Comcast faces Friday U.K. filing deadline for $31B Sky bid, Murdoch may counter

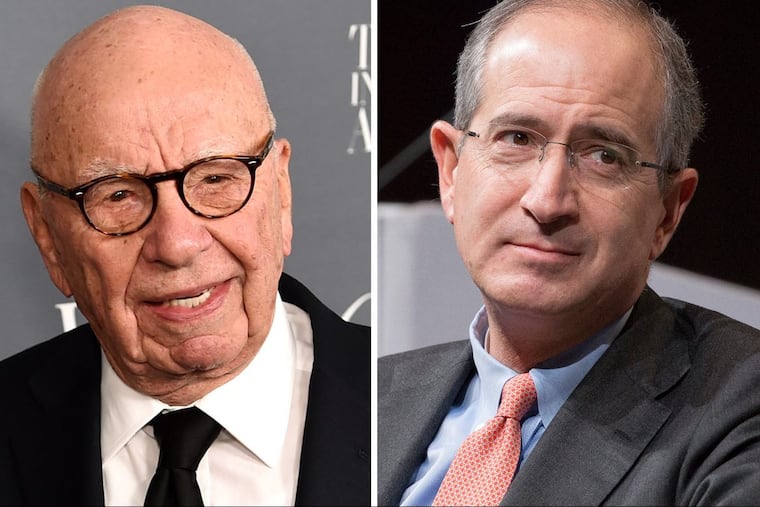

Rupert Murdoch's expected higher bid for Sky is part of a protracted battle between Comcast Corp. and the Walt Disney Co. for 21st Century Fox's entertainment and global businesses.

Rupert Murdoch's 21st Century Fox may be mulling a higher bid for the Sky satellite-TV service as the Comcast/Fox/Disney takeover battle grinds on.

Murdoch could offer $33 billion for Sky, beating Comcast's $31 billion for the satellite television provider with more than 20 million subscribers in several European nations, the U.K.'s Financial Times reported.

Neither Comcast nor 21st Century Fox commented on the report on Tuesday.

"Time is of the essence," Neil Begley, senior vice president at Moody's Investors Service, said. Comcast has to file on Friday with the U.K. Panel on Takeovers and Mergers to begin tendering Sky shares, which could lead to the Philadelphia company's owning a substantial part of Sky.

Murdoch's expected higher bid for Sky is part of a protracted battle between Comcast and the Walt Disney Co. for Fox's entertainment and global businesses. Murdoch has made it clear that he would prefer selling the businesses that he spent his lifetime assembling to Disney, forcing Comcast to constantly bid higher.

The Murdoch-controlled 21st Century Fox and Disney have scheduled July 27 special meetings in New York City seeking shareholder approval for Disney's $71 billion offer to acquire the Fox global and entertainment assets, among them a substantial stake in Sky.

21st Century Fox owns 39 percent of Sky but would like to acquire 100 percent of the business as part of the Fox-Disney deal. Comcast is seeking to disrupt those plans with an offer directly to Sky shareholders that would give the Philadelphia firm majority control — which would be a blow to Murdoch and Disney.

Begley said that he did not think that Sky shareholders will take either the $31 billion Comcast offer or a potential $33 billion Fox offer until "the dust settles" on the broader takeover battle between Comcast and Disney for Fox.

A number of hedge funds including Seth Klarman's Baupost Group, Paul Singer's Elliott Management, Davidson Kempner, and Odey Asset Management have piled into Sky shares on the expectation that the bidding war between Fox and Comcast will continue, the Financial Times reported.