Murphy’s $11 billion tax break proposal for New Jersey needs a pause | Editorial

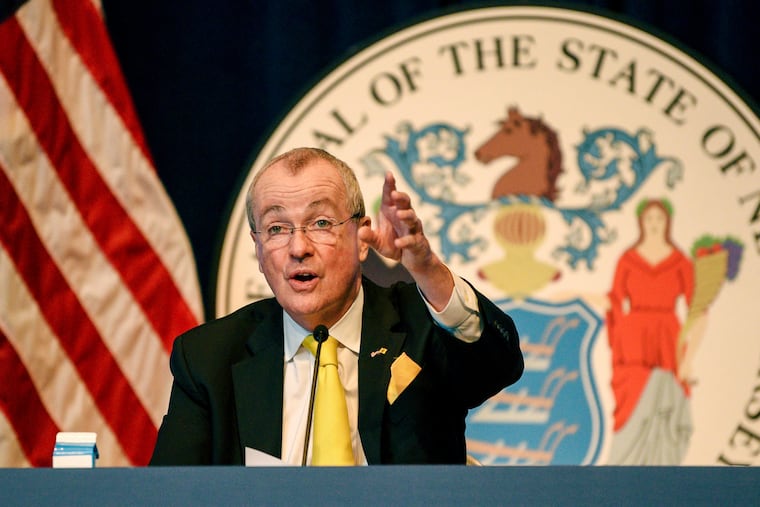

After a year-and-a-half of stalemate between Gov. Phil Murphy and the legislature, the two sides are in too big a rush to push through a massive new tax-incentives package.

Largely out of public view, New Jersey Gov. Phil Murphy and top Democrats allied with South Jersey powerbroker George Norcross have devised an $11 billion tax incentives measure they insist is a dramatic improvement over the state’s expired Economic Opportunity Act, which Murphy campaigned against as a gubernatorial candidate in 2017.

The more than 200-page omnibus bill, titled the New Jersey Economic Recovery Act of 2020, materialized publicly just last week. Proposed tax incentive programs — including one to spur development of grocery stores in underserved neighborhoods, another to directly assist small businesses statewide — would be run by the New Jersey Economic Development Authority. Legislative hearings on the measure were held Friday and a vote is set for Monday in the Assembly and the Senate, both controlled by Democrats.

The rush might be well-timed for what resembles a Christmas tree of a spending bill, well-suited for the eve of a gubernatorial election year. But a process of a few days hardly offers time enough for the public to weigh in on a six-year, big-ticket spending program that would be launched amid the pandemic’s profound economic disruptions that have hurt businesses and individuals. The Murphy administration already is set to borrow up to $9.9 billion to make up for budget shortfalls related to COVID-19.

Supporters of the bill were quick to roll out the welcome mat, however; the New Jersey Chamber of Commerce issued a statement saying the measure will provide “a competitive and robust” incentive program to help the Garden State compete with other jurisdictions.

Still, it sounds like the same old song in justifying generous tax incentives that promise to deliver jobs and economic development and that time and again end up falling far short of their promises.

» READ MORE: Fix N.J.’s bloated and broken tax breaks | Editorial

The New Jersey Policy Perspective think tank assailed the bill as “a doubling down on the failed strategy” of the 2013 Economic Opportunity Act. The fast-tracking is reminiscent of the process that yielded the deeply flawed earlier law Murphy supposedly was intent on reforming when he ordered an investigation and an audit. The resulting audit was scathing, taking the program to task for failing to ensure jobs were actually created, and for lax monitoring of billions of dollars.

Further, the new bill specifies one out of every three dollars of incentives for seven counties in South Jersey, where the influence of Norcross is most keenly felt. There is also a provision that seems tailored to empower the Cooper’s Ferry Partnership, a Camden development organization Norcross controls. Officials in the administration and the Legislature insist that provision would be useful to community development groups statewide, and that the bill targets smaller as well as large companies.

Those and other elements of the bill are encouraging, but the fact remains the track record for these kinds of programs has been dismal. We question why Murphy, who was a strong critic of earlier programs, has changed his tune. Worse, the process has been less than transparent. The public and legislators need more time before New Jersey takes such an enormous and expensive step -- especially at a time when dollars are scarce and the needs are great.