How states got into such a pension fix

Despite years of dire warnings that pension shortfalls could become the monster that ate state budgets, little progress has been made to reduce the gap.

Pension reform is like the weather: Everybody talks about it, but nobody does anything about it.

Despite years of dire warnings that pension shortfalls could become the monster that ate state budgets, little progress has been made to reduce the gap. Since changes must occur, it's time to understand the causes of the crisis so past mistakes will not be repeated.

Pensions in Pennsylvania and New Jersey are staggeringly underfunded. This misery, though, has lots of company. Recently, the Dallas Morning News wrote an editorial about the looming crisis in Texas, which it called "an embarrassment."

Not being alone is no excuse. Public-sector pensions are promissory notes between the public, through their elected representatives and government workers, for future payments. Unfortunately, politicians have been very willing to fail their fiduciary responsibilities.

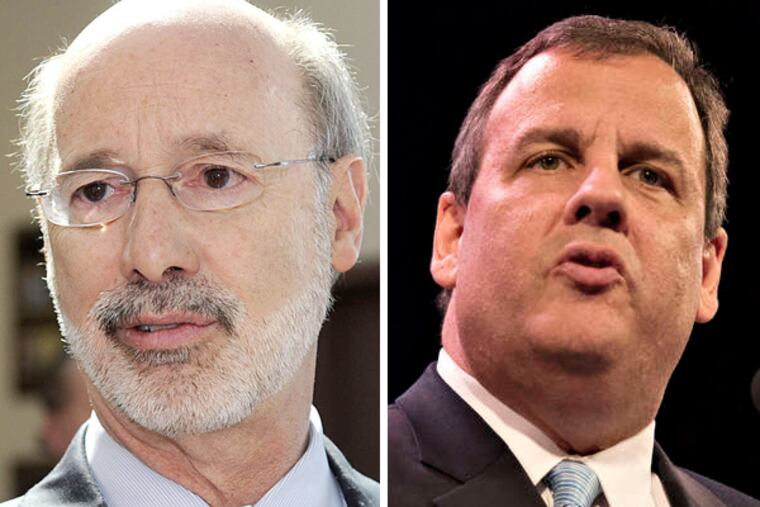

Pension plans are underfunded because governing bodies have underfunded them. Contractually agreed-to plan payments have been diverted to other uses, and the trend continues. In New Jersey, a state court recently ruled the Christie administration violated a 2011 pension-reform law by not making this year's required pension payment.

Let's be clear: The failure to make necessary pension payments was not because of an inability to pay. The funds that should have gone to the pension plan went, instead, to fund other programs and to keep taxes from rising. The fiscal capacity to fund the pensions was there. The political will was not.

Who got the billions of dollars that didn't go into the pension plans? The beneficiaries were individuals and businesses who paid lower taxes, and programs that received extra funding. In other words, everyone, which is why this is a politically feasible transfer of income.

Failure to make required payments raises a question: Why should a government contract made with public-sector workers be different from a public-sector contract made with a private-sector company?

Consider this example: A construction firm builds an office building. It follows the contract precisely, including making requested changes. What would happen if the state decided to pay 10 percent less than the contracted amount and also required that the change costs be paid by the builder?

Since the state had the money to pay the firm but used it for other purposes, a lawsuit would ensue and the state would probably pay up. By contrast, courts are loath to force governments to make budget funding changes. The result is that some programs, such as pensions, get shortchanged.

This transfer of contractually required moneys to non-pension purposes is just one of the major reasons for the pension crisis. A second is underperformance of the pension investment funds.

In Pennsylvania, expectations were that in addition to the contributions made by the employees, an investment return of about 8.5 percent would be needed to keep the pension plan financially stable. That rate of return is quite reasonable.

Over the last 40 years, the Wilshire 5000 index, the broadest market measure, averaged a 12 percent annual rate of return. Over the last 30 years, that return was about 11 percent. Even during the last 20 years, which included the dot-com and housing collapses and the recession, the 9.75 percent return exceeded the target.

Unfortunately, the performance of the pension funds' private and public financial managers has been, to put it mildly, less than stellar. Thus, while many argue that the benefits are too generous, that's true only because of disappointing investment returns. It's hard to blame the victims of lackluster investment management for the lackluster investment management.

If pension-plan members didn't create the problem, should they be required to make the plan whole? Or should those who benefited from the diverted funds also be asked to contribute?

Who pays the cost of pension reform determines which solution to the problem is chosen.

Pension reform is simple: You have to increase pension funding and/or reduce pension outflows. How? The government can pay more into the plan by changing tax and spending priorities; it can reduce current and/or future benefits; it can have plan members pay more, or can change the plan.

The crisis will be alleviated once it is decided who should pay. There is every reason for the reform costs to be distributed between the plan beneficiaries and those who benefited from the diversions - that is, everyone.

Currently, the popular approach is to put the burden of pension reform on plan members. That could encourage future pension shortfalls. By failing to penalize past financially irresponsible diversions, the use of pension funds for more politically popular programs will continue.