Biz owners can’t deduct expenses paid with PPP loan money — at least for now

Congress isn't happy with the IRS ruling--and will likely work to reverse it.

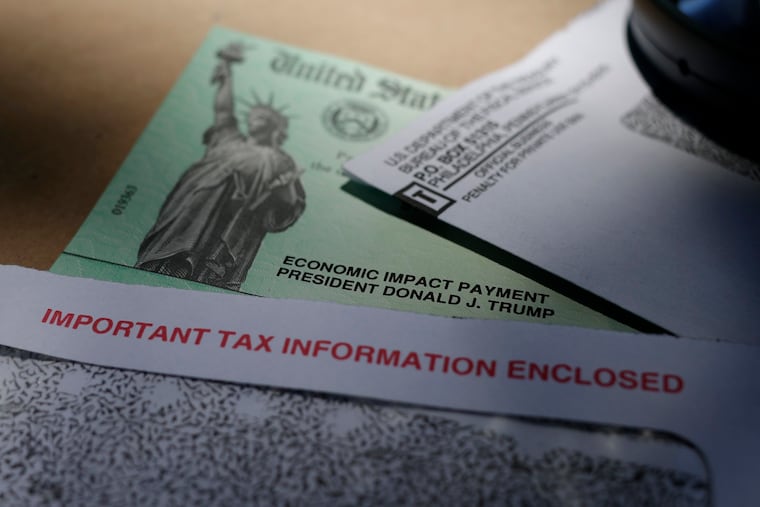

Hoping you could deduct 2020 business expenses paid for with U.S. government loan money?

Not so fast.

The Internal Revenue Service issued a ruling last week for business borrowers who got pandemic-era loans this year under the emergency Paycheck Protection Program (PPP).

The upshot of the IRS’s latest ruling? You can’t deduct business expenses come tax time in April — not if you paid with borrowed money.

Philadelphia-area businesses and organizations received roughly $7.2 billion via 77,180 loans, of which 16% were for more than $150,000. Many of the largest borrowers were law firms, which borrowed $228 million.

Those that borrowed $50,000 or less will see loans forgiven automatically; still, any money spent on business expenses isn’t deductible in 2020 taxes.

“For a calendar year taxpayer, the expenses are non-deductible for year-end 2020 if there is a reasonable expectation of forgiveness, regardless of whether the borrower files a forgiveness application in 2020 or 2021,” wrote Michael Maksymiw, partner in Marcum’s tax and business services, in a note to the firm’s clients.

Does it matter if you apply for forgiveness this year? No. Expenses still aren’t deductible in 2020, says the IRS.

By the way, some members of Congress disagree with this.

Senate Finance Chairman and Republican Chuck Grassley and Democrat Ron Wyden encouraged the IRS to reverse its position last week. Under Dec. 11 government funding legislation, or in next year’s newly-elected House and Senate, it’s possible lawmakers amend the language and change the IRS’s ruling on deductibility, said Blue Bell CPA David Zalles.

No double dipping

Why this new guidance? It reiterates Treasury and the IRS’s position against so-called “double-dipping.”

“Today’s guidance provides taxpayers with greater clarity and flexibility,” said Treasury Secretary Steven T. Mnuchin in the release. “We continue to encourage borrowers to file for loan forgiveness as quickly as possible.”

“Since businesses are not taxed on the proceeds of a forgiven PPP loan, the expenses are not deductible. This results in neither a tax benefit nor tax harm since the taxpayer has not paid anything out of pocket,” Treasury said in the Nov. 18 statement.

PPP loans were designed to be forgiven, provided at least 75% of the money was used for payroll costs, rent, utilities and other eligible expenses.

What if your loan isn’t forgiven? Only then can you and your business take advantage come tax time.

“In cases where your PPP loan is not forgiven, business owners will be able to deduct those expenses,” said Isdaner & Co., an accounting firm in Bala Cynwyd, in a note to clients.

But the PPP rules have changed many times before — and could change again. Just last month, the Small Business Administration issued a simpler PPP forgiveness application for borrowers of $50,000 or less.

The Small Business Association gave out $525 billion in loans this year — ranging in size from less than $50,000 to more than $5 million. Loans are forgiven if borrowers devote at least 60% of the proceeds to payroll costs and 40% to certain expenditures like rent and utilities.

Should Congress come up with another round of stimulus in 2021, they would likely slip in some language which overturns this latest IRS notice. Write old-fashioned letters or call your members of Congress to let them know what you think.