New Jersey announces grants, loans to help businesses affected by coronavirus

The programs are designed to help businesses cover payroll and other operating expenses.

New Jersey Economic Development Authority on Thursday announced a set of programs, including zero-interest loans, grants, and other aid, that could help an estimated 3,000 to 5,000 small- and mid-sized businesses affected by the COVID-19 pandemic.

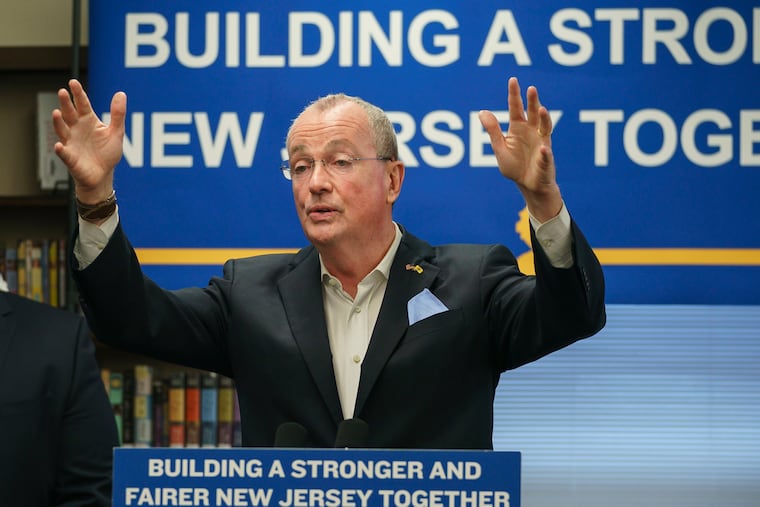

“Our recovery begins with our small businesses," Gov. Phil Murphy said Thursday during his daily briefing on government efforts to contain the virus in the hard-hit state.

A $5 million grant program is for retail, restaurants, entertainment, and other service-sector businesses that employ fewer than 10 and have temporarily had shut down and have had at least a 20% drop in revenue. The grants of up to $5,000 can be used used to pay employees or other operating costs.

The $10 million emergency loan program is for businesses and nonprofits with up to $5 million in annual revenues. The 10-year loans, up to $100,000, are interest-free for the first five years and then will have an interest rate of no more than 3% after that. The businesses have to be at least a year old and be profitable enough as of the end of 2019 to make their existing debt payments.

Other components of the aid package are designed to spur private lending by commercial banks and nonprofit community-development lenders through $20 million loan guarantees, which are expected to generate at least twice that much in lending.

More information on the programs is available at https://cv.business.nj.gov. Applications are expected to be available next week.

On Monday, New Jersey launched its COVID-19 Jobs and Hiring Portal to help connect laid-off workers with companies that are still hiring. Murphy said that since then more than 300 companies had posted 35,000 jobs. The most recent entries are Instacart, Amazon, and Hackensack Meridian Health.