Amnesty plan for $613M in PA unemployment payments

HARRISBURG — Remember when you were unemployed, and the state sent those checks to you, even after you started your new job?

Yeah, about that. It's time to pay up.

But don't worry too much. You can repay that overpayment, and save in the process, thanks to a first-in-the-nation scheme to get some of the $613 million owed to the state's unemployment trust fund.

But wait. There's more.

Business owners who may have shorted the state in their payments into the fund are invited to play along as well.

Here's how it works.

The Department of Labor and Industry is offering a three-month amnesty program to the 130,000 individuals who were overpaid $356 million in unemployment claims. The 50,000 or so employers who owe $257 million in unemployment compensation taxes have the same three-month grace period.

During the amnesty program, which runs June 1 through Aug.31, the department will waive and reduce some fees and penalties normally charged on overpayments. While many states, including Pennsylvania, have hosted similar programs for delinquent taxes, state officials say running one for unemployment compensation is a national first.

"We're hoping we could regain and recoup the funds, but also educate people moving forward so that they don't end up in a situation where they have an overpayment,"said Sara Goulet, the department's press secretary.

The program was authorized by Act 60 of 2012, a law passed last year that refinanced debt from the Unemployment Trust Fund. Goulet said while the state's unemployment trust fund is solvent, it must stay that way in order to support future unemployment benefits – and getting back any amount in overpayments could help.

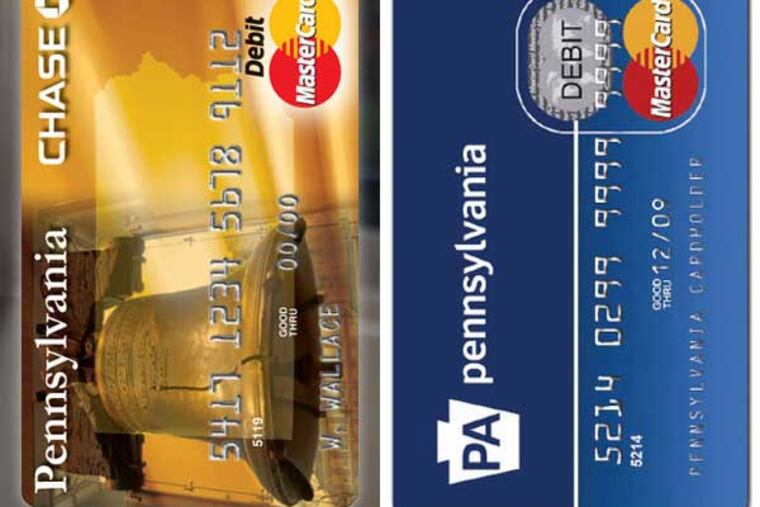

Though the state already notifies people who have received overpayments, a new round of letters will contain information about the amnesty program and its benefits, directing them to a new website, makeitright.pa.gov, where they can make payments.

The state is using a federal grant to help pay for an online advertising campaign that totals several hundred thousand dollars.

"We really do want to have that money for the people who need it," she said. "It's not fair to the people who are following the rules."

Goulet said individual who received overpayments are in one of two categories — fault, and no-fault.

Fault applies to those who willfully misrepresented information to receive additional benefits. The amnesty program will waive half of all interest payments and penalties for those payments, but those who are actively being investigated for unemployment fraud are not eligible.

No-fault overpayments occurred when individuals didn't know they were receiving too much. Goulet said they're often the result of someone not knowing they were no longer eligible for benefits, like residents who do not know they become ineligible for employment as soon as they begin working again and continue receiving benefits until their first paycheck.

During the amnesty program, the state will forgive half of the remaining overpayment balance for no-fault situations.

Many of the businesses cited for underpayments may have not paid enough in quarterly payments owed on the unemployment compensation tax. But during the amnesty program, they will be charged for what they owe, plus half in interest rates and penalties.

The program applies to overpayments to individuals and underpayments by businessses made through June 30, 2012.

For residents who owe the state money, "making it right" could help improve their credit history and clear their record with the state, Goulet said. Residents tagged with overpayments are ineligible to collect benefits in their future.

The Department of Revenue ran a tax amnesty program in the summer of 2010. The state collected more than $254.5 million in back taxes, some more than 15 years past due, out of more than $2 billion in delinquent taxes. The program offered reduced interest rates and penalty waivers.

More than 1 million notices were sent to businesses and residents notifying them of tax delinquencies before the start of the program. By the end of the 54-day amnesty program, 59,461 taxpayers participated.

Contact Melissa Daniels at melissa@paindependent.com