Ronnie Polaneczky: ABSURDIST COMEDY: WAITING FOR THE DOUGH

ANYONE WHO HAS sold a house knows that there can be a lag between the time of sale and the time you hold its profits in your hands.

ANYONE WHO HAS sold a house knows that there can be a lag between the time of sale and the time you hold its profits in your hands.

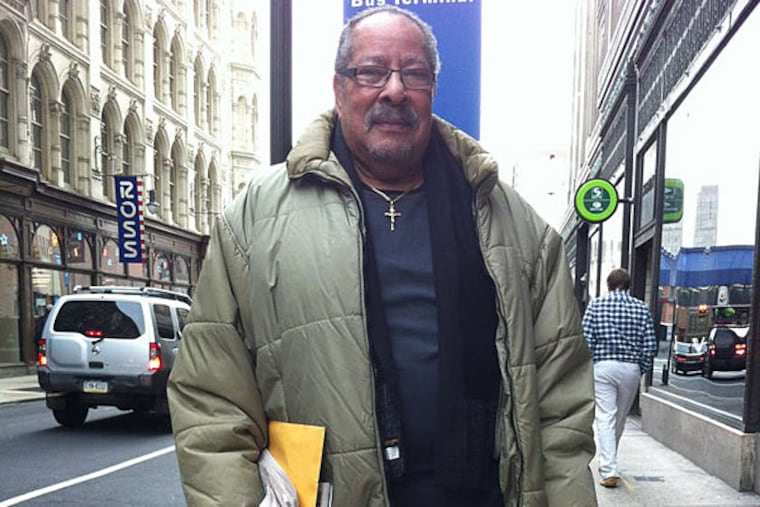

For Richard Butler, it's been six years. Now that the Daily News has intervened, he's hoping to get his cash by Christmas.

But he's not holding his breath. He's been here before.

The nonsense began in July 2010, when Butler received a letter stamped "urgent." Despite its atrocious grammar, it brought exciting news from a man calling himself J.L. Jones. He said that Butler was owed more than $5,200 from "the government."

Butler called Jones and learned that a house that Butler owned on Millick Street, in West Philly, had been seized by the Sheriff's Office for unpaid taxes and sold at auction. After satisfying the lien, the sale netted a profit to which Butler was entitled.

For a 35 percent "servicing fee," Jones' company, R&J Tracer and Recovery Group, could get it for him.

"He wanted to meet me at a bar to talk about it," says Butler, 77, a retired SEPTA bus driver and Air Force veteran who lives in Southwest Philly. "I said, 'You don't have an office?' He said, 'We're not that big yet.' Something smelled fishy."

Instead, Butler called the Sheriff's Office to ask about the property. He'd bought it in 1965 with his common-law wife. When they split up, she stayed in the house, but the deed remained in both their names. He'd not seen her or been to the house in years.

So, he didn't know that it had been seized, then sold in 2006. A Sheriff's Office representative told Butler that he should file a notarized claim for the money he was owed, which he did, and that someone would be in touch.

Weeks passed.

He called the office and was told that his claim was still being processed. More weeks passed.

Finally, he was told that his money had been turned over to the state Treasury Department. He'd have to file a claim to get it back.

By now, the Sheriff's Office was in scandal. Under former Sheriff John Green, audits had found, the office had stashed nearly $56 million in 13 bank accounts - and at least half was owed to property owners who'd lost homes to foreclosures and tax sales.

The office is required to return the money. If recipients cannot be found, the money is turned over to the state until the owners can be found.

But the Sheriff's Office hadn't sent money to the state in years. And the state, apparently, hadn't noticed, until the audit.

In the gap, rogue "bounty hunters," like "J.L. Jones," got their hands on Sheriff's Office records to track down people like Butler, offering money-retrieval services for a fee.

The practice isn't illegal, says the Treasury Department's Karen Gurzenda, a regional claims manager, but fees are capped at 15 percent. The practice also isn't necessary.

"Our website is easy to use," she says. "There's no need for a middleman to get your funds."

The past year has been a nightmare in the Sheriff's Office. Green resigned in disgrace, and key underlings were given the boot. Under new Sheriff Jewell Williams, says spokesman Joe Blake, the office has turned $24.3 million over to the state and $12.1 million to the city; the city, in turn, has turned $9 million over to the state.

"The sheriff is pushing hard to return all money to its rightful owners," Blake says. "We don't want it. It's not ours."

He'd never heard of J.L. Jones nor R&J Tracer and Recovery Group. Neither name was familiar to the City Controller's office, which audited the Sheriff's Office.

"There were so many people going after other people's money, it was like the Wild West out there," Blake says.

Butler's claims problems didn't end when he contacted the Treasury Department. Once he filed his paperwork, he says, he was told that his check would arrive promptly.

Weeks passed.

He contacted the department and learned that because his ex-wife's name was on the deed, he wasn't able to receive the $5,641.22 free and clear.

He was told to have her co-sign new forms. Except that he had no idea how to find her. He says he was told that he could file for half the claim, which he did.

Weeks passed.

And then a new letter arrived from Treasury advising him - again - to file with his ex.

That's when he gave up and called the Daily News for help.

"Please help me," he said. "This is ridiculous."

By Wednesday, some very kind people at the Treasury Department had untangled the mess. They say that Butler and his ex should have their money soon.

Maybe within weeks?

Now that would be a Christmas miracle.

Phone: 215-854-2217.

Twitter: @RonniePhilly.