DEAR HARRY: I am 26 and have just become a father for the first time. I have been solicited by three guys trying to sell me life insurance. I know I need it to protect my expanded family, but do I go for term or some variation of cash-value insurance?

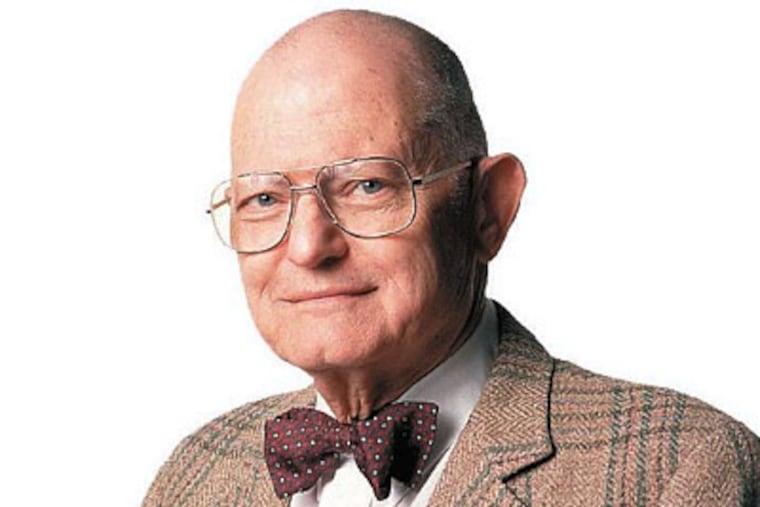

Only one of my pursuers even mentioned term insurance, but even he played it down. They all agreed that you have some kind of ax to grind against insurance agents. One guy got so wrought up when I mentioned your name that I thought his face would explode. Why should I buy term? I think I already know of the many advantages of cash-value life insurance.

WHAT HARRY SAYS: You have term insurance every day of your life. Your homeowner's, your auto, your health insurance are all term. Cash-value (originally called whole-life) insurance was developed to maintain a level premium through a lifetime. As part of that deal, it was necessary to have income to cover the years when the cost was more than the premium. All the rest of the stuff is gingerbread added later on to make things look better to the purchaser. At your age, it is better to have the use of the difference in premium for retirement or a college fund for your youngster.

I suggest a 10-year renewable and convertible term. This will allow you to renew at prevailing premiums or to convert to cash value after 10 years. And in spite of the hate mail I know I'll get, there's a terrible temptation to promote cash value: The commissions are much higher.