Philly trails as venture capital center

The region logged just 34 venture capital investments in start-ups, early-stage and fast-growing companies for 2017. Boston had 155

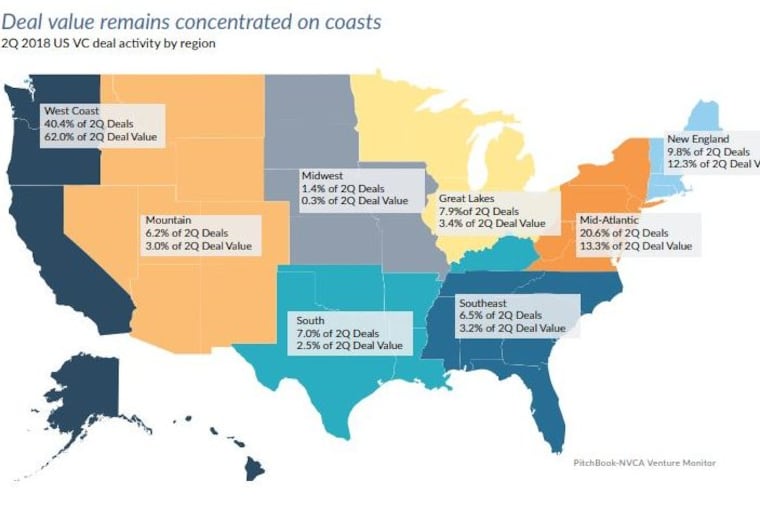

Philadelphia is the nation's fifth-largest city, but the Philly region is only the 12th largest investment center for venture capital investment, trailing smaller places like Austin, San Diego and Denver, according to this year's National Venture Capital Association PitchBook deal count.

The region logged just 34 venture capital investments in start-ups, early-stage and fast-growing companies for 2017. Boston had 155, nearly five times as many. San Francisco-San Jose area companies received more than 400, combined. New York firms attracted more than 200.

Among dozens of firms NVCA tracked, only one Philadelphia-based firm, First Round Capital, made multiple investments. First Round backs companies around the U.S., not just in the Philadelphia area.

The largest venture investors by deal count include SOSV, which, like First Round, focuses on small deals, from offices in Princeton, San Francisco and New York, as well as foreign deals); Plug and Play Tech Center (Silicon Valley, New York, Cleveland, plus offices around the world); the seminal Silicon Valley firm Kleiner Perkins; and New Enterprise Associates.

How good a job does PitchBook do at finding VCs? It's tough measuring private deals: "I find the PitchBook data to be better on buyouts than venture, and also very dependent on how it is pulled, so small nuances in definitions of a deal size, location or type can make it seem artificially high or low," said Stephanie McAlaine, who runs the Association for Corporate Growth's busy Philadelphia chapter.

The Pennsylvania congressional district with the biggest concentration of VC deals this year was north-suburban Pittsburgh (Pa.-14). For its size, Delaware, with its robust fin-tech and biotech-spinoff sectors, attracted more venture capital investments than Pennsylvania or New Jersey.