Oil-by-rail vision takes shape in Eddystone

Exelon's Eddystone Generating Station was destined to become one more weedy waterfront site after the region's last coal-fired power plant shut down in May.

Exelon's Eddystone Generating Station was destined to become one more weedy waterfront site after the region's last coal-fired power plant shut down in May.

That was before Jack Galloway, a man on a mission, helped form the Eddystone Rail Co.

The rail venture, announced Nov. 26, has ambitions far larger than the few miles of track that encircle the plant in Delaware County.

The project's aim is to bring North Dakota crude oil by rail to Eddystone, where it will be transferred to barges and transported to refineries along the Delaware or in New York harbor. The rail terminal will collect a fee for each barrel of oil it tranships.

Enbridge Inc., one of North America's largest energy distributors, is the operating partner in the $68 million project.

In Galloway's view, the rail project will contribute to the revival of the region's embattled refineries by supplying them with cheap domestic crude, inject a little life into the maritime trade, and reclaim part of the Eddystone power plant site (Exelon still operates some gas- and oil-fired units there).

The health of Philadelphia's industries is an issue near to Galloway's heart. For decades, he worked for the Gulf Oil Co. refinery in South Philadelphia, and then for Chevron, in public and government affairs. He was an unabashed cheerleader of Philadelphia as a blue-collar bastion where people and businesses still make goods.

"If you can't keep these industrial jobs, where are all these young people going to work?" asked Galloway, who is 77.

Galloway got into the rail business by a roundabout route.

He formed a company called Canopy Prospecting Inc. to import cane-based Brazilian ethanol to the United States. Although the venture did not get off the ground, Galloway learned a lot about moving fuel.

He also enlisted a protege, Erik L. Johnson, 37, as Canopy's vice president. Johnson was an oarsman on the crew Galloway coached at the Shipley School in Bryn Mawr. Galloway is also an avid rower - he serves as chairman of the Aberdeen Dad Vail Regatta.

Last year, amid a flurry of announcements from Sunoco Inc. and ConocoPhillips about plans to sell or shut down their riverfront refineries, Galloway and his associates began to explore opportunities related to the plants.

C. Alan Walker, Gov. Corbett's secretary for community and economic development, suggested there was an opportunity in delivering crude oil from North Dakota. Production was soaring in that state's Bakken Shale, but the lack of pipeline capacity made it difficult to transport the petroleum to refineries.

The Midwestern crude would solve one of the big economic problems for Philadelphia refineries because it is much cheaper than crude from Africa upon which the Philadelphia refineries depend.

"If you guys were really smart, you'd figure out how to get this crude by rail," Galloway recalls Walker saying of the North Dakota crude.

Galloway and Johnson explored the waterfront and were soon directed to Eddystone. Exelon was receptive to the idea of leasing their rail yard, a barge dock, and one of the 200,000-barrel fuel tanks on its property. The power plant is next to Boeing's Ridley Township helicopter plant.

"It's kind of a neat project when you think about it," said John F. Barnes, chief operating officer of Exelon Power, which operates the company's non-nuclear power plants. He said Exelon's senior management endorsed the plan because it would support job growth.

An agreement with Exelon in hand, Galloway and Johnson then sought out Enbridge in February.

Enbridge, a Canadian company, operates a network of pipelines and terminals, with a large presence in North Dakota. By next year, it will have export capacity of 475,000 barrels a day in the Bakken. It needs rail routes and customers to deliver 120-car trains, which carry a single commodity to one destination.

"It fits well with our long-term strategy of integrating pipelines and rail," said Kelly S. Wilkins, a planning and development manager for Enbridge Pipelines L.L.C., a division of Enbridge.

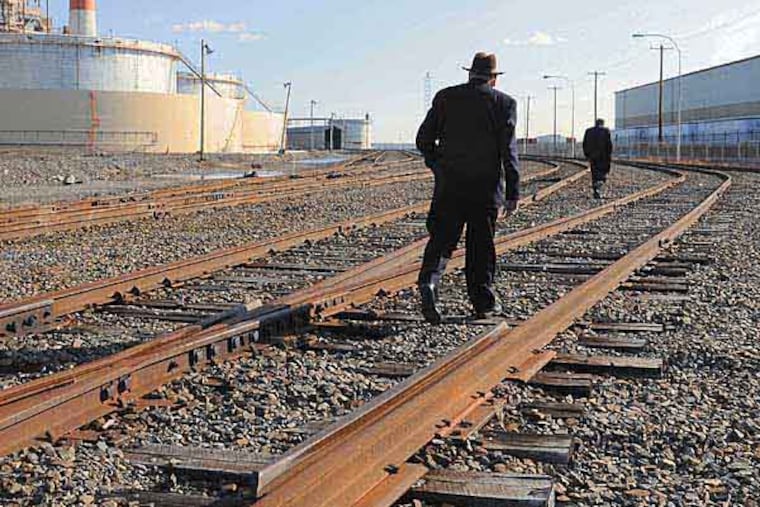

The Eddystone project, which is scheduled to open next fall, calls for building two gigantic rail sidings that will loop around the power plant and tie into the Conrail lines. Forty railcars can be unloaded simultaneously under a covered structure - an entire 120-car train emptied in 12 hours.

Enbridge, which owns 75 percent of the joint venture, will build and manage the project.

Wilkins said the project will succeed as long as the North Dakota crude sells at enough of a discount to pay for the extra cost of shipping it cross-country by rail. "That's the real giant risk," he said.

Plans call for doubling the capacity by 2014, from 80,000 barrels a day to 160,000. A second storage tank is planned for the area where Eddystone's coal heap was.

Several refineries in the area also plan to build their own rail-unloading facilities. Philadelphia Energy Solutions, which operates the former Sunoco refinery in South Philadelphia, plans to build a rail yard along the Schuylkill near 28th Street. And the PBF refinery in Delaware City, Del., is also building a rail yard.

Galloway believes there is plenty of demand, and plenty of crude, for everyone.

"I don't think we're scratching the surface of the crude-by-rail possibilities," he said. "We have more than enough to say grace over."