Would you buy insurance from a convicted thief or murderer? In Pa., some get the OK to sell

Since 2004, the state Insurance Department has issued 111 waivers to people convicted of murder, kidnapping, robbery, drug dealing, burglary, fraud, money laundering, passing counterfeit currency, and other crimes, a review of public records shows.

After being convicted of credit-card theft in 2012, Elizabeth Day King needed to make a living. So the 50-year-old Pittsburgh woman asked Pennsylvania insurance regulators last fall to license her to sell insurance.

Like many states, Pennsylvania grants waivers to convicted felons, allowing them to become insurance agents but only after a "voluminous" background check.

In January, state insurance officials gave King her waiver.

What they missed: Just four weeks earlier King had been charged with felony identity theft, accused of opening credit cards in her daughter's name, then racking up more than $12,000 in charges and not making payment.

A spokesman for the Insurance Department, Ronald G. Ruman, said the agency carefully screens people with felony convictions before deciding whether they should get waivers. In a statement, the department said the information it reviews "is voluminous and provides the department with deep insight into an applicant's personal and professional life."

But Carolyn Walker, King's aunt, a victim in her niece's 2012 credit-card theft, said, "They didn't ask me." Walker is trying to rebuild her credit after King secretly charged $2,000 to her Discover card. "You can't allow her to be near money," the aunt said.

King was authorized to sell accident, annuities, and health and life insurance, for Columbian Life Insurance Co. She did not reply to emails, telephone calls, or a letter sent to her home requesting comment. The company did not respond to a request for comment.

For weeks, the department said it would not comment on the waiver for King or for any other individual. On Friday afternoon, a day after a reporter provided the department with a copy of her state rap sheet, it suspended King's insurance license. Ruman said the arrest fell through the cracks because of a glitch in the state crime reporting system. "We should have received notification of that," Ruman said. "Who knows why it didn't happen." He said the department will try to find the problem and fix it.

Not enough horses

Since 2004, the state Insurance Department has issued 111 waivers to people convicted of murder, kidnapping, robbery, drug dealing, burglary, fraud, money laundering, passing counterfeit currency, and other crimes, a review of public records shows. The department approves most of the applications it gets. It usually issues 10 or fewer a year.

Pennsylvania and many other states have been granting waivers after Congress passed a 1994 crime bill that prohibited people convicted of felonies for "breach of trust or dishonesty" from entering the insurance business unless they obtained a waiver from state regulators. Some states, like Florida, don't give waivers. The Pennsylvania department has been more forgiving, granting nine last year. California — with insurance revenues three times as large — handed out only 10.

As a result, those staffers who investigate consumer complaints have the highest annual caseloads in the nation. In 2014, each consumer staffer on average had 655 complaints -- more than three times the national average, according to an Inquirer analysis of industry data.

J. Robert Hunter, who oversees insurance issues for the nonprofit Consumer Federation of America and is a former Texas insurance commissioner, said short-staffed departments in Pennsylvania and other states may simply be unable to do the necessary monitoring of insurance agents.

"They just don't have the horses to do it," Hunter said. "You need to have enough people to do a thorough job. … If you don't, you're going to miss murder convictions, or whatever."

Pennsylvania pulled in $465 million in insurance-premium taxes last year for its general funds, with much of it going to support police pensions. The Insurance Department's entire budget, including consumer protection: less than $25 million.

This level of funding can have consequences for the consumer. Consider some of the clients at Katherine Almeyda's insurance office, based in York.

Almeyda, 52, who had several forgery convictions, was granted a waiver in 2008. Within four years, she was caught stealing funds from five clients. She pleaded guilty to felony theft and to illegal drug sales, and was sentenced to three years in prison. Almeyda did not reply to requests for comment.

Each state decides how what crimes are ones of "dishonesty or a breach of trust" and whether they disqualify someone from becoming licensed as an insurance agent. A 2011 report by the National Association of Insurance Commissioners points to the confusion: "There has been concern that serious crimes — including, for example, manslaughter, rape, burglary or robbery, arson, unlawful sexual conduct, child abuse, molestation or other crimes against children, kidnapping and murder — might not contain an element of dishonesty or a breach of trust and, despite their seriousness, might not be a trigger for this prohibition status."

Pennsylvania regulators would not say which crimes it considers disqualifying. Nor would they say whether their waiver reviews typically include interviews with the victims.

