Comcast sends $65B bid to Fox’s board, seeking to oust Disney

The deal could fundamentally remake Comcast into an international company with more entertainment.

Comcast is taking shots at Mickey Mouse.

The Philadelphia cable and entertainment giant made a $65 billion cash offer for the assets that 21st Century Fox is already selling to the Walt Disney Co. for $52.4 billion in stock, setting up what may be a punishing takeover battle between the two legacy media giants.

Comcast announced the unsolicited offer by releasing a letter to the Fox board only 24 hours after U.S. District Judge Richard Leon approved AT&T's $85 billion deal for Time Warner. Leon soundly rejected the government's claim that AT&T/Time Warner would be anticompetitive and harm consumers, opening the door for a Comcast deal for Fox.

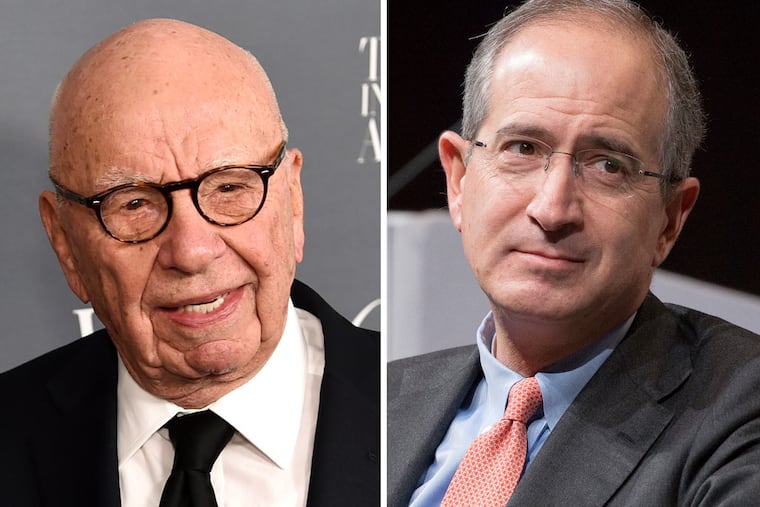

"We are, in our mind, the right buyers," Comcast CEO Brian Roberts said in a conference call with analysts Wednesday afternoon. "We continue to build the entertainment company of the future." Roberts was respectful of Fox founder Rupert Murdoch, 87, praising him for the company he built and saying the Fox businesses would "perfectly complement our own."

Analysts say Comcast needs to make the deal to keep up with new threats from technology firms that are increasingly expanding into entertainment. "It's about keeping up with Netflix and Google and Facebook. It's all about content," Brad Adgate, a longtime media analyst and consultant in Cambridge, Mass., said Wednesday.

The Fox and related Sky TV deal could lead to almost $100 billion in borrowings and potentially transform the conservatively run Comcast into the second-most-indebted company in the world, Moody's says. Roberts said that using cash made it a stronger offer, which "is not the way we started. We started with an all-stock offer and that was not accepted."

Roberts said that he and the Comcast board were confident that the company's existing businesses — cable, internet, and entertainment, coupled with the Fox businesses — could quickly cut the debt.

Fox said it was reviewing Comcast's letter, which was also sent to Murdoch and his sons, Lachlan and James. Fox has scheduled a July 10 special shareholder meeting to vote on the Disney deal. Fox said that the meeting was still on.

A Comcast deal for the Fox assets would sweep the Philadelphia-based company into international markets through the Fox International Networks, Star India TV service, and Sky network in Europe. More than two-thirds of the $38 billion in revenue from the Fox assets are generated overseas.

In the United States, the deal would give Comcast more than 20 regional Fox sports networks, the FX and Nat Geo cable channels, Fox's investments into media start-ups, a 30 percent stake in Hulu, and Fox television and movie studios and content libraries that include Avatar, X-Men, Fantastic Four, Deadpool, and The Shape of Water. The Fox studios could be bolted onto the Comcast-owned Universal and DreamWorks studios.

The deal would diversify Philadelphia-based Comcast, boosting its total revenue by 45 percent, and lead to closer integration with Europe's Sky satellite-TV operations, which would work with Philadelphia engineering teams. The local operations could marginally add jobs due to the merged company's greater scale and global reach, though details are scant at this stage.

None of the Fox businesses are based here. And a previous merger with NBCUniversal did not add significant employment to Philadelphia operations.

The Walt Disney Co. reached a $52.4 billion all-stock deal for the Fox assets in December and is expected to counter Comcast's higher, $65 billion cash offer. Comcast essentially matched Disney's other inducements to Fox to do a deal, which included a $2.5 billion breakup fee to be paid to Fox if government regulators reject the deal. Comcast also said it would pay the $1.5 billion breakup fee that Fox would incur by ditching Disney.

Murdoch initially picked Disney over Comcast in late 2017, even though Comcast offered a premium to Disney's all-stock deal, according to regulatory filings. Among Murdoch's stated reasons was his belief that Disney could more easily obtain regulatory approval in Washington than Comcast. But this may not be an issue after Leon's ruling in the AT&T-Time Warner deal.

Murdoch also may prefer Disney's stock bid, because it would better shelter the Murdoch family's Fox holdings from taxes in a cash deal, one major Fox shareholder has suggested.

Comcast and Disney, two of the largest entertainment and media companies in the United States, have deep pockets and slowing core U.S. businesses. For Comcast, it's the cable TV. For Disney, it's ESPN.

"Disney can compete financially with Comcast," Michael Nathanson, research analyst with the MoffettNathanson LLC firm, said Wednesday. "The question is will. Does [Disney CEO] Bob Iger have the will to follow Brian Roberts, you know, onto the beach on Normandy?"

Nathanson and his partner, Craig Moffett, said that Disney may have more financial resources to do a deal. But Moffett added that "Bob Iger is more beholden to shareholders than Brian Roberts" — because of Roberts' super-voting shares in Comcast.

"We know from the personalities involved there will be blood on the floor somewhere," Susan Crawford, a professor at Harvard Law School and author of Captive Audience, about the Comcast/NBCUniversal merger. "It's clearly going to be a battle of male wills. These are guys who are used to being in control and want their way and will do about anything to get it."

Of Murdoch, she added that "it's hard to imagine an 87-year-old media mogul being in the backseat."

The Fox deal also could give Comcast or Disney additional content to take on on-demand streaming services from Netflix, Google, and Amazon, many analysts believe. These new streamers are spending billions of dollars a year on content — $8 billion by Netflix alone — for their subscribers.

While Comcast has lost about 200,000 cable-TV subscribers since late 2016, Netflix's global membership has soared by 22.3 million to 125 million in almost 200 countries.

Netflix now has a market cap higher than Comcast's or Disney's on Wall Street: $165.6 billion for Netflix, $149 billion for Comcast, and $158.5 billion for Disney.

Comcast and Disney have concluded that greater growth exists outside the United States — and Fox would let them tap into this. Sky has 23 million subscribers in the United Kingdom, Ireland, Germany, Austria, and Italy. Star India operates 69 channels reaching 720 million viewers a month in India and 100 other countries. Fox Networks International distributes 350 channels in 170 countries.

Iger's Disney also could combine ESPN with the Fox regional sports networks in Detroit, Los Angeles, Atlanta, and other cities, monopolizing both regional and national sports fan viewership in TV markets with Fox regional networks and ESPN.

Murdoch, who has President Trump's ear, is dismantling his Fox empire, focusing his remaining assets on the conservative Fox News Channel, business and sports cable channels, and the Fox broadcast-television network — and selling basically everything else.