Corbett's counterproductive pension proposal

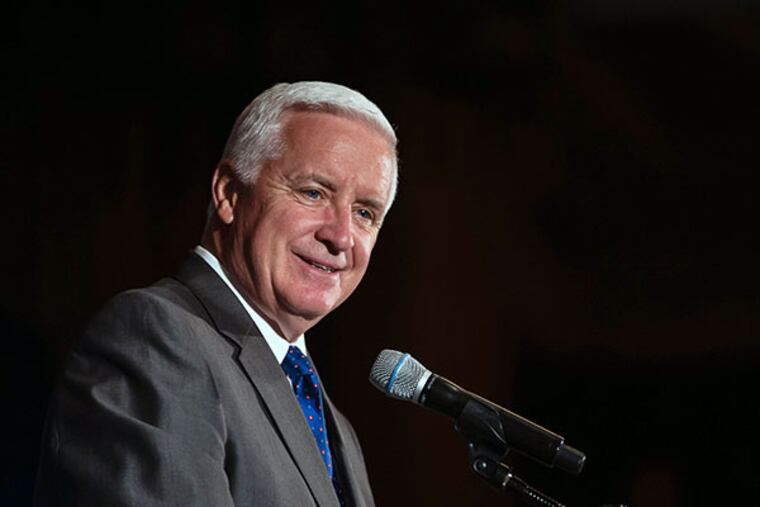

Gov. Corbett is blaming pension costs for increased school taxes. House Republican leaders Sam Smith and Mike Turzai boast that Republican pension legislation would provide budgetary relief to school districts.

Gov. Corbett is blaming pension costs for increased school taxes.

House Republican leaders Sam Smith and Mike Turzai boast that Republican pension legislation would provide budgetary relief to school districts.

Both claims are false.

Pennsylvania has a pension reform plan - Act 120 of 2010 - and it is doing just fine as long as it is not mutated by desperate election-year smokescreens.

As the Democratic chairman of the House Appropriations Committee in 2010, I oversaw the drafting of Act 120 in a bipartisan spirit that remains unrivaled in my 34 years in the state legislature. Republicans Glen Grell in the House and Dominic Pileggi and Pat Browne in the Senate joined me in working collaboratively, on both sides of the aisle and in both chambers, to craft a pension reform that was signed into law by Gov. Ed Rendell 44 months ago.

While it may not provide campaign boilerplate for lawmakers frantic for immediate public acclaim, Act 120 provided significant reforms, including:

Reducing the state's costs by 60 percent - that's $33 billion - and charting predictable, moderate payments to address the debt;

Reducing the benefit multiplier from 2.5 percent to 2 percent of salary for each year of service for new employees;

Eliminating lump-sum withdrawal of contributions and interest at retirement;

Increasing the normal retirement age by five years, to 65, for most people;

Doubling the vesting period to 10 years;

Allowing employees to increase their contributions to counter investment underperformance; and

Requiring that members purchase prior non-state service at full actuarial cost.

Under Act 120, the cost to the employer of providing pension benefits for new teachers is less than 3 percent of payroll - shared between the school districts and the state - which is very low.

Of course, Act 120 was crafted under the assumption that future lawmakers would not try to sabotage it with proposals to defer payments for up to four years, as Corbett proposed in his budget.

Act 120 says Pennsylvania will pay its pension bills, just as public employees have been faithfully paying their fair share.

More than half of today's pension payment goes to pay old debt, not current pension costs. Those unpaid bills are a prime reason for the $50 billion combined shortfalls in the Public School Employees' Retirement System (PSERS) and the State Employees' Retirement System (SERS).

Pennsylvania must remain focused on paying down the pension debt through Act 120, not making the long-term situation worse just to score political points or to free revenue for the governor's election-year budget.

But the plan being touted by the governor and his far-right GOP brethren in the House would do just that - add $67.1 billion to the pension debt by 2018, which comes to $13,525 per household.

The Corbett-Tobash pension plan provides no short-term savings for the state or school districts, nor does it pay down the pension debt any faster than Act 120.

Since 2011, the governor has taken $3 billion from our schools while giving $2.1 billion in unaffordable and ineffective tax breaks to businesses. Those are the real reasons behind rising property taxes and shortfalls in our state budget.

The GOP pension plan is more about ideology than math, slashing retirement benefits for many future public-sector workers by 40 percent. But public employees are regular Pennsylvanians, not the enemy, and they have earned the right to a secure retirement.

Please don't be fooled by political smokescreens posing as pension solutions. Act 120 is the long-term antidote to Pennsylvania's pension woes. The Corbett-Tobash plan is the poison pill.