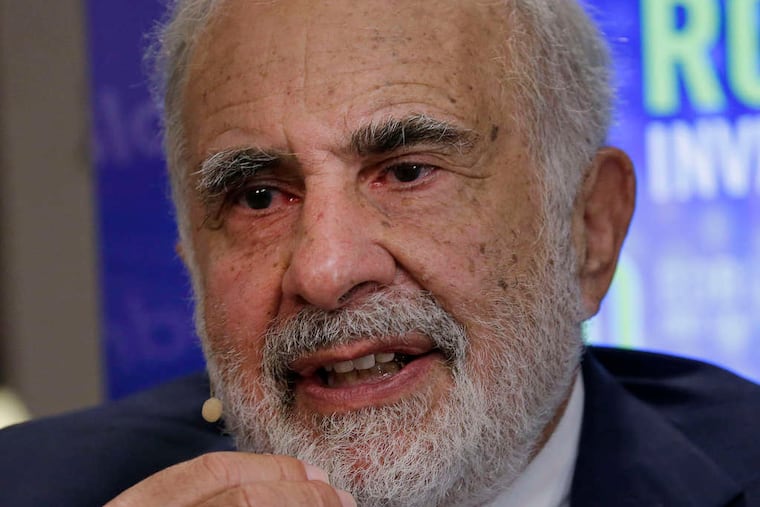

Legendary investor Carl Icahn has big ideas for a Philly-area company

The famed corporate raider wants Yardley-based Crown Holdings to buy back more share and focus more on aluminum beverage cans.

Shares in Crown Holdings Inc., a Yardley company that is among the world’s largest manufacturers of food and beverage cans, jumped sharply Thursday after a Wall Street Journal report that famed activist investor Carl Icahn had accumulated an 8% stake in the company and was agitating for more share buybacks and the sale of noncore businesses.

Crown’s shares were up 9% at 1:45 p.m. on the New York Stock Exchange, at $73.

What is Crown Holdings?

Crown is little-known in the Philadelphia region, but the company — founded in 1892 in Baltimore — is a giant in the world of food and beverage cans, with 200 factories in 40 countries and 26,000 employees.

Last year, more than 60% of Crown’s $11.4 billion in revenue came from beverage cans. In addition to food cans, Crown also makes aerosol cans and packaging for the health and beauty industry.

Crown benefited during the coronavirus pandemic from increased at-home consumption: Its stock soared to $125.09 on March 1, 2022, from $72.31 on March 1, 2020. But this year the stock tumbled — including a 15% drop last week after the company provided a disappointing update to investors.

The shares hit a low of $66 before the news of Icahn’s investment drove them higher this week.

Timothy Donahue, Crown’s chief executive, told investors last week: “Perhaps the COVID benefit to the beverage can was a bit greater than we thought. So coming out of COVID, perhaps we didn’t understand or anticipate lower beverage can sales for at-home consumption.”

Who is Carl Icahn?

For decades, a core part of Icahn’s investment strategy has been to buy significant stakes in publicly traded companies whose stock is not doing as well as he thinks it should.

Sometimes Icahn, who is worth an estimated $18.7 billion makes investments through a conglomerate called Icahn Enterprises, aims to take control of the company, as he did six years ago with Pep Boys, the Philadelphia chain of auto parts and repair stores.

But frequently, Icahn wants to force specific changes at companies to create gains for shareholders. This year, for example, Icahn launched a failed proxy fight against McDonald’s to force the fast-food giant to improve conditions for animals in its supply chain. Specifically, Icahn wanted McDonald’s to prevent its suppliers from keeping pregnant sows in gestation crates, which many consider cruel because the animals can’t turnaround.

What Carl Icahn wants from Crown Holdings

The Journal reported that Icahn wants Crown to be more focused on aluminum beverage cans.

Businesses that Crown could sell include a company Crown bought five years ago that makes packaging and traps used to transport goods, plus a unit that makes aerosol cans and Crown’s North American food can business, according to a research note from Jefferies Group LLC.

“We agree with Mr. Icahn and believe there’s an opportunity to unlock value,” Jefferies analyst Philip Ng wrote in a note to clients. “That said, given the current macro backdrop and capital markets, the timing is less than ideal” for sale, according to Ng.

Crown did not respond to a request for comment Thursday.