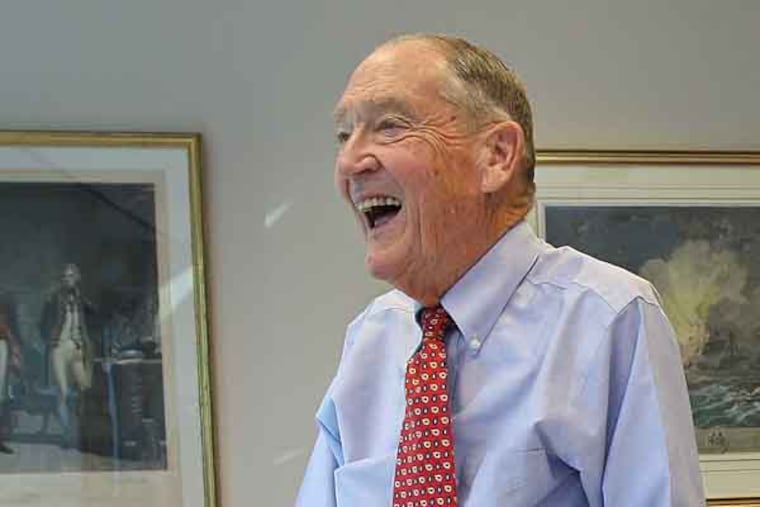

Vanguard founder John Bogle's enduring wisdom

It was five years ago, when he published his seventh book, Enough: The True Measures of Money, Business, and Life, that it seemed Jack Bogle had produced his swan song - part autobiography, part jeremiad, part apologia - and that there wasn't much more to say.

It was five years ago, when he published his seventh book, Enough: The True Measures of Money, Business, and Life, that it seemed Jack Bogle had produced his swan song - part autobiography, part jeremiad, part apologia - and that there wasn't much more to say.

The founder of Vanguard, the Malvern-based mutual fund giant, Bogle underwent a heart transplant in 1996 and has continued, despite intermittent health problems, to live life with gusto and an almost preternatural determination to seize the day.

Since 2008, he has published two more books - and he proudly writes every word himself. They are Don't Count on It! ("reflections on investment illusions, capitalism, mutual funds, indexing, entrepreneurship, idealism, and heroes," Bogel explains) and The Clash of the Cultures ("about how the culture of short-term speculation has crowded out the culture of long-term investment").

"I'm still part of the world, eager to keep up with it, eager to understand it, and enjoying my life," Bogle declared recently over breakfast - scrambled eggs, scrapple burned, one slice of rye toast buttered.

So the thought occurred to ask Bogle: Pretend I am your son and you are writing a letter to me advising how to live a long, happy, honorable life.

He had a ready answer, thoughtful and surprising:

"I'm not sure I'd tell you, 'Just do what I did.' I think I'd tell you, 'Don't do what I did.' I was probably too dedicated to business, but I've had the opportunity to make the financial world a little better, and I think most people would say I have done that, or am doing that, or trying to do that."

In a February speech at Princeton, Bogle finished by quoting Frederick Buechner, the American writer and theologian: "To live is to experience all sorts of things. It would be a shame to experience them - these rich experiences of sadness and happiness and success and failure - and then have it just all vanish, like a dream when you wake up. Pay attention to your life."

Bogle continued: "We're all very different human beings, and I tell this to our crew members when we meet - they have a lot of assets that I don't have; I have a lot of liabilities that they don't have. We're just plain different. They can't live my life, and I can't live theirs. So follow your own instincts, try to be yourself and live your own life. I think there's a lot of wisdom in that.

"Other than that, it comes down to some pretty simple things: First, don't forget your family, because in the end, that's all you really have. Next, be a decent human being, and don't think you're better than anybody else, no matter what your condition of wealth or importance."

"Indeed, never forget the important role of luck in your life. Never, never, never, never say, 'I did it all myself.' Nobody does it all themselves. And when somebody has the temerity to tell me they did, I say to them: 'That's wonderful. I'm not sure I've ever met anybody who did it all themselves, but could I ask you one question: How did you arrange to be born in the United States of America?' "

"Above all, never give up your idealism. No matter how dark things get, keep your eye on the brighter side of things. Never let your determination falter.

"Even when the world turns against you and ridicules your ideas, 'Press on, regardless.' Try to make things happen, and treat everybody as an equal. I can't stand it when somebody demeans somebody who's doing the hard work. The world should work exactly the opposite. They should get much more credit than the big shots and suits."

At 84, Bogle is still full of energy and ambition, still admired by such votaries as the Bogleheads, who meet annually in the fall, recently in Valley Forge, to hear his wisdom and salute his contribution to their lives. A new Bogleheads chapter just opened in Taiwan.

"I tell them, you really shouldn't thank me," Bogle says. "We've had good financial markets, without which there wouldn't be anything. All I did was give you your fair share of the market's returns. That's it."

Although he tries to take Friday afternoons off, Bogle has no immediate intention to retire, a concept that seems anathema to him.

"Eve [his wife] would like me to retire. At least she thinks she would, but I don't think she'd like having me around the house all the time. I think things could get very itchy. There's something very attractive about retiring, but I think working keeps me alive . . . when you get your tail out of bed in the morning and go out and do something useful."

"If I didn't have the intellectual strength or the ethical strength to do what I want to do, I'd probably retire. John Gardner used to say that, after a while, you ought to get 'repotted.' But I'm quite sure that my highest and best use, as they say in the real estate business, is doing what I'm doing, trying to reform - I don't like the word too much - but trying to build a better financial world and a better country."

He still shows up five days a week at the Bogle Financial Markets Research Center, on the Vanguard campus, where he puts in a full day writing, answering correspondence and e-mail, meeting with clients and members of the Vanguard crew, and making himself available to the media for usually provocative and iconoclastic comments about the vagaries of the financial markets and such "outrageous" practices as excessive executive compensation, corporate contributions to political campaigns, and inadequate attention to the interests of shareholders.

"It's been nice to be around another 17 years," Bogle says, using his heart transplant as the marker, "because my ideas about low-cost indexing, simplicity, fiduciary duty, trust, serving human beings with human beings have all caught on.

"Over the last five years, something like $400 billion have come out of actively managed funds and $600 billion have gone into indexed funds. That's a trillion-dollar swing."

Vanguard has been the beneficiary of much of that trend, and has grown accordingly.

"Vanguard now has 14,000 crew members, and it's big business, and that doesn't really appeal to me much. But those are the perils and blessings of success. When I get disturbed about all that size - $2.2 trillion is a lot of assets - I remind myself that we're giving good careers to 14,000 people, and it's a company that's value-oriented, service-oriented, integrity-oriented."

Bogle agrees with Thomas Hobbes that life is "solitary, poor, nasty, brutish, and short." Survival depends on becoming a warrior. The culture of Vanguard is steeped in the symbols and legends of battle. Atop his blog is a clarion line from St. Paul's letter to the Corinthians: "If the trumpet give an uncertain sound, who shall prepare himself for battle?"

Bogle adores struggle. He's an admirer of the Greek god Antaeus. "Each time he got knocked down, he came back stronger," Bogle explains.

"The struggle is what it's all about," he says. "People ask me about success. Success is a word I almost never use. Success sounds like you've achieved something, it's done.

"But to be corny, though not inaccurate, success is a journey and not a destination. You don't say, 'I've arrived, I'm here.' You say, 'I'll try to do a little better tomorrow, and all the tomorrows after that.' "