Why the debt limit fight could be catastrophic and cost the U.S. for generations

The original intent of the debt limit was to force lawmakers to remain fiscally disciplined. That has failed. Instead, the limit has become highly disruptive.

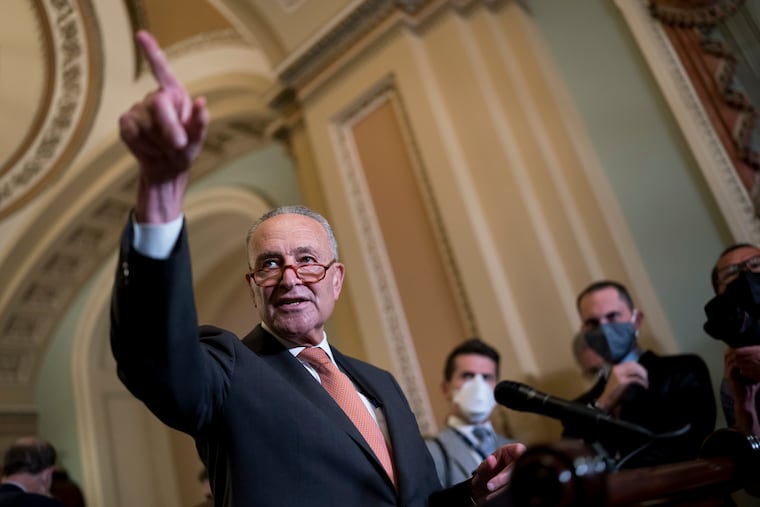

Here we go again. Lawmakers in Washington are taking us to the brink of another government shutdown and a default by the U.S. Treasury. Logic dictates that they will find a way to avoid both, as a financial crisis and an economic calamity will otherwise ensue. But, even if they do, the long-term cost of their brinkmanship is mounting.

Congress has a Sept. 30 deadline to fund the government’s operations for the new fiscal year, which begins Oct. 1. Failure to do so would result in a government shutdown. Shutting down the government would not be an immediate hit to the economy. Essential government workers would remain on the job. But as we have seen in past shutdowns, things would start going off the rails in just a few weeks.

Then there is the Treasury debt limit, which was reinstated on Aug. 1. The limit is the maximum amount of debt that the Treasury can issue to the public or to other federal agencies. The amount is set by law and has been increased over the years to allow the Treasury to finance government operations.

The original intent of the debt limit was to force lawmakers to remain fiscally disciplined. At this, it has failed. Instead, the limit has become highly disruptive. The government is running a budget deficit, and if the Treasury can’t borrow more, it will run out of cash by late October. At that point, someone — Social Security recipients, military personnel, Treasury bond holders, or myriad others who are owed checks from the government — will not get paid in a timely way. The U.S government will default.

A default would be catastrophic. Global financial markets and the economy would be upended. Even if it were resolved quickly, Americans would pay for this default for generations. That’s because global investors would rightly believe that the U.S. government’s finances had been politicized, and that a time would come when they would not be paid what they were owed when owed it. To compensate for this risk, investors would demand higher interest rates on Treasury bonds. Paying those higher rates would exacerbate our daunting long-term fiscal challenges and be a lasting corrosive on the economy, significantly diminishing it.

It is unclear how lawmakers will resolve the impasse. Democratic and Republican lawmakers could come to terms on an agreement in the next few days to suspend the debt limit in a short-term spending bill to fund the government.

This seems the most reasonable outcome, given the bipartisan nature of the financial obligations the debt would need to cover. The $3 trillion in fiscal support lawmakers provided in 2020 to help the economy through the pandemic, beginning with the CARES Act, had strong bipartisan support. And both parties have played a role in passing recent expensive packages along party lines: The Democrats with the $1.9 trillion-dollar American Rescue Plan, and Republicans with the $1.8 trillion dollar tax cuts of 2018.

However, given our increasingly partisan Washington, the Democrats may have to go it alone and add this fix to their massive legislative package of support for public infrastructure, social programs and climate change. But that path is fraught with risk. It is not at all clear that the Democrats can pass the package in time, given the complexity of the process necessary to do it with their votes alone and the difficulty of reaching agreement on anything, even among Democrats themselves.

And even if Democratic lawmakers pull it off, and the Treasury avoids a default, there are sure to be long-term repercussions. The debt limit will be forever so politicized that the party in power will need to increase the limit without support from the other side.

The intensity of the brinkmanship around resolving the debt limit, and the resulting uncertainty and economic damage, will be permanently greater.

A bedrock of the U.S. economy and global financial system is that the U.S. government pays what it owes in a timely way. Alexander Hamilton, the nation’s first Treasury secretary, established this principal at the founding of the nation when he agreed to pay Revolutionary War bond investors 100 cents on the dollar. This despite that the bonds were trading at pennies on the dollar because few believed the new American government would make good on its debts.

When the government did make good, it established the sound credit of the U.S. and paved the way for the U.S. dollar to become the global economy’s reserve currency. The economic benefits of this over the generations are incalculable.

The mounting political brinkmanship over the debt limit is thus painful to watch. If lawmakers were unable to increase or suspend the debt limit before the Treasury fails to make a payment, the resulting chaos in global financial markets would be difficult to bear. The U.S. and global economies, which are still battling their way to recovery, would descend back into recession. In times past, lawmakers took strident warnings like these to heart and acted. Let us hope they do so again. Soon.

Mark Zandi is chief economist of Moody’s Analytics.