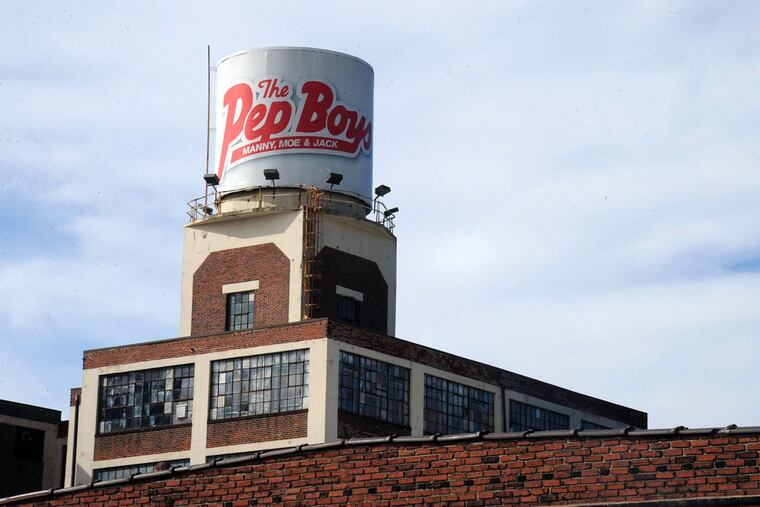

Bidding war boosts Pep Boys stock

Speculators bet Monday that Bridgestone Americas Inc. will top investor Carl Icahn's latest offer for Pep Boys - Manny, Moe & Jack, the Philadelphia-based auto-repair chain, by a Wednesday deadline.

Speculators bet Monday that Bridgestone Americas Inc. will top investor Carl Icahn's latest offer for Pep Boys - Manny, Moe & Jack, the Philadelphia-based auto-repair chain, by a Wednesday deadline.

Pep Boys stock closed Monday at $16.85 a share, above Icahn's offer of $16.50.

Despite its low profitability, the 800-store chain has been trading at its highest prices since 2007, as Icahn and Bridgestone trade bids and push the prospective sale price north of $900 million.

Bridgestone, which wants to fold Pep Boys garages into its 2,000-store, Tennessee-based Firestone chain, agreed to pay $15 a share, or $835 million, for Pep Boys in October - not much more than the company's stores are worth, according to analysts at Stifel.

Icahn, who wants to combine Pep Boys stores with AutoPlus, a smaller chain he bought from Canada's Uni-Select for $330 million this year, countered with a $15.50 bid in early December. Each side has since raised its price.

In 2012, an agreement to sell Pep Boys for $15 a share collapsed when the private-equity buyer backed out.

Sales have been flat at Pep Boys' retail stores, such as the ones Icahn wants to consolidate with Auto Plus. Its repair, tire, and fleet-service businesses, which Bridgestone has said it particularly covets, have reported modest gains in recent quarters.

As the price for the chain rises, the winning buyer could face more pressure to cut costs at Pep Boys' 500-worker headquarters on Allegheny Avenue, and at regional warehouses and retail locations.

"When multiples go up, companies, or the activists who impel them, need to justify having done the deal at such a high price," noted Emilie R. Feldman, an assistant professor of management at the University of Pennsylvania's Wharton School who studies mergers and divestitures.

"One way to do that is to promise synergies from the deal, whether from revenue enhancements or cost cuts," Feldman added. "Of course, one of the main ways to achieve cost synergies is to cut jobs. So you can see where the correlation between high multiples and subsequent job cuts might arise."

But higher prices don't always force bigger cost cuts, said Damien J. Park, managing director at Hedge Fund Solutions, a Philadelphia firm that advises companies dealing with activist investors such as Icahn.

In some cases, Park said, "the combined business has greater market potential and pricing power," and buyers are willing to pay extra without scoring immediate profits.

The two buyers' interests in different parts of Pep Boys have led analysts to propose that the winner could end up selling the less profitable part of the company.

Icahn, as one of Pep Boys' largest shareholders, stands to make money on a deal even - perhaps especially - if Bridgestone ends up outbidding him.

215-854-5194@PhillyJoeD