Fed widens financial purview

It now watches shadow banking and nonfinancial sectors, Bernanke said, to look for signs of crisis.

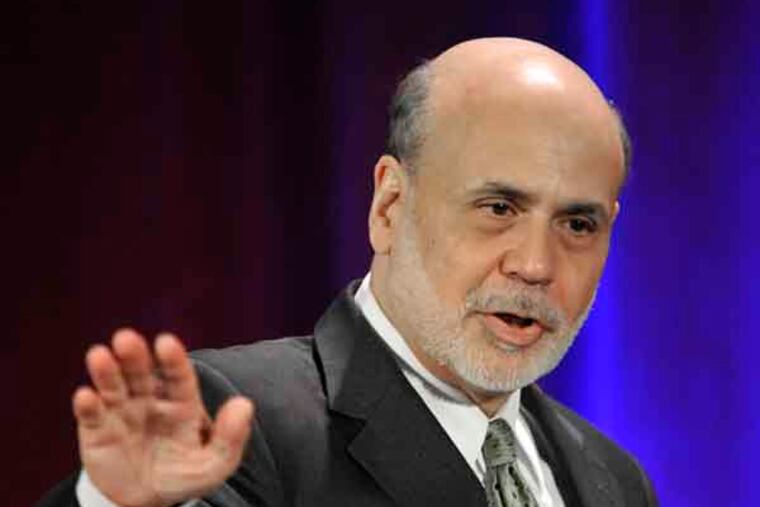

WASHINGTON - The Federal Reserve has broadened its oversight beyond banks and now monitors a wide range of financial institutions that could hasten another financial crisis, Chairman Ben Bernanke said Friday.

Bernanke said the Fed was still monitoring banks and other important financial institutions.

But it has widened its scope to include other participants that could either trigger a crisis or make the system more vulnerable.

Chief among them is the so-called shadow banking system, which includes loans that are turned into securities and sold to investors.

The breakdown of lending in subprime mortgages helped trigger the 2008 crisis.

In a speech to a banking conference sponsored by the Federal Reserve Bank of Chicago, Bernanke said the Fed was also looking more closely at asset markets and the nonfinancial sector, which includes consumers and businesses.

"Probably our best defense against complacency during extended periods of calm is careful monitoring for signs of emerging vulnerabilities," Bernanke said.

"Our economy has not yet fully regained the jobs lost in the recession that accompanied the financial near-collapse," Bernanke said. "And our financial system - despite significant healing over the past four years - continues to struggle with the economic, legal, and reputational consequences of the events of 2007 to 2009."

In 2010, Congress passed a sweeping overhaul of financial regulation that President Obama signed into law.

Opponents of the law, including many of the nation's biggest banks, have mounted an aggressive effort to overturn key provisions that target some of the most influential institutions.

The regulatory overhaul adopted tougher requirements for these institutions that are considered "too big to fail." Their collapse could put the entire financial system at risk. Many of the rules are still being finalized.