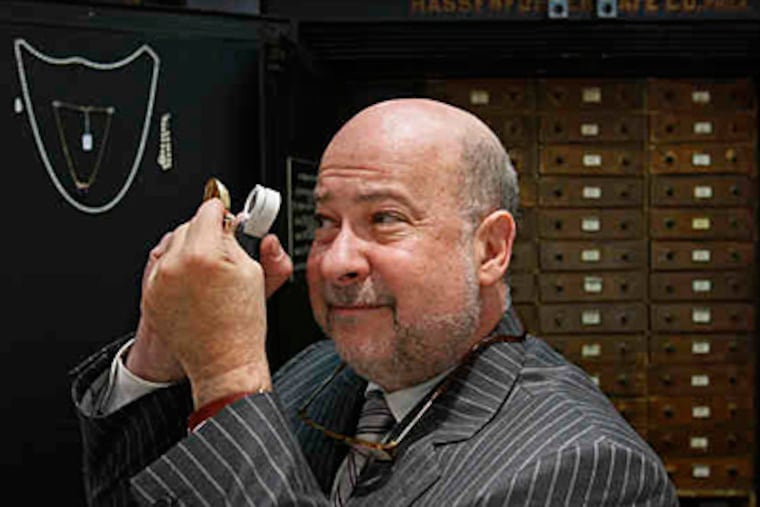

From his pawnshop at 10th and Sansom Streets in Center City, Tod Gordon has an unusual window on credit and the economy.

From his pawnshop at 10th and Sansom Streets in Center City, Tod Gordon has an unusual window on credit and the economy.

Carver W. Reed & Co. Inc. is not the stereotypical pawnshop where the walls are lined with guitars and the glass cases are filled with cameras.

Instead, Carver W. Reed, which celebrates its 150th anniversary Tuesday, specializes in loans that use diamond and gold jewelry exclusively as collateral.

Gordon said his business had catered to wealthier clients for decades. Even so, he said, in 2008 and 2009 he saw a huge increase in the number of business owners pawning the gold watches and diamond jewelry they had bought in better days.

They needed the money to pay their employees, Gordon said, and could not borrow it from a bank.

"The number of people that have come in from walks of life that I never expected to see has been overwhelming," Gordon said. His grandfather bought the business in 1949 from descendants of the founder and kept the name.

Most customers who started borrowing from him during the financial crisis are still playing catch-up, he said.

On the plus side for the economy, he noted, wholesale and retail demand have improved for the jewelry he ends up selling because loans are not repaid.

"I've noticed a dramatic swing in the last three months. People are starting to come back out again and spend money and buy again," said Gordon, who zealously guards his clients' privacy.

He also declined to disclose the value of his outstanding loans because each is backed by jewelry worth three or four times as much as the loan.

The Pennsylvania Department of Banking regulates pawnbrokers and limits the amount of interest that can be charged to 3 percent per month, Gordon said. That adds up to a high rate over a year, but for a month a $10,000 loan costs $300.

"You can't go to a bank to get that," Gordon said.

Building contractors take advantage of such financing to make payroll and buy supplies, he said.

"Their stuff is back out in 60 days max," Gordon said. "I have many contractors; they are all big loan people."

There are 57 licensed pawnshops in Pennsylvania, the same as three years ago, according to the state Banking Department. New Jersey has 35 licensed pawnbrokers.

The 2,600-member National Association of Pawnbrokers, based in Keller, Texas, says that most pawnshops are family businesses and that they are regulated by all the federal laws that apply to other financial institutions, such as the Truth in Lending Act and the Bank Secrecy Act.

"It's an intriguing business," Gordon said. He has worked full time at Carver W. Reed since graduating from college in 1977 and is thrilled to have a daughter in the business now.

He clearly enjoys people and the insights he gains on the economy. He talked about a new customer, a manufacturer of furniture for boats, who has been in business for 38 years and for the first time could not make payroll.

"That, to me, was a real sign of a trickle-down effect," Gordon said.

"Everybody says, 'The cruise lines are hurting,' but nobody thinks about the guy making furniture for the cruise lines."