Administration explains how tax plan would pay for itself, gets attacked for assumptions

The analysis relies on two big - and controversial - assumptions: that it will generate economic activity well in excess of what independent analysts project, and that the rest of the administration's economic agenda, including regulatory reform, infrastructure spending and an overhaul of the welfare system, will take effect.

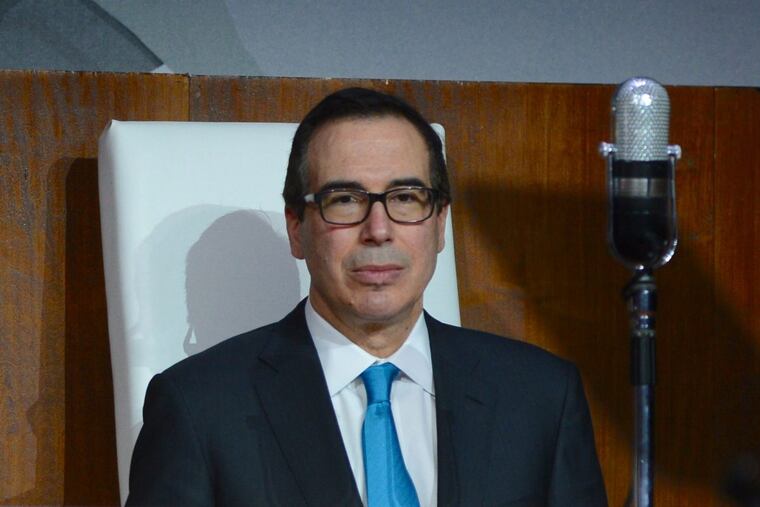

WASHINGTON – For months, Treasury Secretary Steven Mnuchin has said that the Republican tax plan wouldn't add a penny to the national debt, pledging that more than 100 people in his agency were "working around the clock" to calculate how much additional growth would come from the plan. On Monday, the Treasury Department released the fruit of those efforts: a one-page document asserting that the $1.5 trillion tax plan would generate more than enough to pay for itself.

The analysis relies on two big – and controversial – assumptions: that it will generate economic activity well in excess of what independent analysts project, and that the rest of the administration's economic agenda, including regulatory reform, infrastructure spending and an overhaul of the welfare system, will take effect.

Treasury's Office of Tax Policy says the U.S. economy will grow 2.9 percent every year for the next 10 years, a large increase from the 1.9 percent per year growth that the nonpartisan Congressional Budget Office is projecting.

"One percentage point of higher growth sounds like a little bit, but it's the equivalent of me being one foot taller and able to dunk a basketball," says Mark Mazur, an economist who served as assistant secretary for tax policy at Treasury during the Obama administration.

Treasury says half of the increased growth would come from the massive cuts to business taxes. The tax plan proposes cutting the corporate rate from 35 percent to 20 percent.

The office attributes the rest of the increased growth to multiple factors, including some that have yet to happen and are not part of the tax bill. As the one-page analysis says, "We expect the other half to come from changes to pass-through taxation and individual tax reform, as well as a combination of regulatory reform, infrastructure development and welfare reform as proposed in the [Trump] Administration's Fiscal Year 2018 budget."

Treasury estimates that, all told, the tax code changes and other policy efforts would lift economic growth so much that it would generate $1.8 trillion in new revenue over 10 years, as a bigger economy leads to bigger tax bills.

It is an analysis far different from other groups'.

A recent analysis by the Joint Committee on Taxation (JCT), Congress's nonpartisan scorekeeper, predicted that the Senate tax bill would add about 0.1 percent more a year to growth over the next decade, far less than what Treasury says. JCT took into account the economic effects of the tax cuts to individual and business taxes, but not other policy changes advocated by the administration such as welfare reform.

The JCT says the Senate bill's total cost would be $1 trillion after considering growth effects. JCT found almost exactly the same result when it analyzed the House bill and its economic impact: It would boost growth a little, but not nearly enough to cover the entire $1.5 trillion price tag. The House bill would also end up costing $1 trillion, JCT said in a new report out Monday afternoon.

Many economists and tax policy experts slammed the Treasury memo as half-baked. There was no supporting documentation with the statement, making it impossible for independent economists to be able to re-create Treasury's work. Independent analysts have forecast that the bill would add $500 billion to nearly $2 trillion to the debt.

"Treasury has released a one-page [analysis] which will be used by tax cut advocates to claim that the tax cut pays for itself. It's a joke and no substitute for the career staff running the full macro model they have to analyze effects," New York University tax law professor David Kamin tweeted.

Some economists in the Obama administration don't think Treasury ran a model at all. They note that the 2.9 percent growth estimate is what President Trump's budget assumed in the spring.

The nation's leading think tanks that analyze tax and budget policies have all released detailed analyses showing that the tax bill would not fully pay for itself.

In a new analysis of the Senate GOP tax bill that was also released Monday, the Tax Policy Center found that the bill would still cost $1.5 trillion, even after taking into account economic growth. The Penn-Wharton Budget Model predicts that the tax measure would still add $1.5 trillion to $1.8 trillion to the national debt after factoring in growth.

"Even with assumptions favorable to economic growth, the Senate [bill] still increases debt by over $1.5 trillion over the next decade," says economist Kent Smetters, director of the Penn Wharton Budget Model.

The Tax Foundation, which supports the GOP tax plan, says it would cost about $500 billion. Treasury is by far the most optimistic of all.

Scott Greenberg, a senior analyst at the Tax Foundation, tweeted Monday that what Treasury posted "is not an analysis of the economic effects of the Senate tax bill."

Senior administration officials said that different economists could come to different conclusions, but that they wanted to offer some transparency in their perspective. The analysis states, "We acknowledge that some economists predict different growth rates." Kevin Hassett, the chairman of the White House Council of Economic Advisers, defended the higher growth projections in several TV appearances Monday.

"We are going into next year with momentum. It's our view at CEA that all of the capital spending that's going to be drawn back to the U.S. next year is a reason for optimism that we can sustain 3 percent growth for a good, long time," Hassett said on Fox Business.

One Republican senator – Tennessee's Sen. Bob Corker – voted against the tax bill because of concerns about how much money it would add to the deficit. The White House has tried to persuade other GOP lawmakers that the Joint Committee on Taxation is wrong and that the bill would not increase the debt.

Senate Minority Leader Charles Schumer (D., N.Y.) called the analysis "fake math" that shows Republicans are "grasping at straws."

The Washington Post's Damian Paletta contributed to this article.