Amid FBI scrutiny, top PSERS pension officials update financial disclosures

The fund’s investment chief and three of his aides have amended their financial disclosures to reflect their positions on boards that own PSERS real estate.

Amid an FBI investigation into real estate held by Pennsylvania’s big PSERS pension fund, the agency’s investment chief and his top staff have updated their financial disclosures to include their roles on the boards of agency-affiliated companies that own PSERS buildings in Harrisburg and elsewhere.

The filings by PSERS officials James H. Grossman Jr. and three other investment officers, completed since Sept. 22 and recently made public, state flatly that Grossman and the others are not employees of the companies and receive no money from them.

In June, PSERS acknowledged that Grossman and others on his staff had been listed on a different disclosure form filed with the Internal Revenue Service not only as board members for the affiliated companies but as paid staff. This seemed to put them in dual and conflicting roles as top employees of both PSERS and firms that did business with the pension fund.

However, in June the pension plan said those forms were mistaken and that it would file corrected ones with the IRS.

As for the annual financial disclosures that all state workers must file each year under the state Ethics Act, Grossman and the others had either checked “none” or otherwise omitted the real estate entities when asked about board positions. Now, he and the others have amended those forms, too.

Evelyn Williams, a spokesperson for the pension fund, said that the staffers had gotten bad advice from the agency’s lawyers in leaving the form blank. However, Robert Caruso, the executive director of the State Ethics Commission, said it had never penalized anyone who had simply made a mistake.

» READ MORE: Latest PSERS development: SEC probes big Pa. pension fund, asking about ‘compensation and gifts’ to staff

PSERS — the Pennsylvania Public School Employees’ Retirement System — is among the nation’s top 25 public pension funds, sending out $6 billion annually to 250,000 former teachers and other ex-educators. It’s funded by about $5 billion yearly in taxpayer “contributions,” $1 billion from working teachers, and by profits from its $72 billion investment fund. PSERS invested much of the investment money into stocks and bonds, but a small share, relatively speaking, has been sunk directly into real estate in places ranging from Harrisburg to Florida to Texas.

Seven months ago, federal prosecutors served grand jury subpoenas on the fund demanding information about the PSERS board’s mistaken adoption of an unduly positive figure for investment profits — and about the fund’s purchase, since 2017, of 13 properties near its Harrisburg headquarters.

Late last month, the U.S. Securities and Exchange Commission filed a new subpoena asking, in part, whether any PSERS staffers had improperly received gifts from firms that do business with PSERS.

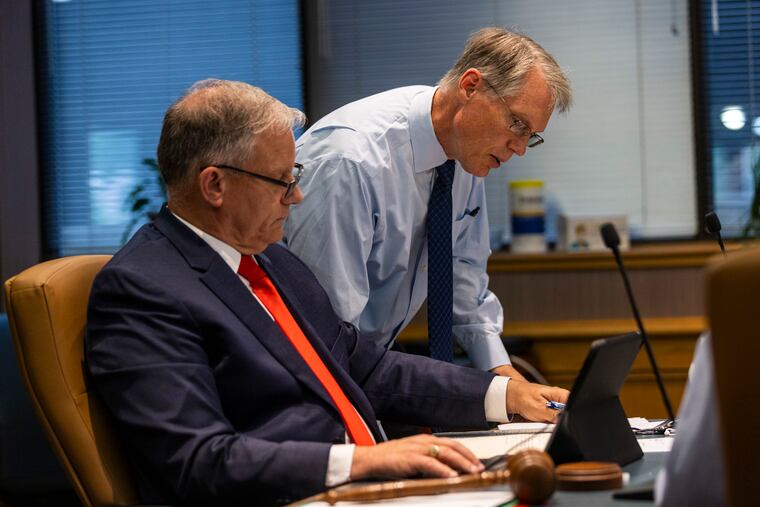

At its board meetings last week, the retirement system leaders agreed to budget an extra $1 million for growing legal bills stemming from the probes — four times the money budgeted in 2020-2021. The fund has hired three law firms to help it cope with the scandal and is paying other lawyers to represent individual staffers, as well. PSERS has a policy that it will pay up to $40 million in total legal bills in any one year for agency staff caught up in an investigation.

In his updated financial disclosures, for the years 2018, 2019, and 2020, Grossman listed himself on the board of directors of four PSERS-owned holding companies that have a mall and apartment buildings in Fort Lauderdale, Fla.; commercial real estate in San Antonio, Texas; PSERS’s office building in Harrisburg, and the newly acquired real estate nearby. He also put himself down as a board member of a fifth company that once oversaw PSERS property in Chester County that was sold in 2013.

In all, Grossman, who is paid $485,421 yearly, the most in state government, has served on at least seven subsidiaries that hold PSERS properties, records show. The fund said it set them up to protect the parent agency from lawsuits.

Charles Spiller, who is one of Grossman’s two deputies, and William Stalter, an investment office expert on real estate, said they served on the same five boards. Another staffer, Melissa Quackenbush, who updated her form Thursday, joined them at one company. Grossman’s new form was posted online publicly early last week. Forms for his aides were released by PSERS on Friday.

As for the Harrisburg real estate identified in the federal subpoenas, PSERS has assembled it in stages since 2017. The retirement plan has bought and knocked down the old office and printing plant of the Harrisburg Patriot-News newspaper. They also bought two other industrial buildings and a string of parking lots.

It has said little publicly about its plans, even while approving a $5 million real estate expenditure for the project in a closed-door session in October 2019. Nothing came of an idea the fund floated internally in which it would partner with Harrisburg University of Science and Technology to build a mixed-use tower.