IOI Payroll’s alleged fraud rocks jewelry firm; IOI’s Bensalem office hangs up

Coming Attractions Jewelers said its payroll company's checks began bouncing.

IOI Payroll last month was sued for fraud in federal court by KeyBank, which alleged that IOI sent through wire transfers for more than $120 million despite not having the money in its accounts to actually pay workers.

Now, IOI Payroll’s alleged fraud is starting to hit local businesses.

Coming Attractions Jewelers pays its employees’ wages and payroll taxes on time — but its payroll company IOI seems not to have delivered $3,600 owed to employees of the Lehigh Valley Mall tenant.

Coming Attractions has used IOI Payroll as its third-party vendor for at least a decade to pay employees and deduct their local, state, and federal taxes. Last month, employee checks started bouncing.

Coming Attractions’ owner said his employees are paid every two weeks.

“Everything had been fine for years. Then I noticed irregularities in how money was coming out of my payroll bank account" at Embassy Bank, said the owner, who asked not to be identified because he is in the midst of negotiations with the IRS.

IOI Payroll removes money every pay period for wages and taxes, but on July 12, the jeweler said, “there was no money in the account.”

“I had to pay my employees out of another account, and now there is $3,600 missing that they should have been paid,” he said. “IOI stole from me and from the IRS. And I still can’t get a straight answer from them.”

IOI has an office in Bensalem on Street Road, but an employee who answered the phone on Tuesday declined to answer questions and then hung up.

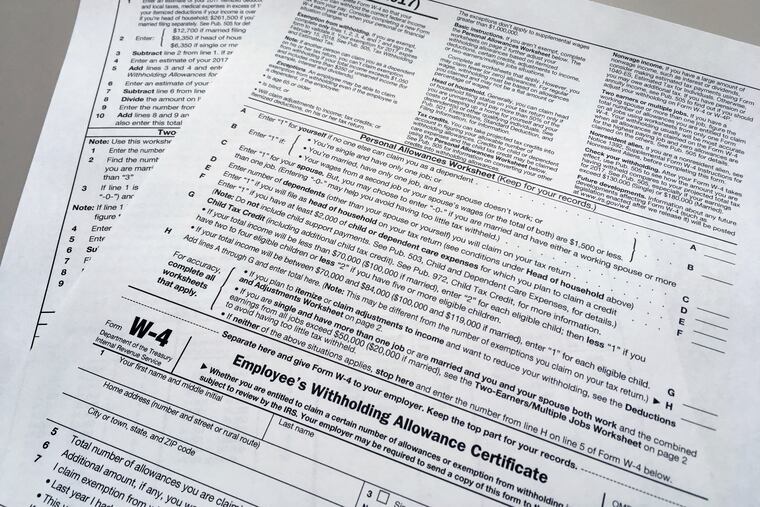

Coming Attractions also received a notice from the Internal Revenue Service that the business owed taxes — money that IOI should have forwarded to the federal government.

“They charged us $55 per payroll period, and they service thousands of small businesses,” the owner said. “I’m sure there are others affected.”

Philadelphia’s local IRS office couldn’t be reached for comment.

IOI, also known as Interlogic Outsourcing Inc., processes payrolls and is based in Elkhart, Ind.

KeyBank filed a lawsuit against the company on July 9, claiming that Interlogic “fraudulently initiated wire transfers,” and that Interlogic chief executive Najeeb Khan knew there weren’t sufficient funds to cover the transfers.

KeyBank, which has numerous branches from Philadelphia to Collegeville, saw its shares drop on the news last month, after the Cleveland-based bank said it discovered fraudulent activity involving “a business customer" without identifying IOI Payroll. The parent firm for regional lender KeyBank said it is investigating to determine its exposure, now estimated at as much as $90 million.

Jeff Kew, a spokesman for Key, issued the following statement: “We are currently investigating a processing irregularity that indicates fraud has been perpetrated by a single business client. While we can’t comment on the details as the investigation continues, we believe that this is an isolated incident. As soon as we became aware of the issue, we began taking all necessary steps to contain and resolve the issue, including notifying law enforcement. We want to emphasize that our clients’ information and funds are secure. We will continue to investigate and pursue this matter, seeking resolution for all our stakeholders.”

A spokeswoman for IOI in Indiana didn’t return calls for comment. The company’s CEO Khan hasn’t been seen publicly since the stories broke about alleged fraud at IOI, according to news reports.

Are you a business affected by IOI Payroll? Contact us.