In high-tax N.J., pay-hike cap for cops, firefighters, a hot issue

Garden State residents pay the highest property taxes in the country. Gov. Christie and municipal officials say a limit on contract awards for firefighters and police officers reins in property tax increases. Public safety officials say the cap makes the negotiation process unfair.

New Jersey residents, politicians, and public employees can agree on at least two things.

Property taxes are high — among the highest in the country. And public safety is a necessity. But municipal officials also know that salaries and benefits for the state's 33,500 local police and firefighters — whose average annual compensation is about $98,000 — make up a substantial share of the budgets of the state's 565 towns, townships, boroughs, cities, and villages.

How to reconcile these realities has become a contentious political question.

In 2010, the state imposed a new 2 percent cap on property-tax increases. And in an effort to hold down real estate levies, it capped salary increases for firefighters and police officers — who are barred by law from striking and whose contract disputes are decided by arbitration — at 2 percent if negotiations go to arbitration.

That limit on arbitration awards expires on Dec. 31. Police officers and firefighters want it gone. Municipalities are fighting to extend it, arguing that ending it could lead to fresh cuts in services and higher taxes in a state where the average residential real-estate levy is nearly $9,000 a year.

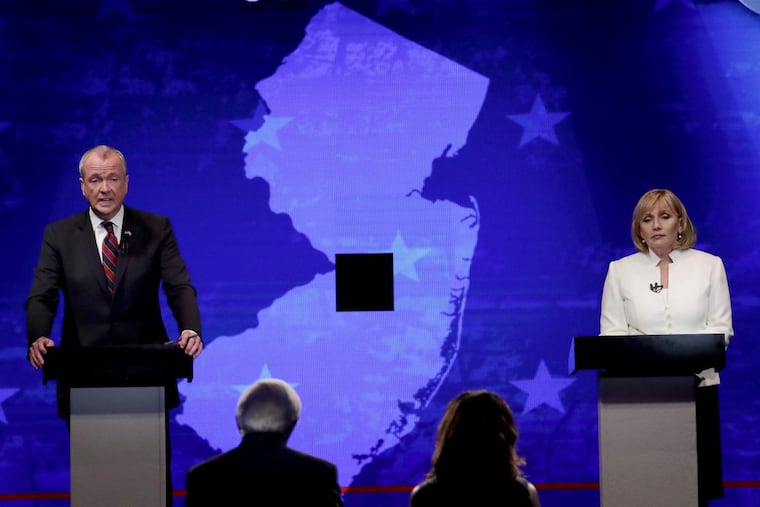

Earlier this month in their first gubernatorial debate, Kim Guadagno, New Jersey's lieutenant governor and the Republican nominee for governor, said she supports extending the arbitration cap. Her Democratic opponent, former ambassador and business executive Phil Murphy, hasn't taken a stand. He said he is waiting for a report, due after the election, from the eight-member task force charged with studying the cap's impact.

But Dominick Marino, president of the Professional Fire Fighters Association of New Jersey and a legislative appointee to the task force, said he is unsure whether a final report will come. He said he and the three others appointed to the task force by the Legislature are waiting for more information about the distribution of funds in municipal budgets in the years since the arbitration cap took effect and whether lower property tax increases detailed in the report are purely the work of the cap.

Last month, four of the eight members on the task force released a report that argued the caps were effective. It says fewer contract negotiations have gone to arbitration, "leaving it to the parties to settle labor contracts through direct negotiation and within budgetary constraints." The four, all appointed by Christie, called the findings "too important to be kept from the public."

The four legislative appointees rejected the study, calling it "one-sided" and incomplete. "They released it before the November election to make it a political football," said Marino, whose organization has endorsed Murphy.

In the last five years, property taxes in New Jersey have ticked up by 10 percent, according to the governor's office, which argues that the increase would have been higher without the arbitration cap. The Treasury Department calculated the state's average annual property tax bill last year as $8,288.

Michael Darcy, executive director of the New Jersey State League of Municipalities, said extending the arbitration awards cap for firefighters and police is his group's No. 1 priority.

"In recent years, we have had very few tools given to us that are known to both control property tax increases, and, at same time, they don't necessarily impact the ability to deliver services," said Darcy, referring to last month's report.

In a statement the day the governor's appointees released their report, Christie said both political parties had come together on the issue in the past "because it was the right thing to do for property taxpayers." He argued the state legislature should make the cap permanent.

Local governments in New Jersey, the most densely populated state in the country, pay a total of about $3 billion annually to police officers and firefighters, according to state data.

John Donnadio, executive director of the New Jersey Association of Counties, estimated that spending on law enforcement employees represents 15 percent to 25 percent of counties' operating budgets. Thus, the tax cap makes the arbitration cap a necessity, Donnadio said.

"We can't have one without the other," he said, adding that county officials worry they'll have to cut services or raise taxes if the state does not extend the arbitration cap. "It's critically important."

Marino said the property-tax cap on its own would reduce spending across the board and said both the property-tax and arbitration caps together represent "a double hit to police and fire when they're negotiating."

"For individuals to risk their lives at any given alarm or emergency they go to, they should be compensated for the job they're performing," Marino said.

Limits on government spending in some states implicitly cap arbitration awards for public employees who cannot strike, according to the National Conference of State Legislatures.

In Nebraska, the law limits arbitration awards to compensation in comparable communities, said Al Downs, a policy specialist for the organization.

Nevada limits contract arbitration awards in negotiations with firefighters, police officers, and school district employees based on the financial ability of their municipality to pay while continuing to provide vital services, Downs said.