TD Bank makes gains among consumers and small businesses

TD Bank edged ahead of Wells Fargo Bank in Philadelphia-area deposits at branches that focus on consumers and small businesses, according to June 30 data released Tuesday by the Federal Deposit Insurance Corp.

TD Bank edged ahead of Wells Fargo Bank in Philadelphia-area deposits at branches that focus on consumers and small businesses, according to June 30 data released Tuesday by the Federal Deposit Insurance Corp.

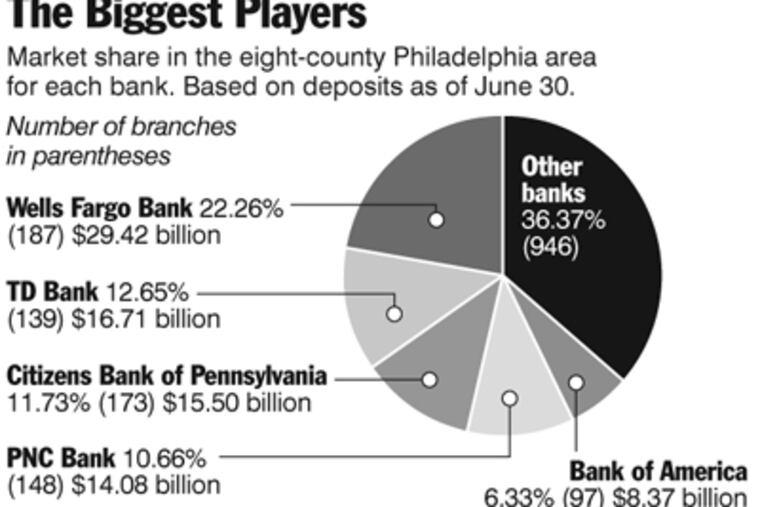

But Wells Fargo, formerly Wachovia Bank, remained the overall leader with $29.42 billion in deposits at 187 branches in the eight-county region, including $13.8 billion in deposits at two Center City branches. Deposits at large Center City branches often include shifting corporate money and can be extremely volatile from year to year.

At smaller branches, those that have less than $500 million in deposits and are more likely to cater to local customers, TD's share climbed to 15.7 percent from 14.7 percent. The bank, which is based in Toronto but has one of its U.S. headquarters in Cherry Hill, added $463 million in deposits from June 30, 2010, to June 30, 2011.

Michael Carbone, TD's regional president for the metro Philadelphia market, was happy to hear of the gains at TD and said he expected the growth to continue because the bank was extremely busy opening new accounts in August and September.

"Our call centers have been lighting up in terms of all the noise in our industry," Carbone said, referring to the uproar over the new debit-card fees at some banks. He said TD had no plans for a debit-card fee.

Overall, TD ranked second, with $16.71 billion in deposits at 139 branches, up from $15.19 billion the year before.

At Wells Fargo, the share of deposits at smaller branches fell slightly to 15.5 percent from 15.71 percent, while deposits at those branches climbed to $15 billion from $14.8 billion.

"We're just pleased that we maintained a good, steady customer base through a long conversion, which is a feat in itself," spokeswoman Barbara Nate said. Wachovia was purchased by Wells Fargo at the end of 2008 but in the Philadelphia region did not begin operating under the new name until this year.

Nate said Wells Fargo's customer count in terms of households grew modestly from June 2010 to June 2011.

There was very little change in market share among the next three banks with the largest chunk of local deposits: Citizens, PNC, and Beneficial.

The volatility of large Center City branches is evident at Citizens and Sovereign. Deposits in a Citizens branch at 1701 John F. Kennedy Blvd. soared to $5.07 billion from $2.52 billion, accounting for most of the bank's overall gain in deposits. Deposits more than doubled to $2.24 billion at a Sovereign branch at 20th and Market Streets.

Among the fastest-growing banks in the region on a percentage basis were WSFS Bank, which is expanding in Chester and Delaware Counties; Valley Green Bank in Philadelphia; and Customers Bank, former Sovereign head Jay Sidhu's new bank.