Why legal experts are fine with an ex-State Farm lawyer being the judge in a lawsuit vs. the insurer

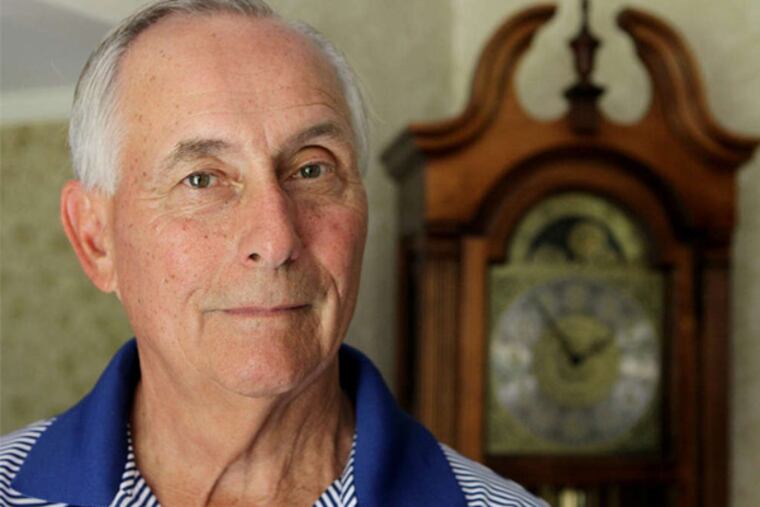

Montgomery County Senior Judge Arthur Tilson represented State Farm in at least 129 cases during a 15-year period that ended in 1993. He was appointed to the bench in 2001.

Michael Beautyman has battled State Farm since 2009, when he said a torrential rain in Florida flooded his Porsche 911 Carrera, soaking the car’s electronics and breeding toxic mold.

State Farm refused to pay for thousands of dollars in repairs, so Beautyman, a Flourtown-based lawyer, sued the insurer. Nine years later, his case has gone nowhere.

Now, Beautyman claims State Farm was helped by a judge who oversaw the case and who, in an unusual twist, used to be State Farm’s lawyer. Montgomery County Senior Judge Arthur Tilson represented State Farm in at least 129 cases during a 15-year period that ended in 1993, according to briefs filed by Beautyman’s attorney. Tilson was appointed to the bench in 2001.

Beautyman argues that Tilson should have recused himself from the case. Legal ethics experts largely disagree. And another judge – not Tilson – denied Beautyman’s motion last week that raised the issue. Beautyman’s attorney is considering an appeal.

Tilson did not return messages seeking comment.

The slow-moving case, which has no scheduled trial date, pits a giant insurance company against a lawyer who said he’s “not going to stop” fighting, and now is drawing attention to the self-policed rules regarding judicial recusal.

Pennsylvania’s code of judicial conduct requires judges to disqualify themselves “in any proceeding in which the judge’s impartiality might reasonably be questioned.” Judges must consider whether they personally know the parties or facts of the case, if they have an economic interest in the subject, or other factors.

“He relied upon State Farm for his daily bread,” Stephen Alvstad, a partner at Beautyman’s firm and his attorney in this case, said of Tilson. Alvstad argued that no reasonable person would want a lawsuit overseen by a judge who represented the other party 129 times, no matter how long ago.

Although the number of cases in which Tilson served as State Farm’s lawyer seems large – and only accounts for litigation in Montgomery County – legal ethics experts mostly shrugged. They noted that Tilson had been on the bench for more than a decade before he considered motions in Beautyman’s case. And judges typically start off as lawyers.

“Merely having represented State Farm for over 15 years and in many cases by itself doesn’t warrant for recusal,” said Stephen Gillers, a professor of legal ethics at New York University. “Absent any personal relationships, knowledge of facts, or some kind of financial interest, judges are not recused because one of the parties is a former client, even a frequent former client.”

Beautyman didn’t raise the issue until 2018, five years after Tilson last issued an order in the case. Montgomery County rotates judges, so Tilson is no longer in charge of the case. Tilson reached the then-mandatory retirement age of 70 in 2013, but still serves as a part-time senior judge.

“Issues of disqualification and issues of recusal should be brought up as soon as the party becomes aware of the concern," said Robert Tintner, a Fox Rothschild lawyer who handles the Philadelphia Bar Association’s ethics hotline. “It is entirely inappropriate to use either a recusal motion or disqualification motion as a tactical weapon.”

Alvstad said he and his client didn’t discover Tilson’s work for State Farm until they looked for it last year, when they considered Tilson’s “odd rulings” and recalled a comment they said he made about his law firm doing work for the insurer.

The “most galling episode,” according to Alvstad, was when Tilson initially overruled some of State Farm’s preliminary objections, then granted them after the insurer filed them again.

“It’s essential that the public, the citizens, have faith in the fairness of the judicial process,” Beautyman said. “You have so many cases that a judge represented one party. It erodes the public’s faith in the judicial system. And if the public does not have faith in the judicial process, that will lead to anarchy.”

State Farm declined comment due to pending litigation. But in court filings, the insurer said Beautyman’s complaints against Tilson were unfounded. Among other arguments, the insurer said one of Tilson’s orders — giving Beautyman more time to respond to discovery — was “not a win for State Farm.”

“State Farm did not get any help from Judge Tilson with the orders entered in this matter,” State Farm lawyer Yolanda Konopacka DeSipio wrote. “Plaintiff’s attempt to rewrite history five and six years after it occurred does not help to move the case forward.”

The case remains stuck in arguments over discovery. Beautyman has been unable to persuade a judge to force the insurer to give him an unredacted copy of his claim file, which he says is essential to prove that State Farm acted in bad faith in refusing to pay for repairs.

In June 2009, Beautyman said, he found his car parked at a Boca Raton, Fla., airport with steamed-up windows and water inside. The 2004 Porsche wouldn’t start. He had it towed to a mechanic.

Beautyman said State Farm took two weeks to first inspect the Porsche (State Farm said it accidentally looked at the wrong car). After months of back and forth and multiple inspections at several locations, State Farm refused to pay for repairs because it said the water damage was caused by poor maintenance — clogged drains, not a sudden flood event.

The insurer also disputed that toxic mold grew in the car, but also, there is no coverage in the policy for fungi, State Farm said in court filings.

“If I were to negligently fail to clean the drain tubes, there’s still insurance coverage just as if I negligently drive the car into a tree,” Beautyman contended.

Beautyman paid roughly $11,500 for repairs and diagnostic tests, according to court filings. State Farm provided $728.94. Beautyman called the car a “total loss” in his 2010 complaint, though the car sold for $12,000 at a Conshohocken auction, according to court records.

“This litigation is going to proceed on its course no matter what, because I’m not going to stop and State Farm is not going to stop,” Beautyman said.

The Porsche, meanwhile, has moved on. The car got a new owner in Ohio in 2011, according to documents filed by State Farm. A Carfax history report on the vehicle makes no mention of water damage.