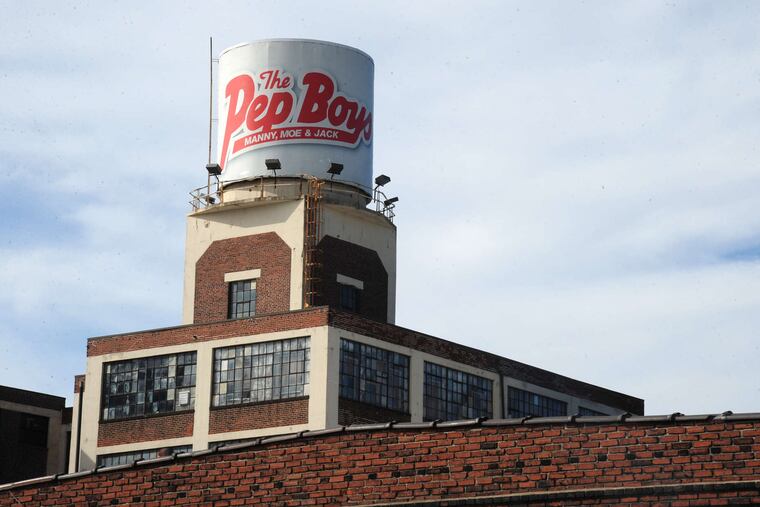

Icon Pep Boys ends 94-year run, selling to Bridgestone

Bridgestone will pay $835 million for the 800-store, barely profitable Pep Boys.

PEP BOYS - Manny, Moe & Jack, the iconic Philadelphia-based auto-parts and service store chain, has agreed to be sold to Bridgestone, the Japan-based tiremaker that owns Firestone tire stores.

Bridgestone will pay $15 a share, or $835 million, for the 800-store, barely profitable company, which has 14,000 employees in 35 states and yearly sales of $2 billion.

Pep Boys, which began in 1921 in West Philadelphia, has sought buyers several times since 2006, including an announced offer in 2012, and its share price has trailed faster-growing competitors like AutoZone.

Most recently, it was under pressure to boost profits, or find a new owner, by activist shareholders including New York investor Mario Gabelli, whose Gamco mutual funds control 19 percent of the company.

"The parts business has been going down the rathole with its performance" since the 1990s, said Robert Costello, owner of Costello Asset Management in Huntingdon Valley, and a longtime Pep Boys watcher. "In the end they were sold for their service network."

Pep Boys' first store was opened at 63rd and Market in the city's Overbrook section by Navy veterans Manny Rosenfeld, Moe Strauss, Moe Radavitz and Graham "Jack" Jackson.

The chain with its cartoon logo of three of the founders quickly became a fixture in neighborhood and suburban shopping centers.

Pep Boys supplied mass-market car-buyers from the days of Ford's Model T forward, and grew with suburbia after World War II, with some of the founders' children taking senior management roles.

But Pep Boys' retail business and its mixed retail and service format have suffered in recent years as fewer Americans fix their own cars, and chains like AutoZone and Advance Auto Parts, with smaller stores in newer shopping districts, grew more quickly.

Pep Boys remains a leading tire seller in a fragmented national market, but has struggled to exploit its 7,500 service bays to attract more new-model cars. It is also less profitable than other chains, Stifel and Co. analyst James J. Albertine told clients yesterday.

Even as the company is saddled with older stores that aren't busy enough, the company "lacks critical mass in many markets," and needs capital from a new owner like Bridgestone to add well-run service locations in lucrative markets while improving online sales, Albertine added.

Bridgestone may decide to sell the Pep Boys retail store business, keeping tire and service, analyst Antony Cristello told clients of BB&T Capital Markets, Richmond. With more stores, Bridgestone is less likely to sell competitors' tires, which could result in fewer bargains for consumers.

Will the merger result in store closings and office consolidations? "Of course there will be some overlap," said Brian Zuckerman, Pep Boys general counsel. "They want our 800 locations. They are excited to combine us with their 2,200 stores."

Pep Boys' Allegheny Avenue headquarters, with 500 people, will stay open "in the near term," Zuckerman added. The long-term future of the Philadelphia offices "will be assessed" once the deal is done.

Bridgestone, which owns many of the world's best-selling tire brands, has its U.S. headquarters in Nashville, Tenn.

Besides Firestone Complete Auto Care stores, including several in the Philadelphia area that compete with nearby Pep Boys, Bridgestone Retail Operations also operates Tires Plus, Hibdon and Wheel Works tire stores.

Bridgestone Americas CEO Gary Garfield said in a statement that he looked forward to building a "stronger organization" by combining, not just the stores, but also the two companies' distributor networks, with Pep Boys contributing "more than 35 percent" of the combined companies' sales.

Scott Sider, the former Hertz executive who took over as Pep Boys CEO last summer, said the deal "offers new opportunities for our employees across a bigger business." He predicted "a smooth and successful transition." Target date is the beginning of 2016.

The sale price is a 60 percent premium to Pep Boys' trading value last spring, before takeover speculation raised shares this summer.

But it is unchanged from the $15-a-share price that Gores Group, a Los Angeles buyout firm, agreed to pay for Pep Boys in 2012, in a deal that unraveled. Share buybacks since then have reduced the total value of the offer, from $1 billion at the time of the Gores proposal to $835 million.

The sale was approved unanimously by Pep Boys' board, which includes prominent Philadelphians such as accountant Jane Scaccetti, national investors such as James Mitarotonda of Barington Partners and three Gabelli allies elected to the board in June.

The Philadelphia law firm Morgan Lewis & Bockius advised Pep Boys on the sale.

On Twitter: @PhillyJoeD