Malvern-based chipmaker Vishay hosts U.S. Commerce Secretary and Rep. Houlahan, pushing Congress to help semiconductor firms

Pennsylvania could get a slice of $52 billion in federal funds under the Bipartisan Innovation Act to build more semiconductor plants.

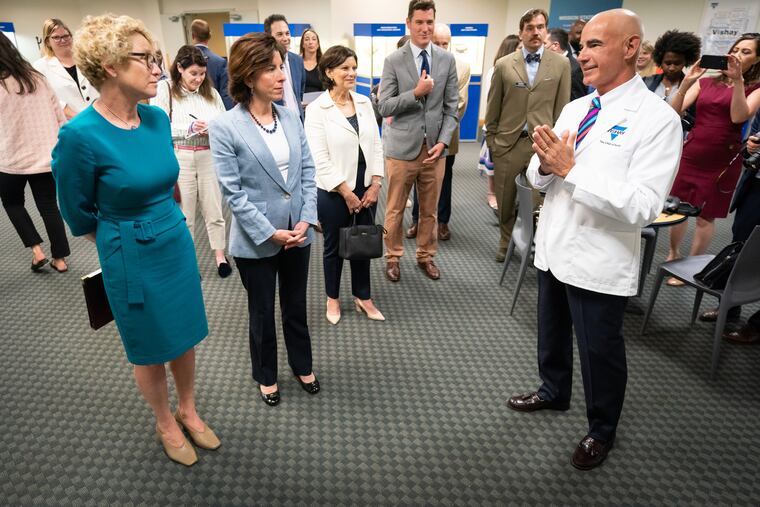

U.S. Commerce Secretary Gina Raimondo visited a semiconductor manufacturer in the Philadelphia suburbs Wednesday, as she and local officials expressed support for proposed legislation in Washington that seeks to boost the key sector and bring manufacturing back to America.

Vishay Intertechnology, of Malvern, is one of the world’s largest manufacturers of semiconductors and electronic components. It’s also one of several U.S. chipmakers facing supply chain issues brought on by the economic tumult of the pandemic. Geopolitical tensions between China and Taiwan, a main chip supplier to large U.S. tech companies, also threaten to further strain the sector.

In 1990, the United States accounted for about 40% of global semiconductor fabrication, according to the Congressional Research Service. But that market share declined over decades to about 12% in 2020, Raimondo said, as firms pursued cheaper manufacturing offshore.

“We’d like to get that back to 20%-25% of all chips in America,” Raimondo said in remarks at Vishay’s headquarters on Lancaster Avenue in Malvern. “But it will take years, not months. There’s no reason this can’t happen. It’s about our national security.”

Help us make our Business coverage better for you: We may change parts of the Business section and need your help. Complete our anonymous survey and you can enter to win a $75 American Express gift card.

New legislation now in Congress “would incentivize domestic productions of [semiconductor] chips,” said U.S. Rep. Chrissy Houlahan, a Democrat who represents the Chester County-based congressional district. She accompanied Raimondo on a tour of Pennsylvania businesses Wednesday.

The Bipartisan Innovation Act now being debated in Congress could deliver $52 billion in subsidies just to the semiconductor sector. The bill would also establish a supply chain office at the Commerce Department and encourage basic research to make U.S. industry more competitive globally. The act is currently in conference with members from both houses of Congress to reconcile differences between the Senate’s U.S. Innovation and Competition Act and the House of Representatives’ more costly America COMPETES Act.”

The Senate and House have so far failed to agree on the final bill. Houlahan gave an optimistic passage date of July, or perhaps later this year, and said the bill has both Republican and Democratic allies.

President Joe Biden has urged passage of the bill, saying supply chain issues are worsening inflation for U.S. consumers. Biden points to giant chipmaker Intel, which is set to build production facilities in Ohio in a $20 billion investment. If the Bipartisan Innovation Act passes, Biden said, Intel is likely to increase that investment.

At Vishay, about 35% of semiconductor and electronic components sales are to the automotive industry and 35% to industrial customers. It produces a broad line of components, used in everything from cell phones, microwaves, dishwashers, electronic thermostats, and even missiles.

Known as a “broadline” manufacturer, Vishay makes many different types of components and a mix of domestic and foreign production, said Peter Henrici, corporate secretary of the company. “Our customers can get all the different types of parts they need in one place.”

The company employs 22,000 people globally, with about 2,200 working in the U.S. The bulk of Vishay employees work in Europe and Asian countries such as Malaysia, the Philippines and Taiwan. Vishay’s U.S. manufacturing takes place in at least 10 states, but not in Malvern, or elsewhere in Pennsylvania.

Vishay, too, has been affected by supply chain bottlenecks and resultant inflation.

“The shortages [of components] are causing car prices to go up,” Henrici said following the event at company headquarters, noting that automakers are among its largest customers.

Many of the specialty semiconductors needed for electric cars, for example, “are in short supply, as the automotive industry goes through what we call electrification,” said David Valletta, Vishay’s executive vice president of sales worldwide. “The electric vehicles need to have more power. That’s created a logjam, and we’re trying to add more capacity.”

Its peer companies include ON Semiconductor, Infineon Technologies, STMicroelectronics, Diodes Inc. and lpha & Omega Semiconductor. For specialty components, competitors include Kyocera-AVX, among others, Valletta said.

Like many employers, Vishay is eager to hire more engineers and fabrication laborers. Its South Dakota facility, for example, needs more engineering and manufacturing employees.

In some cases, Vishay is doing what’s called “near-shoring,” bringing manufacturing closer to home in countries such as Mexico and the Dominican Republic.

Recent Chinese threats regarding Taiwan have also prompted concerns about U.S. national security. America’s largest tech firms, including Google, Apple, and Amazon, rely on Taiwanese chipmaker TSMC alone for nearly 90% of their chip production.

“Taiwan is an amazing partner of ours,” Houlahan said. “We’ve seen, as a result of the [Russian president Vladimir] Putin war [against Ukraine], that China is looking for an analog. So let’s move manufacturing out of places that are vulnerable.”

Vishay was founded by Felix Zandman in 1962.

In early 2021, the Vishay share price hit a 52-week high of $26 a share. The stock closed Wednesday at $20.36 a share.

The company has instituted a buyback of shares, according to Henrici, which the company hopes will boost the stock price. In 2021, Vishay reported net income of $298 million, on sales of $3.2 billion, up from $123 million net income on sales of $2.5 billion in 2020.

A government-aided push such as the Bipartisan Innovation Act “could make a huge difference in research and development’s competitive edge,” he said. “As a public company, we need to show the return on investment in a reasonable time frame. And that’s where government funding comes in.”