PhillyDeals: 2013 tax season brings hikes for those with big incomes

In his first presidential campaign, Barack Obama called for higher taxes on wealthier Americans to pay for programs that benefit people with less.

In his first presidential campaign, Barack Obama called for higher taxes on wealthier Americans to pay for programs that benefit people with less.

In his second campaign, President Obama acknowledged the role those same successful people play in hiring, investing, and creating scarce jobs.

Which Obama got to ram his program through Congress and the Internal Revenue Service?

The 2013 tax season will bring some significant hikes over last year's rates for many people with six-figure incomes, notes Bill Burns, managing partner for tax services at BDO's Philadelphia office.

Individuals making more than $400,000 a year, or couples making more than $450,000, will see their top tax rate jump to $39.60 for every $100 they make, from $35 last year. That's back to what the government charged under President Clinton, before the Bush tax cuts and the Bush and Obama bailouts zoomed the federal deficit.

Taxes on capital gains and stock dividends for the same successful Americans will rise to 20 percent, from 15 percent.

On top of that, the government also has boosted taxes on interest income, dividends, and capital gains for people earning more than $200,000, and couples over $250,000, an extra 3.8 percent, with the new levy going to pay for expanded Medicaid (Obamacare).

That applies to "passive" investors putting up money for other people's apartment buildings and other small and mid-sized investments. But managing partners who run small businesses don't pay the increase - as though in recognition that people who run businesses are, after all, more likely to create jobs than passive investors who buy stock in multinational companies.

The nominal corporate tax rates will stay at 35 percent. As CEOs like Andrew Liveris of Dow Chemical are fond of reminding the president, that's more than a lot of rival European, Asian, and Latin American countries now charge, though, as with rich individuals, big companies do what they legally can to pay less than the full rate.

Besides the tax rates, rules and exemptions have changed. "They tinker every year," says BDO's Burns. "It becomes more difficult for taxpayers to keep up. Three or four bills come out every year with some tax implication."

Ready for reform? Simpler rules that would waste less in compliance and avoidance costs?

Lawrence Gibbs, the IRS commissioner in President Ronald Reagan's later years, urged the American Bar Association's Philadelphia Tax Conference last month to lean on congressional representatives to push for a Reagan-style tax-code simplification.

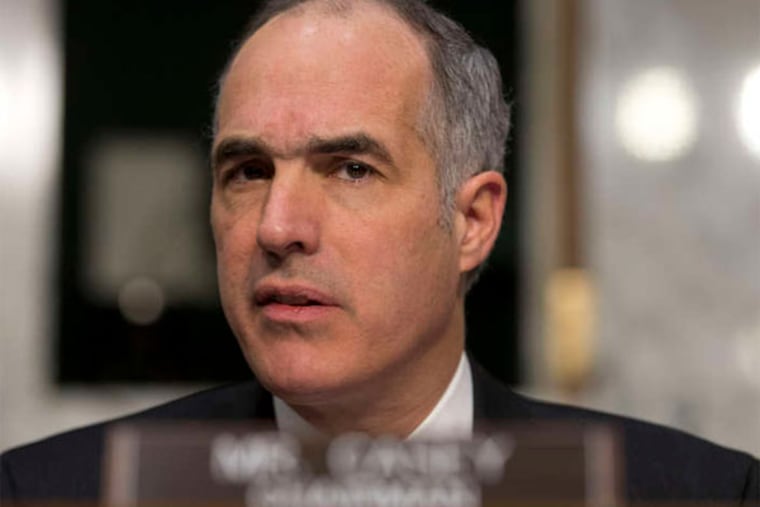

But U.S. Sen. Bob Casey (D., Pa.) told a Greater Philadelphia Chamber of Commerce meeting this year any large-scale tax reform would likely be held up until after next year's Senate elections.