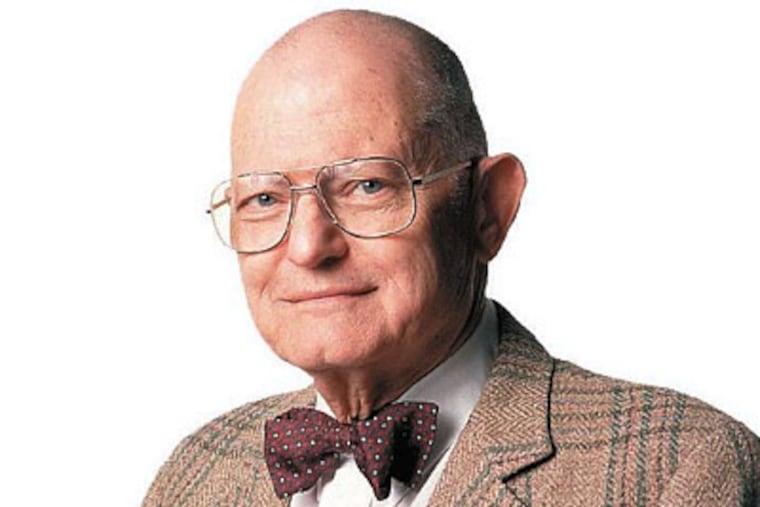

Harry Gross: Lowdown on reverse mortgages

DEAR HARRY: I know that you have answered questions about reverse mortgages before, but I don't fully understand how they work. Some experts say that they are great, and others say to avoid them completely. My husband is in his 70s and not in the best of

DEAR HARRY: I know that you have answered questions about reverse mortgages before, but I don't fully understand how they work. Some experts say that they are great, and others say to avoid them completely. My husband is in his 70s and not in the best of health. I am in my 60s and presently out of work. Our home is worth about $300,000 with $600 monthly mortgage payments that go out to 2035. We're both on Social Security, getting about $1,300 together. We were told that we could get a reverse-mortgage arrangement that would give us $60,000 now, without us ever having to pay anything on any mortgage forever. We would only have to pay for real-estate taxes and insurance. This sounds too good to be true, and we know what you say about that. Will we lose the building ever? Will our heirs sill inherit the property? My head is spinning, and I'm afraid.

WHAT HARRY SAYS: The lender will take over your present mortgage and add the $60,000 to it, plus substantial fees. The interest on the loan will be added to the balance of the debt. At the time of the death of the last of you to die, the property will be sold. Any proceeds above the amount of the loan and interest will be available to your heirs. The kicker here is that the fees will be charged at the beginning. They can be hefty and numerous. With today's longer life expectancies, it isn't certain that there will be much left for your heirs. I hope the spinning has stopped.