Biden administration cancels $1.2B in student loans with new repayment plan

With this latest round of student loan forgiveness, the Biden administration has approved almost $138 billion in debt relief for 3.9 million people.

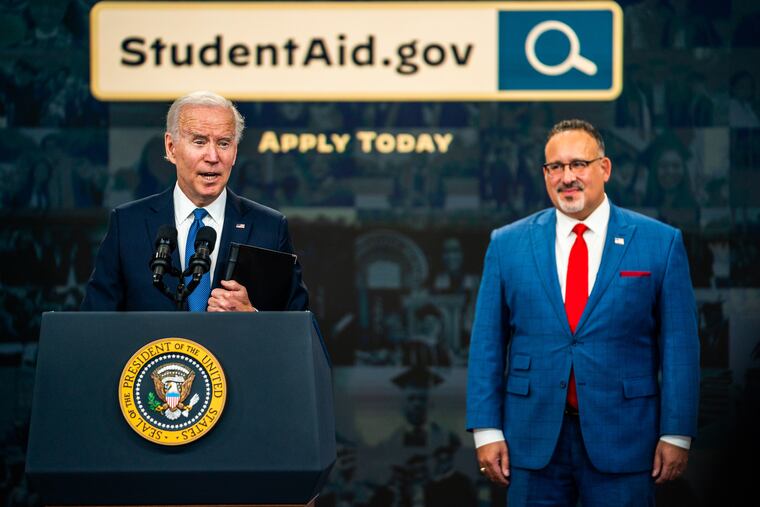

Starting Wednesday, President Biden will email 153,000 student loan borrowers enrolled in his signature repayment plan to let them know their debts — totaling $1.2 billion — have been forgiven.

The notice makes good on the administration’s promise to accelerate forgiveness for borrowers with low original balances who are enrolled in the Saving on a Valuable Education (Save) plan. Rather than wait 20 to 25 years for relief through other income-driven repayment plans, enrollees in the Save plan who borrowed less than $12,000 can have their debt wiped clean after 10 years of payments. The Education Department had originally planned to begin forgiveness in July but started identifying eligible borrowers this month.

People who are notified do not need to take any further action to receive loan forgiveness. Student loan servicers, the middlemen who collect payments on the federal government's behalf, will begin discharging the debt in coming days, according to the department. Next week, the agency plans to directly contact borrowers who would be eligible for early cancellation under the Save plan but are not currently enrolled.

“This plan reflects our unapologetic commitment to deliver as much relief as possible to as many borrowers as possible, as quickly as possible,” Education Secretary Miguel Cardona said on a call with reporters on Tuesday. “We’re providing real, immediate breathing room from an unacceptable reality where student loan payments compete with basic needs.”

With this latest round of student loan forgiveness, the Biden administration has approved almost $138 billion in debt relief for 3.9 million people. Under Biden, the education agency has focused on lowering the debt burden of those who borrowed money for college, expanding or easing rules for existing relief programs. It is also crafting another plan to offer relief to more borrowers after a loan forgiveness plan that Biden introduced in 2022 was struck down by the Supreme Court last year.

After the court’s decision, the Biden administration finalized the Save plan.

So far, about 7.5 million people of the more than 40 million with federal student loan debt are enrolled in Save. The plan pegs monthly student loan payments to earnings and family size, just like other income-driven plans. One big difference is that the new plan increases the amount of income protected from the calculation of debt payments from 150 percent to 225 percent of the federal poverty line.

That means a single borrower earning less than $15 an hour will be spared from payments. Those earning more would save an estimated $1,000 a year, according to the department. Even if borrowers' monthly payment is $0, they will still get credit toward forgiveness. According to the Education Department, 4.3 million people enrolled in the plan have a $0 monthly payment.

The department began introducing some features of the Save plan in time for the resumption of student loan payments in October. This summer, the federal agency will start capping payments for undergraduate loans to 5 percent — down from 10 percent — of income above the 225 percent federal poverty threshold. Borrowers with debt from undergraduate and graduate studies will pay a weighted average between 5 and 10 percent toward their debts.

The faster path to cancellation could have a meaningful impact on people who attended community colleges, dropped out of college or are at risk of defaulting on their loans. The Education Department estimates that 85 percent of future community college borrowers, who typically take out small loans, could be debt-free within 10 years under the Save plan.