Bridgestone could raise its bid for Pep Boys

Shares of Pep Boys - Manny Moe & Jack rose Tuesday as investors bet that Bridgestone Corp. will boost its $15-a-share offer to beat billionaire Carl Icahn's Monday bid of $15.50 a share for the Philadelphia-based auto-parts sales and service chain.

Shares of Pep Boys - Manny Moe & Jack rose Tuesday as investors bet that Bridgestone Corp. will boost its $15-a-share offer to beat billionaire Carl Icahn's Monday bid of $15.50 a share for the Philadelphia-based auto-parts sales and service chain.

Shares closed at $16.30, up 1.5 percent or 24 cents, in Tuesday trading on the New York Stock Exchange. That's the marginally profitable chain's highest daily closing price since 2008.

On Tuesday morning, Pep Boys said its board recognized that Icahn's offer may be "a superior proposal" compared with the deal it agreed to accept from Bridgestone in October.

But for now at least, the Bridgestone offer still is on track to go before Pep Boys shareholders, led by New York investor Mario Gabelli's Gamco funds, which own 20 percent of the company.

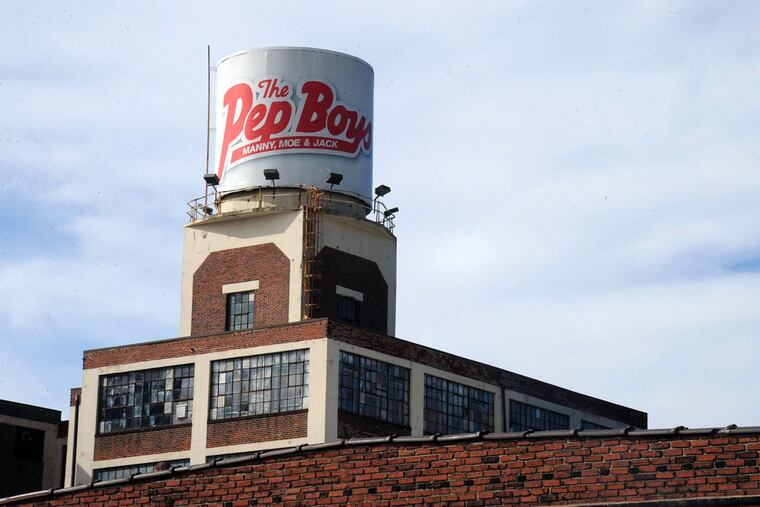

Pep Boys, which has 800 locations nationally, employs 500 at its Allegheny Avenue headquarters.

Bridgestone wants to merge Pep Boys garages into its Nashville-based, 2,200-store Firestone chain. Icahn wants to combine its retail stores with his Auto Plus chain.

"Since the market is bidding up the stock price well above Icahn's offer, it appears the general consensus is that Bridgestone will increase its offer," said Damien J. Park, managing partner at Philadelphia-based Hedge Fund Solutions, which advises companies on takeover offers.

"It's typical Icahn - heads he wins, tails he wins," Park added. If Bridgestone outbids the billionaire corporate raider, Icahn stands to earn millions in profits on the 12 percent of Pep Boys shares he owns.

And Icahn could still make an offer later for Pep Boys' retail locations if Bridgestone cuts them loose from the company's garage, tire and fleet-service units, as some analysts expect.

"I wouldn't bet against Icahn," who has a long career valuing businesses for their earnings potential and can raise vast funds to support a transaction, said Andrew Greenberg, managing director at investment bank Fairmount Partners in West Conshohocken.

"It seems like [Icahn] thinks Bridgestone was trying to get the stores somewhat cheap," Greenberg added. A 2013 report by Stifel & Co. estimated that Pep Boys controlled real estate alone that was worth more than $700 million, close to the total value of Bridgestone's offer.

"Pep Boys has been beaten up by three trends: the emergence of more adroit competitors, the extension of online commerce to auto parts and supplies, and the greater efficiency of newly manufactured automobiles," Greenberg said. "These businesses are going to be subject to consolidation. It is just a question of whether it occurs in a single transaction or multiple, sequential ones."

Now that the board has a better offer, it could change its recommendation on the deal, or terminate the agreement and make a new one with Icahn, according to Pep Boys' deal with Bridgestone.

Under the original deal, Bridgestone has until February to get a majority of Pep Boys shareholders to approve its offer or it will lapse.

215-854-5194 @PhillyJoeD