Turzai wants more tax-credit scholarships for nonpublic schools

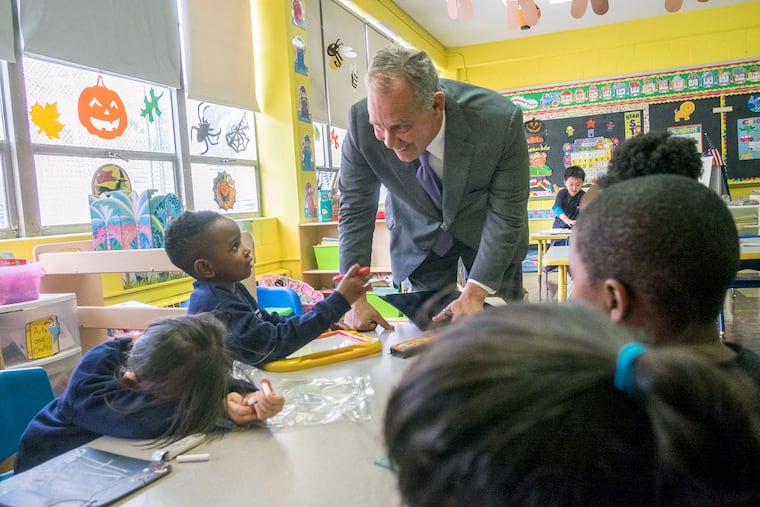

After touring St. Thomas Aquinas Catholic School in Point Breeze on Wednesday, House Speaker Mike Turzai announced a proposal to expand state scholarship programs that help low-income families afford such schools.

After touring St. Thomas Aquinas Catholic School in Point Breeze on Wednesday, House Speaker Mike Turzai announced a proposal to expand state scholarship programs that help low-income families afford such schools.

Turzai (R., Allegheny) wants to boost the total corporate tax credits businesses can receive for contributing to scholarship and educational-improvement programs to $250 million in the 2017-18 budget - $75 million more than the current cap.

"It really has been an important part of allowing school choice in the commonwealth of Pennsylvania," Turzai said.

His proposed legislation, which he said would be introduced this year, would increase the tax credits that businesses can take for contributions to the Educational Improvement Tax Credit (EITC) program by $50 million and the Opportunity Scholarship Tax Credits (OSTC) by $25 million.

The proposed EITC increase would be twice the size of the boost the legislature approved in the current budget.

The money businesses contribute under the EITC program goes for scholarships to help low-income families send their children to nonpublic schools from pre-K through grade 12. It also supports after-school and other programs at both public and private schools.

OSTC provides scholarships to nonpublic schools for students whose neighborhood schools perform in the lowest 15 percent in the state.

Critics charge that the tax-credit programs reduce revenue available for public schools and other needs and improperly provide state aid to religious schools.

Turzai said the scholarships go directly to families that may choose to send their children to Catholic or other religious schools.

He said the state budget includes more than $11 billion for K-12 public education.

"The total amount of tax credits we offer under the Educational Improvement Tax Credit and the Opportunity Tax Credits is now $175 million - not close to the number we are spending on K-12 public education," Turzai said.

St. Thomas is one of 15 Catholic schools in impoverished urban neighborhoods that are managed for the Archdiocese of Philadelphia by the nonprofit Independence Mission Schools network.

Anne McGoldrick, network president, said tuition at all Independence Mission Schools is $4,500. She said most families pay about $2,000 and receive aid to cover the remainder. Pre-K tuition at mission schools is $3,500.

Nicole Unegbu, principal of St. Thomas, said the scholarship programs lauded by Turzai were essential for her ethnically and racially diverse school of 300 pre-K through 8th graders.

"It makes school choice an option for our families," she said.

martha.woodall@phillynews.com215-854-2789 @marwooda