Investing in You: Beware offers of student debt 'help'

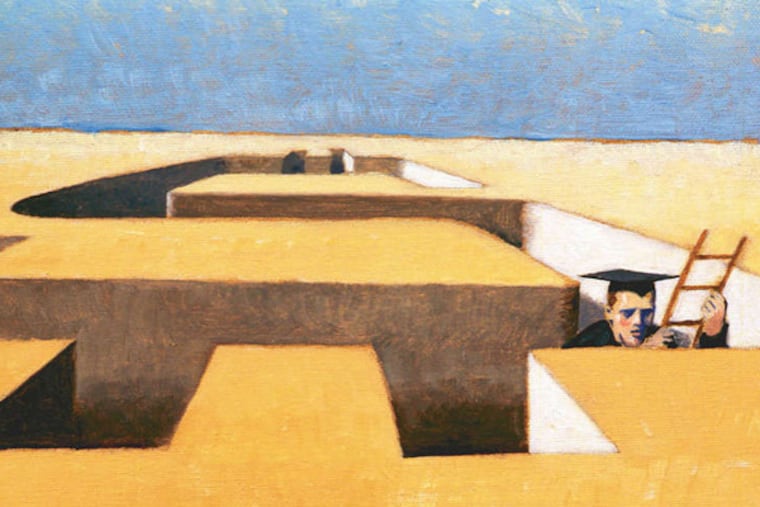

What's another name for student debt consolidator? A new low in scam artists. So here's how not to become a target of "debt relief" companies.

What's another name for student debt consolidator? A new low in scam artists. So here's how not to become a target of "debt relief" companies.

Many 2014 college graduates are receiving their first loan bills. Student loans total $1.2 trillion nationally, and about seven million students have defaulted.

You don't need to pay anyone to get help with, or to restructure, your federal student loans - period. (Private loans are another matter entirely). Do it yourself for free.

"We have a client here who was solicited by a company to pay an up-front fee of $700 for help in consolidating her student loans. However, she has all federal loans, so she could consolidate them for free," said Shawn Needham, of Clarifi, a nonprofit financial counseling agency with branches in Center City and the suburbs.

Law enforcement, including state attorneys general and the Consumer Financial Protection Bureau, are going after student debt-relief companies, citing rising complaints and aggressive advertising, explained Mark Kantrowitz, founder of Edvisors.com.

"Some are even advertising on late-night TV, not just on the Web," he said.

The only phone number you need is the U.S. Department of Education's student loan center: 1-800-4FEDAID (1-800-433-3243).

The Department of Education issues a vague warning on its Website about debt relief (https://studentaid.ed.gov), but it's not prominent enough.

The warning appears under "Loan Consolidation" at the bottom of the website, under "Repay Your Loans" and reads:

"There is no application fee to consolidate your federal student loans into a Direct Consolidation Loan. If you are contacted by someone offering to consolidate your loans for a fee, you are not dealing with the U.S. Department of Education's loan consolidation servicer."

Uncle Sam: Take a hint from Captain Obvious, with a red-letter warning on the home page.

Alternative repayment programs, such as Income-Based Repayment or Pay as You Earn, are available at no cost to federal student-loan borrowers. Visit ConsumerFinance.gov for more information.

Or to apply for a Direct Consolidation Loan through the Department of Education, visit its Direct Consolidation Loans website (www.loanconsolidation.ed.gov) or call 1-800-557-7392.

This website changed drastically in May, so be prepared to spend some time online.

Earlier this month, the Consumer Financial Protection Bureau highlighted two student "debt-relief" scams, which charge high fees for free federal loan-repayment benefits. The scams "illegally tricked borrowers into paying up-front fees for federal loan benefits," the agency said in a Dec. 11 statement.

The CFPB, in a joint filing with Florida's attorney general, shut down College Education Services and separately filed suit against Student Loan Processing.US.

"Student loans are already a significant debt for many Americans. College Education Services and Student Loan Processing.US added to that hardship by taking advantage of troubled borrowers and failing to describe their services honestly," said CFPB director Richard Cordray.

"When scam artists prey on student-loan borrowers, we will take action to halt their illegal activity."

College Education Services, its owner, Marcia Elena Vargas, and advisor and employee, Frank Liz, were based in Tampa, and operated websites including CollegeDefaultedStudentLoan.com and HelpStudentLoanDefault.com. They reaped millions of dollars in advance fees from consumers, the agency said.

Federal law requires that at least one debt be renegotiated, settled, or reduced before a fee can be collected. College Education Services charged consumers between $195 and $2,500 up front; the average was about $500.

College Education Services promised lower monthly payments for consumers. One advertisement said, "Cut Your Student Loan Monthly Payment Up to 50% - Save Today!" Instead, sometimes the monthly payments increased. The CFPB is seeking to ban College Education Services from the industry.

The CFPB alleges that since 2011, Student Loan Processing.US and its owner, James Krause, marketed services to assist student borrowers applying for Department of Education federal student loan repayment programs.

The company operates websites under the names StudentLoanProcessing.us, StudentLoanProcessing.org, and slpus.org.

Student Loan Processing.US is a fictitious business name for Irvine Web Works Inc., headquartered in Laguna Nigel, Calif., with an office in Dallas.

The bureau accuses the company and Krause of falsely representing an affiliation with the U.S. Department of Education and charging illegal advance fees - 1 percent of the consumer's federal student loan balance or $250, whichever was higher.

The company also deceived borrowers about the costs and terms. Student Loan Processing.US failed to disclose that its "monthly service fee" would continue until the consumer's federal student loans were paid in full or discharged, which could take decades.

Investing in You:

DON'T BE A VICTIM

Warning signs that a company offering student loan debt relief may be a scam:

Pressure to pay high up-front fees

Avoid companies that require payment before doing anything, especially if they try to get a credit card number or bank account information, or require that you sign a contract.

Requests for a Federal Student Aid PIN

Be cautious of companies that ask for your Federal Student Aid PIN. This unique ID is the equivalent of your signature, and giving it away is giving a company the power to perform actions on your student loan. Honest companies will work with you to come up with a plan without the PIN.

If you are a borrower who has run into trouble with companies offering debt relief services when repaying student loans, visit www.consumerfinance.gov/complaint.

More information is available at www.consumerfinance.gov/students.

EndText

215-854-2808