Tax plan backed by most House Republicans in Pa., N.J.

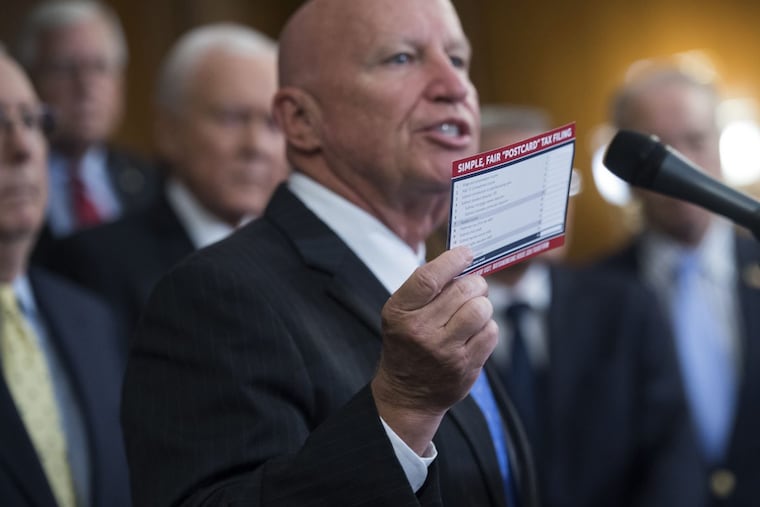

House Republicans hope to pass their tax overhaul plan Thursday, and Philadelphia-area representatives in competitive districts are mostly on board with it, even though it would trim tax breaks popular in the region.

WASHINGTON — It's crunch time for House Republicans and their plan to overhaul the tax code, and most in the Philadelphia area are on board with their party's proposal.

Two Republicans from the Philadelphia suburbs — Delaware County's Pat Meehan and South Jersey's Tom MacArthur — have announced their support for the bill up for a vote Thursday. Two more, Chester County's Ryan Costello and Bucks County's Brian Fitzpatrick, have strongly signaled they will also vote 'yes' as the GOP tries to take a major step toward one of its top policy goals.

Each is touting the plan as a way to simplify the tax code, cut taxes for most Americans and boost businesses and wages by slashing corporate taxes.

They have waved off concerns that by eliminating or scaling back popular deductions — including capping one for state and local taxes, which is used heavily in the Philadelphia region — the bill will short-change people in high-tax states. Such concerns have led at least three New Jersey Republicans, including the Shore's Frank LoBiondo, to oppose the bill.

Supporters argue that taken all together, the tax bill will provide a benefit.

"The vast majority are still coming out ahead," Costello said in an interview. "Do you accept the status quo? Or do you vote for a bill that's going to give the overwhelming majority of your constituents a tax cut? Along with the projected economic growth?"

For taxpayers and Republicans, the stakes of the vote are huge. President Trump is planning to visit Capitol Hill just before the vote.

Democrats warn that the tax plan may not be the political salve Republicans expect — especially in the suburban swing districts where Democrats surged in this month's elections, and where the state and local deduction is used most.

"Congressional Republicans are doing their best to put their majorities at risk," said Senate Minority Leader Chuck Schumer (D., N.Y.).

A Quinnipiac Poll released Wednesday found that 59 percent of voters believe the tax plan favors the rich over the middle class.

Projections from Congress' nonpartisan tax analysts predict that around 61 percent of tax filers would see tax cuts of at least $100 in 2019. Nearly 44 percent would see savings of $500 or more, according to the Joint Committee on Taxation.

Around 8 percent, though, are projected to pay more, and that share rises over time. Though relatively small, that means millions of households facing tax hikes. While most of the increases would affect those making $200,000 or more, some lower down the scale would also take a hit. Among those making $75,000 to $100,000, for instance, nearly 8 percent would face higher taxes in 2019, the committee found.

The people more likely to get bit are like those in the Philadelphia suburbs: relatively high-income individuals with expensive homes in high-cost areas, said Frank Sammartino, a senior fellow at the nonpartisan Tax Policy Center. That's because those people are more likely to rely on the big deductions that would be eliminated or capped in the GOP plan — part of a trade-off to pay for cuts.

"If you're higher income and in a higher tax state, you're more likely to either have a tax increase or you would get, if not a tax increase, at least a smaller tax cut than someone in a different situation," Sammartino said.

That issue is more likely to impact New Jerseyans. More than four-in-10 filers there use the state and local deduction, claiming an average of nearly $18,000. Under the House bill that deduction would be capped at $10,000 for property taxes only and eliminated for income or sales taxes.

The deduction is also popular in the Philadelphia suburbs. In Chester County, 46 percent of filers used it, claiming an average of $15,125, according to the most recent IRS data.

Add in the loss of other major deductions — including write-offs for medical expenses and student-loan interest — and the end of personal exemptions worth $12,150 for a family of three, and the GOP's new, larger standard deduction of $24,000 might not be that much better for some local taxpayers.

Chester County taxpayers who itemized their 2015 taxes claimed more than $30,000 in deductions, on average. That's already more than the proposed standard deduction — one of the GOP's top selling points.

But local Republicans said that once all the elements are considered — including lower tax rates and a $600 boost in the child tax credit — the overwhelming majority of constituents will see a tax cut.

"We've run a lot of models in my office," MacArthur said. "You have to look at the whole package."

He promoted the bill in his district Monday alongside Ivanka Trump, the president's daughter, and Treasury Secretary Steven Mnuchin.

Costello, who represents most of Chester County, argued that most people will now use the standard deduction and that those with larger deductions tend to be wealthier people likely to get stung by the Alternative Minimum Tax — which will be eliminated.

Many Republicans see approving the bill as a matter of political survival as they try to energize their base and fend off Democratic challenges.

"I've seen more unity on this issue, frankly, than anything I've seen in quite some time," Meehan said about the GOP determination to get the tax bill approved.

House Republicans are widely expected to pass the bill, and Senate Republicans want to move their version later this month.

But stumbling blocks remain: The Senate plan would entirely eliminate the state and local deduction, which MacArthur said is a non-starter in the House. The Senate has also added a repeal of the Affordable Care Act's mandate that everyone carry health insurance, adding the emotional politics of health care to the mix.

At least three New Jersey Republicans already oppose the House measure out of concern for the new limits on the property-tax deduction. LoBiondo called the change "detrimental to New Jersey residents." Some have argued that Garden State residents are giving up a major tax break to finance bigger cuts for the rest of the country.

Democrats, including Sen. Bob Casey (D., Pa.), have derided the bill as a giveaway to corporations and the wealthy while adding $1.4 trillion in debt. The Penn Wharton Budget Model projected that 37 percent of the tax cuts next year will go to the top 1 percent of earners, and that share rises to 57 in a decade.

Republicans said many benefits will flow to average workers once businesses see a tax cut — prompting hiring and better pay.

"If this Congress is serious about standing up for middle class families and unleashing the power of the American economy, tax reform is the natural starting point," Fitzpatrick said in a statement.