Editorial: Same as it ever was

It's the first day of June, and you know what that means in Harrisburg - only 30 days until the legislature misses the deadline for approving the state budget.

It's the first day of June, and you know what that means in Harrisburg - only 30 days until the legislature misses the deadline for approving the state budget.

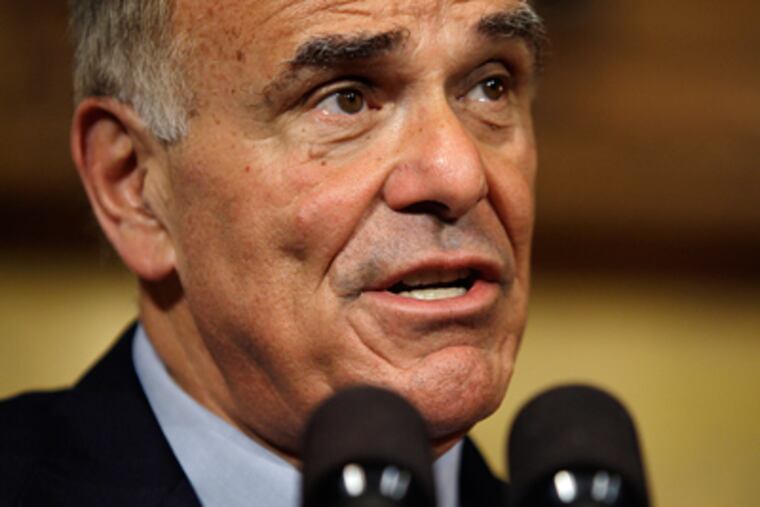

If that's a cynical assessment, it's also one with ample precedent. The seven previous annual budgets submitted by Gov. Rendell failed to receive the legislature's approval by the legally required deadline of June 30.

Because of persistently low tax collections in the weak economy, this year the state is facing a budget deficit of about $1.3 billion. Only a few months ago, officials were hoping the deficit would be half that much.

So the partisan wrangling during the next few weeks will be over how to close that budget gap. Republicans, who control the state Senate, want to balance the budget primarily through cutting programs. Many Democrats agree that more cuts are necessary, but in the House they also are pushing a package of tax increases to make up about one-fourth of that deficit.

The tax hikes approved by the House Appropriations Committee a week ago are reasonable. They include a first-ever tax on smokeless tobacco, a 30-cent-per-pack increase in the cigarette tax, and a levy on the production of natural gas for the state's booming Marcellus Shale gas industry.

Together, these tax increases would bring in about $330 million. Pennsylvania is the only state without a tax on smokeless tobacco products, and the only natural-gas extraction state of any size without a wellhead tax. These measures should be included in the final budget package, election year or not.

While they're at it, legislators should enact a gasoline-tax increase to help fund the state's crumbling network of roads, bridges, and mass transit infrastructure. That task promises to be an even heavier lift in an election year, but the need is unquestionable and urgent.

The state's shortage of money for overdue transportation projects has only grown worse with the federal government's rejection of tolls on Interstate 80.

House Democrats should have moved ahead with a tax on cigars, too, but decided there wasn't enough support for it. So Pennsylvania will remain one of only two states that doesn't tax stogies.

Democrats also have backtracked on a worthwhile proposal to eliminate the sales tax "vendor discount." The discount is a reward for merchants simply for turning over their sales tax collections to the state as required by law. It's unnecessary and shouldn't be preserved in this budget.

Rendell said he'll likely meet with the leaders of the House and Senate this week to see where compromise is possible. Last year's budget deadlock dragged on 101 days past the deadline. All parties should at least pledge not to repeat that spectacle. There's room for compromise to make cuts and raise the right taxes.