Facing a fiscal mess

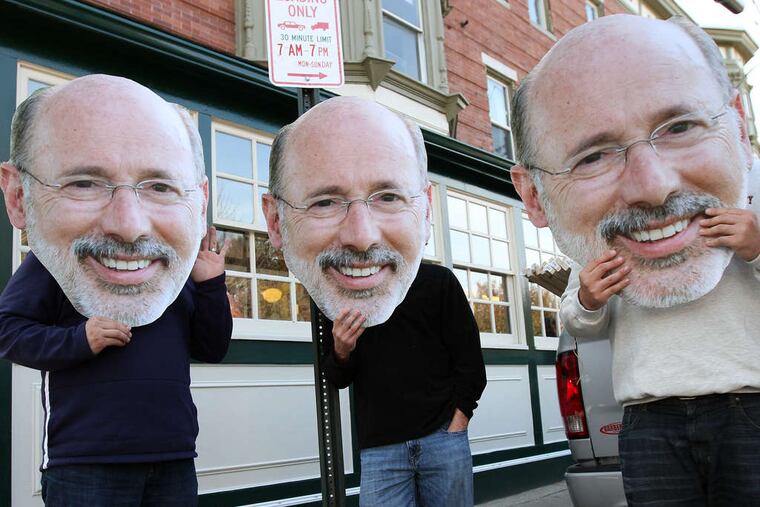

Confronting a $1.9 billion budget deficit, Gov.-elect Tom Wolf and the next legislature are going to have to upset some of their friends to keep the state afloat.

Confronting a $1.9 billion budget deficit, Gov.-elect Tom Wolf and the next legislature are going to have to upset some of their friends to keep the state afloat.

They can't count on one-shot gimmicks because Gov. Corbett and the current legislature ransacked the cupboard. They relied on $2.2 billion in nonrecurring funds, ranging from tobacco settlement proceeds to loan fund transfers, to prop up their election-year budget.

Wolf rightly called the stopgaps "unacceptable." But it would be equally unacceptable if the next governor doesn't soon lay the groundwork for stabilizing the state's finances. He and incoming legislative leaders have few choices but to learn from experience and address the state's structural deficit with genuine reforms.

They can start with a rational approach to business taxes, which should not be cut unless the result is likely to improve the economy. For years, Pennsylvania sliced the capital stock and franchise tax on the grounds that it would stimulate job growth, but it didn't work. The state still hasn't recovered all the jobs lost in the recession.

Meanwhile, Harrisburg has blown a hole in its revenues. The franchise tax brought in more than $1 billion a year before the recession, according to the Keystone Research Center, but because of the cuts, it is expected to generate only $118 million next year. It's a major reason for Pennsylvania's failure to accrue a surplus, as other states have, in the years since the recession.

Other taxpayers will have to make up the difference or there will be severe cuts to important social, educational, and public safety programs.

Wolf campaigned on imposing a 5 percent severance tax on natural-gas drillers, which he said could raise $1 billion. At current wholesale prices, which are lower than the estimate Wolf's campaign used, the tax would still produce $525 million to $675 million a year, according to an Associated Press analysis. That could close a substantial portion of the deficit. Republicans and some Democrats have long protected drillers, but it's time to make a deal.

Perhaps it could involve one of the few potential sources of one-time revenue still available. Last summer, the state Senate killed Corbett's plan to sell state liquor stores, a version of which was passed by the House. Wolf, his fellow Democrats in the legislature, and some Republicans don't want to anger organized labor by privatizing the Liquor Control Board's unionized government jobs. But they are protecting the agency at the expense of other constituents, from schoolchildren to the elderly to property-tax payers, as well as anyone who has to shop in a State Store.

Pensions are another huge cost to taxpayers. Wolf and legislators should be wary of any plan that shortchanges the state pension funds to fill current budget holes. Future generations of taxpayers and workers would pay the price.

Wolf and legislative leaders have a few more weeks to whine about the problems their predecessors created. Then they have to solve them.