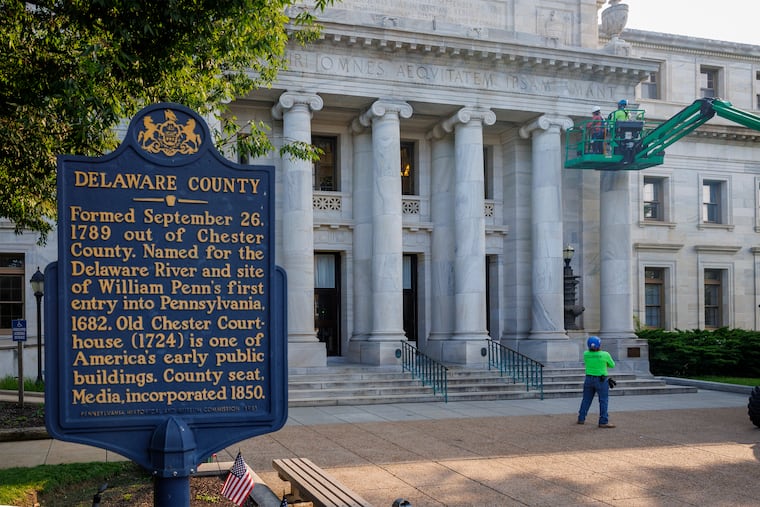

Delaware County may get a 19% property tax increase in 2026 after a 23% hike this year

Voters supported Democrats in Tuesday’s elections, despite Republican messaging focused on a 23% tax hike that took effect this year.

Delaware County’s executive director is asking the all-Democratic Council to raise property taxes 19% — just days after an election centered on the county’s double-digit increase this year.

The proposed increase, which would take effect in January if approved, comes on the heels of this year’s 23% property tax hike. Voters overwhelmingly supported Democrats in Tuesday’s council elections, despite GOP messaging focused on the rising tax rate.

Barbara O’Malley, the county’s executive director, delivered a draft budget to council members Friday. The $340 million budget increases overall county spending by just under 6% and calls for a 19% property tax increase to ensure the county can fund all operating expenses without relying on onetime funding sources.

The increase would translate to an additional $185 annually for the average Delaware County homeowner, a spokesperson for the county said. That is the same dollar amount of this year’s increase.

“This revenue enhancement is required to close the gap and maintain our reserves at the minimum standards,” O’Malley said in her memo. “We recognize these are challenging economic times for our residents and do not make a tax enhancement recommendation lightly.”

Tax increases in future years, O’Malley said, should be minimal if the council agrees to the 19% hike.

The Delaware County Council will introduce its own budget on Dec. 3 and vote on a budget on Dec. 10. Members of the all-Democratic five-member council could reject all or parts of the executive director’s recommendations.

On Monday, the county’s budget task force, formed to allow citizen input following the latest tax increase, will present to the board.

Council Vice Chair Richard Womack said he hoped the final budget could have a smaller tax increase than 19% and would review the task force’s proposals while seeking ways to cut spending.

“The last tax increase I voted no because I felt like we did not do a significant dive to really see where we can actually make some cuts,” Womack said. “We’re doing everything possible to make sure we don’t have that type of budget tax increase again.”

County officials released the 369-page draft budget just days after voters overwhelmingly voted to reelect Womack and elect County Controller Joanne Phillips to the council Tuesday, retaining unanimous Democratic control of the board, which the party has controlled since the 2019 election.

Republicans had leaned into last year’s 23% tax increase, arguing Democrats were overspending and warning of future double-digit increases, as they sought to win two minority seats on the board.

Michael Straw, chair of the Media Borough Republican Committee, called the potential hike “unfair” to residents and criticized the county for not releasing the draft budget earlier.

“Voters, in my opinion, deserved the right to know whether their taxes were going up and spending was going to be increased, and I think that would have changed some more individuals’ minds,” Straw said.

Democrats argue the tax increases have been a necessary response to decades of underinvestment under Republicans. When Democrats took office in 2020, they say the county was facing challenges because prior leadership had gone too long without raising taxes and had underinvested in county infrastructure and services. Democrats avoided substantially raising taxes in their early years in office, instead relying on COVID-19 relief funds.

But as those funds run out, and as inflation continues, the county is facing structural deficits that officials argue must be solved with tax increases.

“Providing stable funding for mandated services that our residents need and deserve is essential for sound government,” O’Malley said in a memo to council. “This county had minimal revenue enhancements over the last decade, necessitating these increases for the last two years.”

This year’s spending increases, O’Malley said, were due to increased court system costs, employee health benefits, and increases to the county’s SEPTA contribution and employee pay.

The need to ensure the county is financially stable, O’Malley said, was underscored by the state budget impasse, which had forced the county to curtail funding for some services while temporarily footing the bill for state-funded services.

Despite the GOP warnings, voters opted to keep Democrats in office, in some cases calling the tax increases necessary to maintain and improve county services.

“They should go up,” said Chester City voter Nicole Porter, explaining that she supports increases as long as they reinvest in parts of the community that need it most.

“If it costs a little more to get the roads fixed … I’m OK with that,” she said.

Staff writer Nate File contributed to this article.

This suburban content is produced with support from the Leslie Miller and Richard Worley Foundation and The Lenfest Institute for Journalism. Editorial content is created independently of the project donors. Gifts to support The Inquirer’s high-impact journalism can be made at inquirer.com/donate. A list of Lenfest Institute donors can be found at lenfestinstitute.org/supporters.