Retired and investing with friends or family? Think hard, and then think again

The story of Ron Smith and his daughter Lynn Byrne is a cautionary tale about investing with risky start-up companies. The father-and-daughter duo invested and lost roughly $230,000 in a physical therapist's start-up small business - and say they've gotten no help from state regulators.

Thinking of investing with friends or family? Take a huge step back — and consider the story of Ron Smith and his daughter Lynn Byrne of Doylestown.

Theirs is a cautionary tale about investing with friends and their risky start-up companies. Altogether, the father-and-daughter duo invested and lost roughly $230,000 in a physical therapist's start-up small business — and got no help from regulators.

Smith, 82, and his daughter, 53, in 2013 invested in a company called R.I.M. Medical, founded by Linda T. Miller and partner Keith DeStefano, of Wyncote and Collegeville, respectively. Smith was one of several Philadelphia-area investors who put in $1 million in Miller's lymphedema "compression" medical device. Smith's daughter Lynn was a breast-cancer patient of Miller's under treatment for cancer-related lymphedema by Miller at a physical-therapy practice.

"I wanted to help her because the compression had been so helpful in my cancer treatment," Byrne recalled.

"I would do anything for my daughter," Smith added.

Miller made the business look better than it was and blamed the manufacturer, which ran over budget, Smith alleges. When the company went under, Smith and his daughter, as well as several other investors, lost all their money.

Investments gone bad often read like a financial "he said, she said." Miller says it was a "misunderstanding" and not a crime or theft from a retiree and a cancer survivor.

"This wasn't elder abuse, as Ron Smith calls it," Miller says. "He's come after me in all different manner, and I almost lost my house. Everyone lost money, including me and my partner." They cosigned a $500,000 loan from the Small Business Administration. Currently the loan is in default. DeStefano declined to comment.

Investing in friends' start-up businesses is risky business — and generally isn't suitable for an older person who doesn't have a lifetime left to make up for a sizable loss.

Byrne wells up in tears discussing the loss; she invested $80,000, her father invested $150,000.

"I feel terrible that I got my father involved," Byrne said.

Smith alleges Miller was effectively out of business "when she took the money from us. It was a Ponzi scheme. She didn't tell us she'd let all the sales force go three months before."

Due diligence

The importance of doing due diligence on a start-up venture can't be overstated — except the due diligence needs to be done ahead of time on the main players.

Miller said she'd founded companies before that were successful. Smith alleged Miller used his money to pay off old creditors and to gamble. She tried to file for bankruptcy in 2014 but was denied.

Justice?

Smith is pursuing resolution like a dog with a bone — but is getting nowhere.

"I went to the police department in Doylestown, then the Bucks County District Attorney's Office, who told me they didn't have money to investigate. The DA sent me to the state Banking and Securities office. Five different people there gave me the runaround. So I went to the Montgomery County district attorney to file a complaint, who in turn sent me to the attorney general in Norristown."

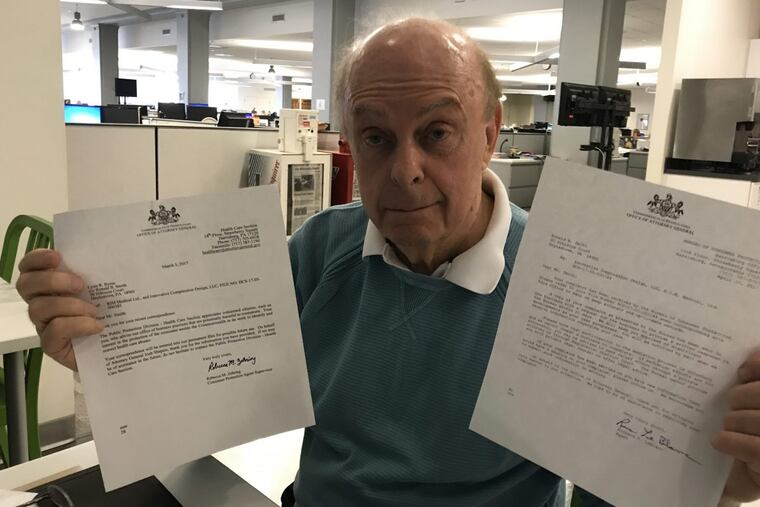

Don't expect any help from state regulators if you invest in a start-up, Smith said. He's filed complaints with the Pennsylvania Department of Banking and Securities and Attorney General Josh Shapiro. He got back two form letters.

"I don't want anyone else to lose money to Miller," Smith added.

Banking and Securities spokesman Ed Novak in Harrisburg said the department "cannot confirm or deny anything about complaints. Those are completely confidential."

Miller said with hindsight, she wouldn't have taken money from Smith and his daughter.

"It was unfortunate. It was high risk. It looked great. I cashed out my entire pension. My frustration is that Ron is really the one who has continued to say that something was shady and illegal. And I'm embarrassed because I still get a processor serving me papers. We're all disappointed. We all took hits. We've all tried to move on. If you ask them, it was an unfortunate thing that had great potential. It didn't happen."

Another investor, Anthony Visco, a retired attorney, confirmed that Miller's business "went belly up. Miller wasn't a good business person. I didn't blame her, however. I put in $100,000 and it was a stupid investment. She wasn't a thief, but she was a bad businesswoman. She made bad decisions and business deals. She sunk everything she had into this."

What would he advise about investing with friends and relatives? "Even if you know and love them, do your due diligence and ask a lot of questions."