Charter debt 'stunningly bad'

NEARLY $500 MILLION in expensive and lightly regulated borrowing by Philadelphia charter schools uncovered this week contains some spending that is "not defensible" and "stunningly bad," according to Gov. Wolf's top policy official.

NEARLY $500 MILLION in expensive and lightly regulated borrowing by Philadelphia charter schools uncovered this week contains some spending that is "not defensible" and "stunningly bad," according to Gov. Wolf's top policy official.

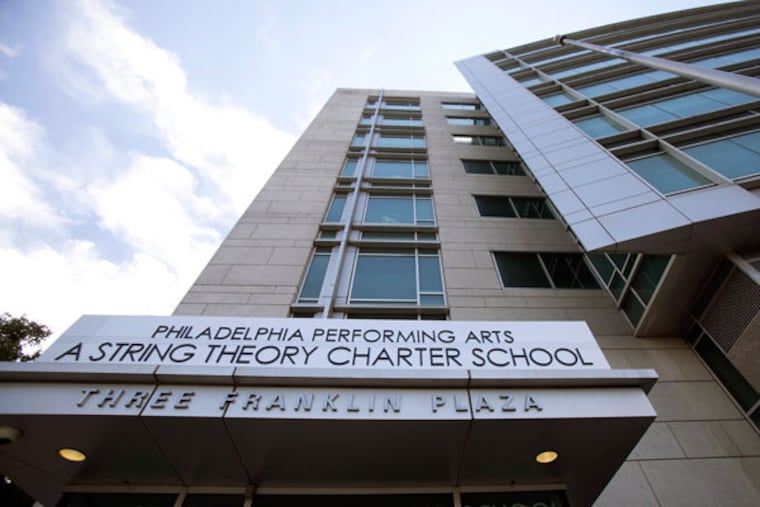

A Philly.com investigation published Monday online and in the Daily News found that numerous charters are saddled with millions of dollars of debt after using a city financing agency to tap into public bonds. One charter, String Theory Schools, borrowed $55 million to buy a Center City highrise, and has since cut academic programs and student busing to pay down its debt.

"There are some stunningly bad numbers in there, where far too much money was going into capital projects and financing arms," said John Hanger, the governor's secretary of policy and planning. "We want to be sure dollars are going into the classroom, and not to capital projects that are unnecessary or overly luxurious."

Since 2001, $468 million in tax-exempt bonds have been issued to charter schools with help from the Philadelphia Industrial Development Authority, the city's largest economic-development agency. The bonds frequently carried "junk" ratings, which means much higher interest rates than traditional government borrowing.

Hanger said the governor is focused on overhauling the state's scandal-plagued cyber charters, which have drawn unwanted national attention, but pledged that Wolf also would seek broader reforms to the state's educational system, including charter lending.

"The story underlines that there are more parts of how charter schools are operating that require more tightening and oversight," he said. "There are specific reforms to [school] building projects that we're going to look at very carefully in the coming year."

An Inquirer editorial yesterday called for large-scale reform of Pennsylvania's law governing charter schools. The 1997 law has not been updated.

Technically, the state already has been weighing in on charter deals for years: The Department of Community and Economic Development, in Harrisburg, must approve every tax-exempt bond deal.

But Philly.com's report included analysis of DCED documents that found that the agency's approval process consisted mainly of signing off on PIDC bond documents.

In several cases, DCED secretary C. Alan Walker approved applications that outlined charter schools' intents to enter into circular leasing arrangements. In such a deal, an entity closely related to the charter school will purchase a property, then lease it to the charter schools. The charter then is reimbursed by the state for the rent it pays.

The state's auditor general has criticized this practice.

Hanger acknowledged that DCED's oversight had been problematic.

"This may be an area where we need to come forward with further reforms," he said of the DCED. "We're going to certainly examine what further action we can take under existing charter-school law."