Web Wealth: Economic fear

Many of us are experiencing fear over the economy, the sad state of our retirement accounts, and rising unemployment. Here are some sites explaining that fear, and, perhaps, ways to get over it.

Many of us are experiencing fear over the economy, the sad state of our retirement accounts, and rising unemployment. Here are some sites explaining that fear, and, perhaps, ways to get over it.

Necessary fear. Carolyn Baker, who describes herself as a history professor and author, maintains her "speaking truth to power" Web site and earlier this year published this riff on fear over the economy. Natural fear is often of help in seeing ourselves through danger. "Fear is not necessarily a negative emotion or an unproductive waste of energy. I'm not talking about fear for the sake of fear, but rather, fear as a motivator, fear as a force that compels us to act," she writes.

http://carolynbaker.net/site/content/view/433/

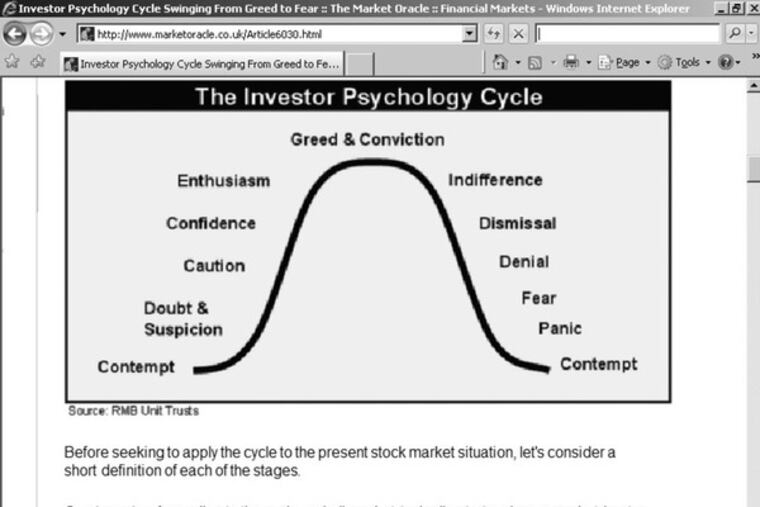

Fear curve. The "investor psychology cycle" is described in a chart on this site, called the Market Oracle. Fear is far down the negative side of that cycle, we are told. But it isn't the bottom. Turns out we've still got to go through "panic" and "contempt." On the bright side, though, those bad things mean a bull market is coming, at least according to the chart.

http://www.marketoracle.co.uk/Article6030.html

Fear index. The Chicago Board of Trade Volatility Index, whose ticker symbol is VIX, is also known as the Fear Index. It shows expectations of market volatility by tracking "put" and "call" options in shares of companies in the S&P 500 index. If the VIX number is under 20, complacency rules. If it's over 30, the market is considered volatile and you should lock all windows above the ground floor. The VIX has gone as high as 80 this year. When we looked, it stood at 55.73.

http://finance.yahoo.com/q?s=%5Evix

Level head. Perhaps the cure for fear is as simple as knowing more about what's going on. For this, one thing you can do is turn to the levelheaded, even entertaining, blog by Harvard University economist Greg Mankiw. See the restaurant bill with an "inflation surcharge." Read Mankiw's etymologically corrective suggestion for a "car commisar" instead of a "car czar."