Prime time is increasingly becoming on-demand

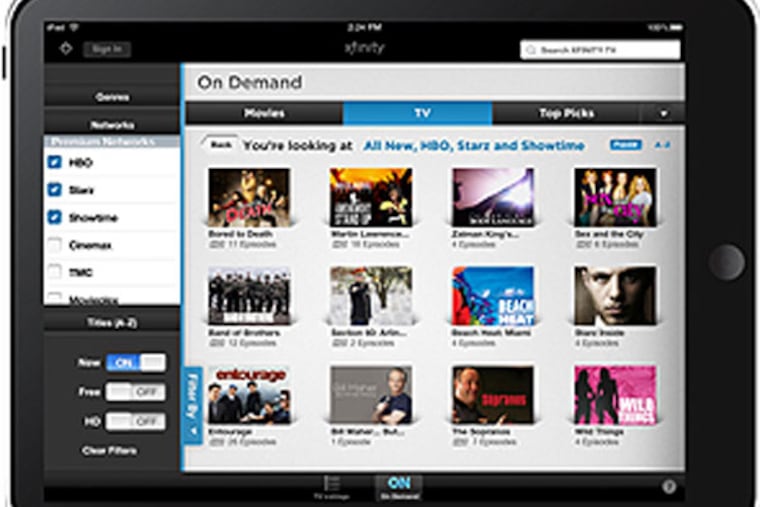

Comcast Corp. has heavily marketed its video-on-demand service over the years, and its subscribers have responded with 30 billion downloads since its inception in 2003.

Comcast Corp. has heavily marketed its video-on-demand service over the years, and its subscribers have responded with 30 billion downloads since its inception in 2003.

The problem: Comcast, a pioneer in the platform, and broadcast-TV companies have little revenue to show for it.

CBS Corp. research head David Poltrack now says video-on-demand's day may be here, and it could be a new form of television.

"This is beginning to represent a very, very large marketplace," Poltrack, chief research officer at the nation's No. 1 TV network, said in an interview Wednesday.

For the first time, CBS, Fox, NBC, and ABC are making available most current-season episodes of prime-time shows on video-on-demand services.

The upgraded content is part of the broader trend of networks and TV distributors connecting with "time-shifting" viewers who don't watch a show when it first airs.

This season, Poltrack said, CBS viewers, taking advantage of the new availability, have watched 58 percent more minutes of CBS shows with video on demand than they did in the year-ago season: 3.5 billion minutes compared with 2.2 billion. Poltrack attributed the sharp increase to viewers watching current CBS prime-time shows not previously available through on-demand services.

The time-shifted minutes, Poltrack said, have boosted the viewership for CBS prime-time shows by 3 percent in the advertiser-prized demographic of adults between 18 and 49.

The biggest beneficiary, Poltrack said, has been The Good Wife, whose viewership has expanded 8 percent with on-demand.

Poltrack thinks that on-demand could become "a significant part of overall TV viewing."

He and others also believe that on-demand could eclipse digital-video recorders, which allow viewers to record shows and skip through commercials. Because DVR viewers can do that, their viewing does not count toward ratings in the industry standard C3 window. (TV ratings consist of viewership the day the show airs and the three following days.)

Many people, Poltrack said, now record prime-time shows on DVRs and watch them on Saturday and Sunday. Even if viewers watch a show within the three-day window on a DVR, they don't count toward ratings if they skip advertisements.

About 35 percent of DVR watching is done during non-prime-time hours during the weekend, Poltrack said.

When CBS and other programming companies negotiated to make their shows available through on-demand in recent years, they insisted that the cable companies disable the skip-through functions so that viewing can count toward C3 ratings. The cable companies agreed.

CBS, Comcast, and others are now talking about how to "monetize" or package all current-season TV shows and sell them to advertisers. Comcast says it's working with Nielsen Holdings N.V. on new ratings for this package of shows.

Matt Strauss, Comcast's senior vice president and general manager for video services, said on-demand viewing by Comcast subscribers for all content had risen 40 percent this year compared with 2012, and 60 percent of the viewing is TV shows.

"We are starting to see," said Brian Fuhrer, a senior vice president at Nielsen, "where a show has more [ratings] contribution from on-demand than DVR."

BY THE NUMBERS

30B

Downloads since video on-demand became available in 2003.

3.5B

Minutes of CBS programming watched through on-demand this season.

8%

increase in on-demand viewership this season among adults 18 to 49 for the CBS prime-time series "The Good Wife." EndText

215-854-5897 @bobfernandez1