Newly released emails show how PSERS managers tried to undercut whistleblower

At least eight PSERS executives worked for three weeks to craft a reply to board member Joe Torsella. They said they were comprehensive and substantive.

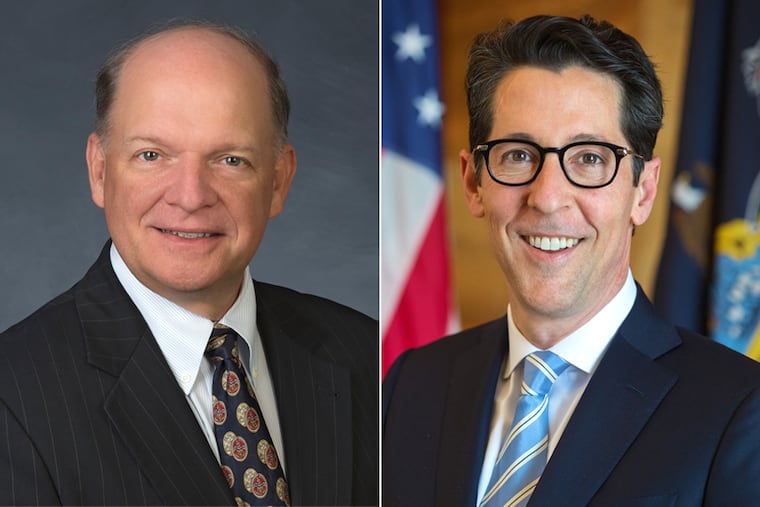

When the top staff of Pennsylvania’s biggest pension fund was asked about board member Joe Torsella, a gadfly who pushed relentlessly for change at the $73 billion plan, they complained that Torsella didn’t trust them and even called him “intractable” in a public statement.

Now a new set of previously private fund emails further documents the PSERS fund management’s attitude toward former State Treasurer Torsella and how it dealt with him.

The messages, released in response to a Right-To-Know filing by The Inquirer, were exchanged among top executives of PSERS, the mammoth Public School Employees’ Retirement System, as they circled the wagons to respond to Torsella about the fund’s finances. He and other critics have long maintained that the system’s performance has lagged compared with other public funds.

In July 2020, Torsella put his finger on something very odd in the fund’s official reports. Suddenly, the plan was booking $150 million more in assets from five years before than it had previously put down on its books. Torsella questioned this surprising discovery in a pointed letter to PSERS.

In time, it would become all too clear that Torsella had uncovered an issue that would metastasize into a major scandal for the fund.

But back in 2020, at least eight PSERS executives worked for three weeks on a reply to Torsella, assisted by pension fund consultants. The emails they all exchanged, obtained by The Inquirer after the fund dropped months of legal opposition to their release, reveal a management determined not to give an inch to Torsella.

They were also intent on impressing him.

At one point, James H. Grossman Jr., then the fund’s investment chief, and Brian Carl, then and now chief financial officer, asked the team whether it could “‘juice’” up the reply “with some official sounding phrases.”

Carl offered a few, including “promulgated by the Governmental Accounting Standards Board” and “in accordance with ... the Actuarial Standards Board.” Both duly made it into the reply to Torsella.

The emails show that Glen Grell, then the plan’s executive director, opposed a lengthy part of a draft reply to Torsella “because it suggests he is correct in his criticisms.”

In his letter, Torsella had complained that the board hadn’t been told about the big surge in revenue from 2015. He asked whether the board had a policy to keep the board in the loop.

In text removed from a reply draft, PSERS originally said the fund would take up his concerns about what disclosure is made to the board. The draft also said a policy shift would “minimize the need in the future to restate prior performance.” This was deleted, too.

Help us make our Business coverage better for you: We may change parts of the Business section and need your help. Complete our anonymous survey and you can enter to win a $75 American Express gift card.

Asked recently about all this, Torsella said he would not comment about the phrasing of the emails or the discussions that occurred.

That said, he added generally, “I find anything that suggests a concern with spin over substance deeply troubling. As I’ve said frequently, any investment culture that is more focused on rebutting perceived ‘critics’ rather than welcoming the healthy dialogue and transparency that is vital to good governance does not serve the beneficiaries.”

Lawyers for Grossman and Grell said the PSERS executive had worked hard to develop a detailed response to Torsella’s letter. Attorney Matthew Haverstick, speaking for Grossman, said the goal had been to make the reply “more comprehensive and more substantive and more robust.”

Said Marc Raspanti, Grell’s lawyer, “The exchanged letters between Mr. Torsella and Mr. Grell clearly reflect an open dialogue between PSERS staff and a board member. Mr. Torsella posed questions in a letter to PSERS staff. In turn, PSERS staff provided an exhaustive response to every question.”

As for the call for staff to ‘juice’ the letter, a PSERS spokeswoman said “Mr. Carl used the phrase to demonstrate that the letter should appropriately reflect that PSERS was following governing standards in the industry.”

In the end, the official reply to Torsella said there was no problem with the big bump in revenue from 2015.

In hindsight, Torsella was right to focus on the 2015 returns. Early last year, the fund reversed course and admitted its performance numbers were false and too high. It adopted a new reduced figure, a step that forced it to hike the pension payments by working educators. The reversal also triggered an FBI investigation that continues today.

In an internal investigation into the mess, an outside law firm, Womble Bond Dickinson, traced the mistake to bad data erroneously inputted by a consultant. Neither Torsella nor the PSERS executive knew of the consultant’s mistake at the time of their exchange.

As The Inquirer has previously reported, Grell made a small joke regarding Torsella in late 2020 as the then-treasurer’s first term on the PSERS board neared its end. “AND it’s somebody’s final Board Meeting!!” Grell wrote in another email. Grell’s lawyer, Raspanti, said the note was not disrespectful and wasn’t meant to be.

Torsella returned to the board last year, reappointed, after a brief absence, by Gov. Tom Wolf. Grell and Grossman announced their resignations late last year after months of growing controversy over the fund’s performance and the official investigations.

Help us make our Business coverage better for you: Complete our anonymous survey and you can enter to win a $75 American Express gift card.