Par Funding investors closer to getting their money back as $250M in claims are approved

More than 1,700 investors in Par Funding are hoping to get back $250 million invested in Par Funding, a Philadelphia small-business lender whose owners face federal fraud charges.

The first of 1,730 investors in Par Funding have received notice that they can expect to get their money back — minus any interest they collected before the Philadelphia-based merchant-cash-advance loan company stopped payments and then was taken over by a court-appointed receiver in 2020.

Receiver Ryan Stumphauzer said in a filing Monday that his office has approved investor claims totaling $250 million, while denying others. Some investors will be paid directly by the receiver and others through administrators such as Ambler-based Camaplan, depending on how they invested. Stumphauzer’s office is still working on a formal distribution plan for the money.

Par Funding, also known as Complete Business Solutions Group, its operators and outside salespeople raised more than $550 million from investors from 2011 to 2020 after making what prosecutors described as “materially false and fraudulent statements” to investors about Par’s leadership and financial health. By charging high rates of interest to small-business borrowers who couldn’t get bank loans, Par paid attractive profits to early investors, but the government says the company’s owners used much of the money for personal purposes and stopped paying investors back.

A public hearing on investor repayment is scheduled for 10 a.m. Wednesday in federal court in Miami. The hearing can be viewed remotely.

Several investors, posting over Thanksgiving weekend on a Facebook page set up by former clients of Dean Vagnozzi, a Collegeville insurance salesman who advertised on KYW news and WPHT talk radio and raised more than $100 million for Par, said they were told they would get most of their money back.

Payments may vary depending on which Par investments they bought and how long they collected annual interest of 10% or more while the company was in business.

Investors who believe they are owed more were invited to appeal, according to documents sent by the receiver, though some found the process daunting.

“Good luck trying to decipher that,” said Joseph Brock, a labor-relations consultant who was disappointed to see the receiver proposed paying him $90,200 of the $200,000 he reported investing in Par through one of Vagnozzi’s funds.

Federal Judge Rodolfo Ruiz authorized a takeover of Par Funding and its affiliates in 2020 after the U.S. Securities and Exchange Commission alleged in a civil complaint that Par’s founders and salespeople had failed to register the $550 million it raised as securities. They also lied that the investment was insured and failed to warn investors the firm’s principal founder, Joseph LaForte, had served time in federal prison for fraud, the SEC said.

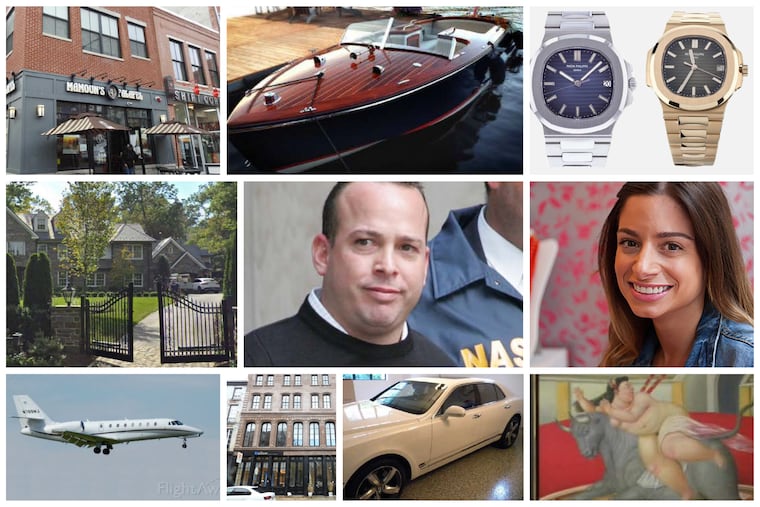

LaForte and his wife, Lisa McElhone, who are facing separate criminal charges, have agreed to pay back nearly $200 million in connection with the SEC complaint.

To pay the claims, the receiver has collected $133 million in cash and $43 million worth of Philadelphia properties, resort homes, cars, boats, art, jewelry, and other property from LaForte and McElhone and other former Par officers and salespeople. The receiver has been selling those properties in recent months to help repay investors.

The receiver also expects to collect up to $45 million from an insurance settlement against Philadelphia lawyer John Pauciulo and his former firm Eckert Seamans, which advised agents who sold the unregistered Par Funding investments. Additional repayment funds could come from millions in tax refund claims and from Par borrowers who have not repaid loans.

The insurance claim has been delayed while lawyers for Vagnozzi and others try to get additional money from Eckert’s insurers. They argue in court filings that they, too, were victims of Pauciulo’s bad advice. Pauciulo left the firm and was assessed a $125,000 fine by the SEC last year.

In a filing with the SEC case earlier this year, Vagnozzi noted that he had to pay the receiver $5 million to resolve civil fraud claims against him, lost his state insurance license, was unable to meet some of his family’s expenses, and went to work for Federal Express. Vagnozzi has not been charged with criminal wrongdoing.

LaForte, McElhone, LaForte’s brother James, and other former Par managers face criminal fraud, conspiracy, and other charges in a case scheduled for trial in April in federal court in Philadelphia.

Another salesman, former Montgomery County securities broker Perry Abbonizio, pleaded guilty to criminal fraud charges and is awaiting sentencing. A former collector for Par, Renato Gioe, pleaded guilty to criminal extortion.

Federal prosecutors have said in court that they may file an expanded indictment against the Par principals, possibly including additional defendants.

The LaFortes are contesting the criminal charges. In a motion calling for Joseph LaForte’s release from jail before that trial, his lawyers argued earlier this month that Par investors will likely suffer “no actual loss” of their principal, once the receiver collects all the money and sends it to them.

The lawyers also argued that LaForte had been unable to review the extensive government records in the case against him, given his limited access to computers in prison. Prosecutors responded with a memo noting that managers at the federal lockup in Philadelphia have agreed to give the LaForte brothers more time to review documents in jail.

James LaForte, a former Par loan collector, faces additional criminal charges in Philadelphia in a February assault that sent receiver’s lawyer Gaetan Alfano to the hospital, and in a separate federal criminal racketeering case in New York, where he is described as a “soldier” for the Gambino crime organization who helped send at least $1.5 million in Par funds into businesses controlled by his Gambino crew boss.

The receiver’s work in sorting claims and finding assets to pay them continued despite the assault. According to Monday’s filing, the receiver has rejected duplicate claims in cases where both individual investors and the administrators who handle their funds filed separate payment demands.

He also “disallowed” more than $40 million in claims from companies affiliated with another small-business lender, Anthony Zingarelli, noting Zingarelli-related businesses “owe substantial funds” to Par affiliates. A few other claims are still under review.