To be sure, the majority of people who received waivers appear to have straightened out their lives, according to a review of the people the state Insurance Department listed as receiving waivers since 2004.

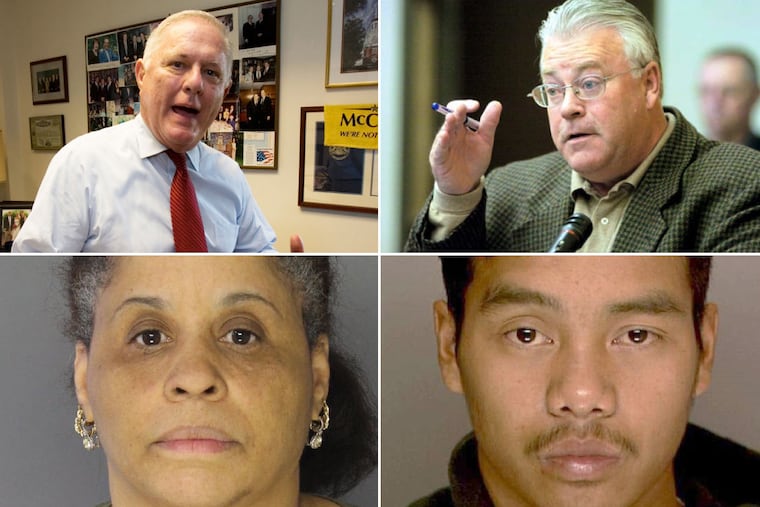

Former Luzerne County Clerk of Court Robert Reilly, who pleaded guilty in 2010 to lying to the FBI during a government kickback investigation, is an example.

"I never was in trouble before that, never since that," said Reilly, 64, of Wilkes- Barre, who was stripped of his government pension. "It totally ruined my whole life."

Reilly worked as a shipping supervisor but wanted a less physically demanding job in insurance. He received his waiver in March 2016, after a six-month screening and testing period. It was difficult to find insurance companies willing to allow him to sell policies for them because of his record, he said, but he now has been approved by two companies.

State waivers are also required for people with convictions who want to enter the insurance industry in other than a sales role.

Robert B. Asher, 79, an influential Montgomery County Republican convicted of federal political corruption charges after a 1986 jury trial, sought and received a waiver in 2013 to serve on the board of the Independence Blue Cross insurance company.

But Asher said he never became a board member because it would have required getting waivers from every state in which the company operated.

"We had to get a waiver in 26 other states," Asher said. "I said, 'Just forget it.' "

Asher, who until a year ago ran his family's 125-year-old Montgomery County candy company, Asher Chocolates Inc., said he had no other criminal problems.

The murder waiver

At the other end of the spectrum is Soutchay Chareunsack, a South Philadelphia home repairman.

When the Insurance Department gave a waiver in 2013 to Chareunsack, 42, it said he qualified despite a 1995 robbery conviction. The waiver didn't mention that Chareunsack also was convicted of participating in a murder during that robbery or other, earlier convictions.

Police said he and other members of the Thug Posse slipped into the apartment of Reno Nichols, a 23-year-old college student. Another gang member shot Reno in the head three times before the group fled with a coat, a Sony Walkman, and a wallet.

Chareunsack pleaded guilty to murder, robbery, and conspiracy charges in exchange for a 10-year sentence.

Chareunsack had also been convicted of drug dealing, firearms violations, and, in 1993, abuse of a corpse. (He dumped a 14-year-old girl's body in Montgomery County after she died from carbon monoxide poisoning when she, Chareunsack, and others fell asleep in a Philadelphia garage with a car engine running, police said.)

The murder victim's uncle, Arnold Hall Jr., one of 23-year-old's closest relatives in Philadelphia, said he was never contacted by the Insurance Department about the waiver.

Hall, 77, of East Mount Airy, said he firmly believes job opportunities should be available for people after they serve their sentences. Even so, Hall, a former president of the Philadelphia Home and School Council, had one question about the Insurance Department's screening for waivers: "To what degree did they look at this man?"

Chareunsack has not yet followed through and used the waiver to complete his insurance license. When contacted, he said he would not answer questions unless the reporter first revealed the address where he lived.

When the reporter wouldn't agree, Chareunsack said he had nothing to talk about and hung up the phone.